The world has suddenly changed, but there is a constant that will outlive us all

The week in Review…

with Jason Deane

This time last week, when I wrote my last update, England still had a Queen, Boris Johnson was still Prime Minister, and Putin’s forces were still advancing, albeit slowly, in Ukraine.

How quickly the world changes.

The news of the passing of her Majesty affected me more deeply than I expected and, from what I can glean, this has been the case for many. The last time I had felt emotional at the passing of such a regal figure was, of course, Princess Diana, and I can’t help but wonder if Her Majesty would approve of such a thought.

Her last official act was, ironically, to usher in yet another change in the British political and economic landscape, inviting the “pro crypto” Liz Truss to take the reins of power.

However, we can only hope she fundamentally understands the difference between “Bitcoin” and “crypto” since her latest statements seem to imply more of a focus on stable coins and crypto technologies.

In other words, assets that are linked to TradFi or have some form of centralised control system. It’s a step forward, but perhaps not as far as we’d yet like to go.

Meanwhile, in a bold counter attack, Ukraine has decimated Russia’s defences in Kharkiv Oblast and also made gains elsewhere.

The combination of modern weaponry, smart strategies and Ukraine’s steely determination has meant that Russia will find it impossible to come back from this without a general mobilisation, a route that Putin cannot afford to take without serious fallout. Even pro-Russian bloggers have acknowledged that Russia “has already lost”.

When the war began, many considered Russia’s military to be the second best in the world. This disastrous campaign has confirmed that, in fact, the Russian army is the second best in Ukraine and its days as a super power are almost certainly behind it – at least for the current (and next) generation.

This, perhaps, may be one of the reasons that the Russian central bank is currently re-considering its anti-crypto stance as it begins to understand just how much the world is changing and just how far behind the nation will find itself if it’s not careful. We’ll see.

This time next week, Ethereum’s merge may well also be in place. My view on this is well documented and constantly gets me into trouble with Ethereum supporters, but I still find it ironic that this move to proof-of-stake is happening just as the massive benefits of proof-of-work are really being understood. How will the markets be affected? That, frankly, is anyone’s guess.

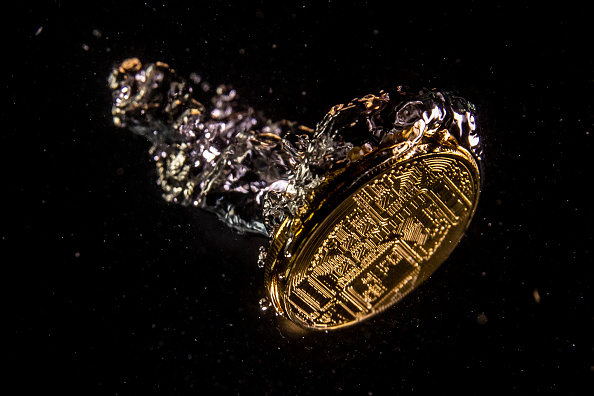

Meanwhile, honey badger don’t care what we mere humans get up to. Bitcoin remains flat in dollar terms, but my Twitter feed remains full of new developments and, especially, new mining deployments, clearly reflected in the continuously growing hash rate across the globe.

In a world of uncertainty of our own doing, there is, after all, something reassuring about the constant stream of blocks quietly ticking by in the background. It is the new constant that will ultimately outlive us all.

Long live the King!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on September 14 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Have you booked your tickets for the Crypto AM Summit and Awards? Click here… Crypto AM Summit & Awards 2022 – CityAM

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.026 trillion.

What Bitcoin did yesterday

We closed yesterday, September 8 2022, at a price of $19,329.83. The daily high yesterday was $19,417.35 and the daily low was $19,076.71.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $396.05 billion. To put it into context, the market cap of gold is $11.47 trillion and Tesla is $899.88 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $40.048 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 38.9%.

Fear and Greed Index

Market sentiment today is 22, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 39.85. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 51.15. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“[Bitcoin’s] volatility is declining with increasing adoption and participation.”

Bloomberg Crypto Outlook 2022

What they said yesterday

Stackers gonna stack…

Going global…

Regulation = adoption…

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST