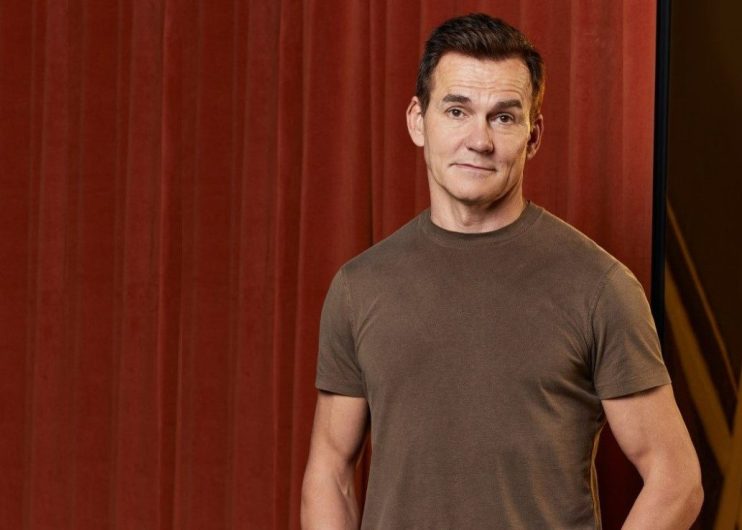

THG boss Matt Moulding slams ‘numerous’ proposals from suitors as unacceptable

E-commerce beauty firm THG has dubbed a number of approaches from potential bidders as “unacceptable.”

There had been speculation that the online retailer – which owns brands including Cult Beauty and Lookfantastic – could be prime for a takeover, after experiencing a turbulent year.

In a trading update, CEO Matthew Moulding said the board had received “indicative proposals from numerous parties in recent weeks.”

However, he said: “The board has concluded that each and every proposal to date has been unacceptable, failing to reflect the fair value of the group, and confirms that THG is not currently in receipt of any approaches.”

The retailer was readying itself to “step up” to the premium segment of the London Stock Exchange “at the appropriate time,” the CEO said.

In full year results for 2021, THG posted record full year revenue at £2.2bn and adjusted EBITDA performance at £161m.

Boss Moulding said the retailer had surpassed targets set when the firm went public a year ago and the size of the business had effectively doubled in two years.

On rapid inflation, THG said it would aim to reduce the impact of price rises on consumers by “maximising efficiencies in our operating model, absorbing some of the pricing pressures, and raising prices at a lower rate to underlying input costs.”

Guidance remained unchanged, despite cautions that consumer spending could be subdued by pressures on household budgets. However, the retailer pointed to a one per cent revenue hit from the conflict between Russia and Ukraine.

Adjusted EBITDA jumped seven per cent year-on-year, to £161m from £151m, an increase of 7.0% year-on-year.

THG said it was impacted by “substantial cost headwinds in the second half of the year,” after being affected by commodity inflation, particularly in whey protein, foreign exchange movements, increased costs of warehouse labour and freight and duty.

The impact of such headwinds trebled in the second-half, relative to the first-half, with THG stating it believed the pressure was mostly short term and would “dissipate over time.”

Shares were up more than 16 per cent on Thursday morning, with the price down 82 per cent in a year.

Edison Group director, Russell Pointon, said: “The retail sector as a whole is facing an unsteady outlook due to many macroeconomic factors. However, management expects the current inflationary environment to be transitory and anticipates that it will be able to limit the impact of rising prices on consumers by operating efficiencies and price rises at a lower rate than underlying input costs.

“Investors and customers alike will keep a close eye on whether outlined strategies like automation and cost saving actions can shield the group from these pressures, as well as from industry-specific challenges such as rising whey prices.”