THG shares swell after e-commerce retailer inks banking facility

Shares in THG have surged after the group reported resilient sales of healthy and beauty products despite consumers tightening their belts.

In third quarter results on Tuesday, the e-commerce retailer posted growth of 4.9 per cent in its beauty arm and 2.9 per cent in its nutrition division.

Its share price surged by 19 per cent on Tuesday afternoon, after its market value has been slashed by almost three quarters in the past year to date.

The London-listed group said consumer behaviour had “remained stable and consistent”, with shoppers keen to continue forking out on health and wellness items despite the cost of living rocketing.

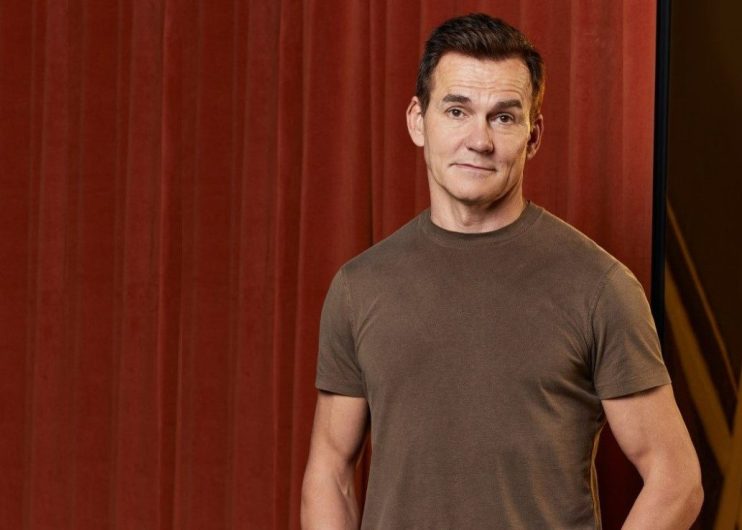

Matthew Moulding’s business has inked a deal for a £156m banking facility from lenders BNP Paribas, HSBC and NatWest on a three-year term.

The Look Fantastic owner reiterated its guidance for adjusted EBITDA of between £100mn and £130mn. Last month, it cut guidance from a previously anticipated £161m, which would have seen earnings match last year’s performance.

Boss Matthew Moulding said the firm was committed to “investment in price protection,” as it geared up for a boost in demand in the run up to Christmas.

THG was “well positioned to grow margins into 2023, whilst reducing pricing to consumers,” as commodity prices eased further, he said.

The firm had said it will continue to hike prices at a “slower and lower” rate than inflation, in order to keep enticing consumers in the tough economic environment, after posting record interim sales.

In its half-year results, the e-commerce retailer said a reduced gross profit margin primarily reflected a strategy to “partially shield consumers” historic levels of inflation as well as “unusually high raw material costs,” including whey protein.