The truth about growth and value performance

A statement I have heard many times in recent years, last year especially, is that the “value” style of investing no longer makes sense. That the very idea of buying an unfashionable stock doesn’t make sense when the new hottest stock with the most epic growth forecasts is being dangled, tantalisingly, in front of you.

The implication is that, if you want attractive returns, the only place you will get them is in “growth” stocks. Even better, technology stocks.

But this is wrong.

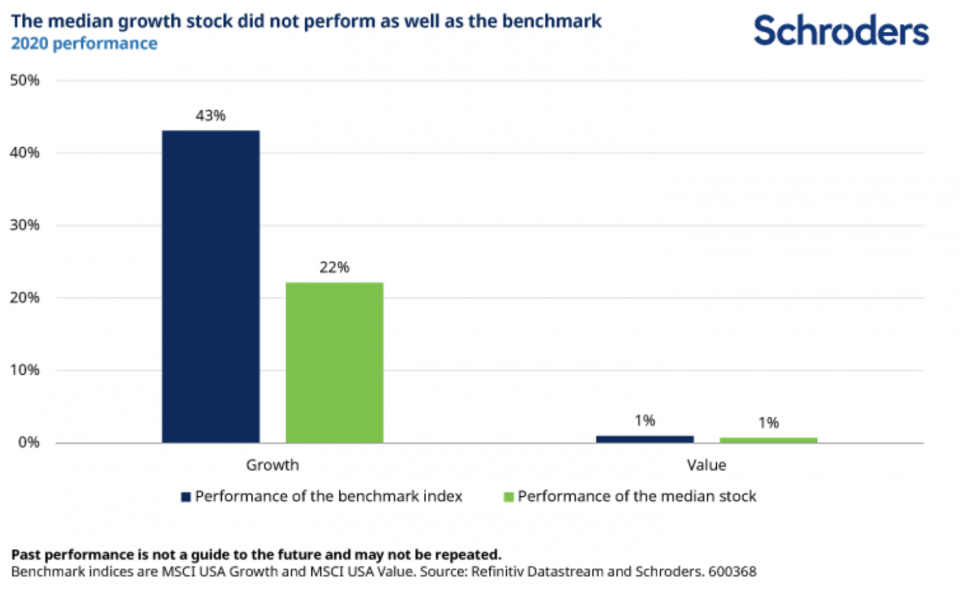

Let’s start with the headlines. In 2020, growth stocks (MSCI USA Growth index) returned 43% in 2020, while value stocks (MSCI USA Value index) returned only 1%. So does this mean value was on a hiding to nothing? Not quite.

The median company in the MSCI USA Growth index only returned 22%, some way short of the index’s performance. This is because the index was dominated by the strong performance of a handful of very large companies. It overstates how well most growth companies performed.

18% of the companies in the MSCI USA Value index returned more than 22% last year. This doesn’t change the facts that growth clearly outperformed value but it does demonstrate that a reasonable number of value companies also performed very well. Just as all growth companies didn’t do as well as the index would suggest, not all value companies had a bad year.

Discover more from Schroders:

– Learn: Why I can stomach higher equity valuations

– Read: Why lockdown winners aren’t vaccine loser

– Watch: Will 2021 be the time for investors to stop hibernating?

Some of the better performing US value companies include the chemical manufacturer, Albemarle (+106%), the mining company, Freeport McMoran (+99%), the delivery company, Fedex (+74%), and the agricultural, construction and forestry machinery manufacturer, Deere (+58%).

The roster of top performers is quite likely to be different this year. But anyone who has been sucked into the hype to believe that it is only high growth companies that can offer high returns needs to think again.

The figures are even more striking in other markets. In emerging markets, an impressive 38% of value companies outperformed the median growth company. In the UK, Europe ex UK, and Japan the proportions were 30%, 27% and 24%. Less sexy companies can generate just as sexy returns.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.