‘They had their chance and walked away,’ Octopus boss slams rivals in Bulb battle

The boss of Octopus Energy has hit back at rival firms challenging its buyout of Bulb, amid a protracted legal battle over the fallen supplier’s future.

Chief executive Greg Jackson told City A.M. that other suppliers should have made a bid for Bulb, rather than challenging the deal in the courtroom.

He said: “They had their chance, and walked away. They can’t compete on service or value so are resorting to the courts, increasing costs and uncertainty for taxpayers.”

Octopus is inching towards a takeover of Bulb, after a court approved the transfer of its 1.6m customers by 20 December earlier this month.

However, British Gas owner Centrica, E.ON and Scottish Power have sustained their legal challenge and are now pursuing a judicial review of the acquisition.

The three energy firms have argued there has not been enough time to assess the terms of the deal before it goes through, and have also criticised the lack of transparency around the takeover – particularly concerning the amount of taxpayer funding involved.

If the judicial review is successful, then Octopus’ deal for Bulb could still be scrapped, potentially re-opening the bidding process while leaving the supplier in special administration.

Octopus’ Bulb deal challenged over state funding

Rival suppliers are concerned over the extent of Government support involved in the takeover, with the rival firms suggesting this was not made clear as an option to them during the bidding process.

In the courtroom yesterday, the companies challenging the deal argued they were aware of the potential existence and scale of government funding on offer, according to The Guardian.

“If the claimants had been told subsidies were on offer, that would fundamentally change the landscape in what they were participating in the bidding process,” said the lawyer representing Centrica.

He also accused the Government of trying to hide “a mess-up worth billions” from taxpayers as it attempted to wrap up a deal to buy Bulb.

Meanwhile, lawyers for Octopus warned that Bulb’s customers had to be transferred before the end of the year.

If not, Octopus “will lose its wholesale energy supply arrangements, with the result that it will not be able to ensure continuity of supplies for customers” its lawyer said.

Both sides will file documents to the court tomorrow, suggesting a timeline for the judicial review process, which will then be determined by the judge over the following days.

This is expected to take place separately to Octopus’ takeover on 20 December, as City A.M. understands the judicial review process is likely to run into at least the first few months of next year – potentially as late as Easter in April.

An Octopus Energy spokesperson said: “We are pleased that we can now move towards completion before the end of the year.

“Whilst we’d rather have had the whole judicial review process completed before then in order to give certainty to Bulb’s staff and customers and to British taxpayers, we hope that we can finally start bringing to an end to this expensive period of public ownership.”

By contrast, EON told City A.M. the deal “gives away billions of pounds in taxpayer-funded subsidies but provides none of the clarity and transparency the British public deserves.”

A spokesperson said: “Weeks have passed and countless requests ignored, and we’re still without an explanation of why such huge subsidy is needed, along with the detail of how these billions will be fully paid back, if they ever will be.

“Rather than rushing into an agreement that gives the worst deal for almost everyone, the British public deserves an honest explanation of where their money is going and how they might, in the future, get some of it back.”

Centrica and Scottish Power have also been approached for comment by City A.M.

Was Centrica offered support to buy Bulb?

As the legal challenge continues, there have been fresh reports that Centrica was encouraged to make an offer for collapsed energy supplier Bulb, and was told Government support was on offer.

Any invitation for state support would undermine the case the three companies have made that public funding, known as the Government-backed adjustment mechanism, was not on offer during the sales process.

The details were revealed in emails from Lazard, the investment bank handling the sale, and were seen by The Financial Times.

Despite the bidding process having closed with Octopus as the sole suitor, Lazard reportedly invited Chris O’Shea, Centrica chief executive, to make a bid.

Lazard has been approached for comment.

Octopus’ takeover deal includes a £100-200m lump sum, at least £1bn in hedging support funded by taxpayers, and a profit-share arrangement with the Government until the hedging has been paid off, City A.M. understands.

Bulb’s customers are also expected to be ring-fenced from Octopus’ primary operations over the winter.

However, many of the key terms have not been disclosed, such as the timeframe Octopus has been given to repay the costs of the energy that the Government will buy for Bulb customers this winter and the interest rates involved.

The specifics of the “profit share” agreement that will apply until Octopus has repaid the funding also remain elusive.

There is growing uncertainty over the costs involved in propping up Bulb on life-support for over a year, with the Office for Budget Responsibility estimating last month that the costs have spiked to an eye-watering £6.5bn.

This would make it the biggest state bailout since RBS in 2008 during the financial crisis.

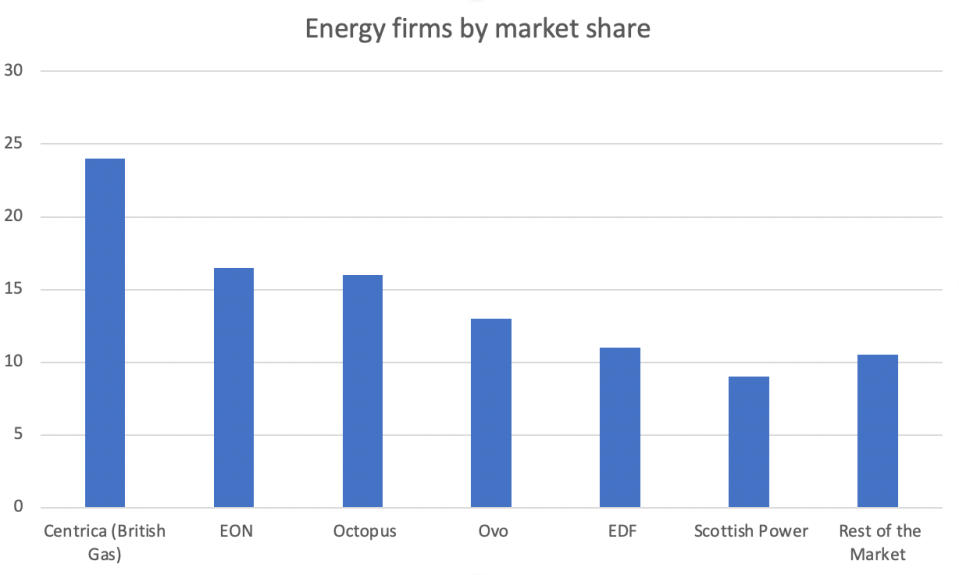

The sale to Octopus also threatens to change the landscape of the energy sector – with a new Big Six emerging with a near 90 per cent market share.

This is a threat to both challenger suppliers and Centrica and EON – with the merged Octopus company becoming the third biggest retail energy supplier in the UK if the Bulb deal goes through.