The three Cs driving WFH and their impact on global cities

Investors in the office sector face a divergent picture due to the working from home (WFH) trend, says fund manager Tom Walker.

Recent encouraging news regarding a Covid-19 vaccine means many of us are looking forward to resuming our “normal” lives. Getting out of the house will be top priority for many, particularly those of us in countries that have re-entered lockdown this winter.

But will we be heading back to the office? The pandemic’s effect on our working lives has been profound. It has certainly dispelled any myths around “shirking from home” with many companies finding that their employees can be just as, if not more, productive at home as in the office. The key question to answer is how damaging Covid-19 will be to long-term office demand.

We think there are three primary forces working together and leading to market change: commuting, culture and Covid-19. Importantly, these three forces will play out differently in different global cities, making a nuanced picture for investors.

Covid-19

Firstly, different countries have handled the pandemic with varying degrees of success so far. While many of us in Europe are experiencing a second lockdown, some Asian countries dealt with the virus very effectively.

Despite being the initial centre of the virus, China has been successful in containing it and enabling normal activity, including office work, to resume in its cities. Other examples include Hong Kong, Singapore, Tokyo, Sydney and Oslo.

Cities that have contained the pandemic have seen less disruption to normal working patterns and therefore a more muted work from home (WFH) trend. By contrast, when the authorities’ handling of the pandemic has been less successful, the working from home trend has been more pronounced. London is a case in point here, along with New York.

It is also worth noting that both these cities have a large amount of high rise buildings. Moving large numbers of people around a skyscraper is almost impossible when you have to adhere to social distancing.

Discover more from Schroders:

– Learn: Can asset management’s Covid-19 response help regain public trust?

– Read: How does the FTSE’s performance in 2020 compare historically?

– Watch: What will the world look like in 2021?

Commuting

However, the popularity of working from home isn’t purely down to the spread of the virus. Commuting is also a crucial factor, in our view.

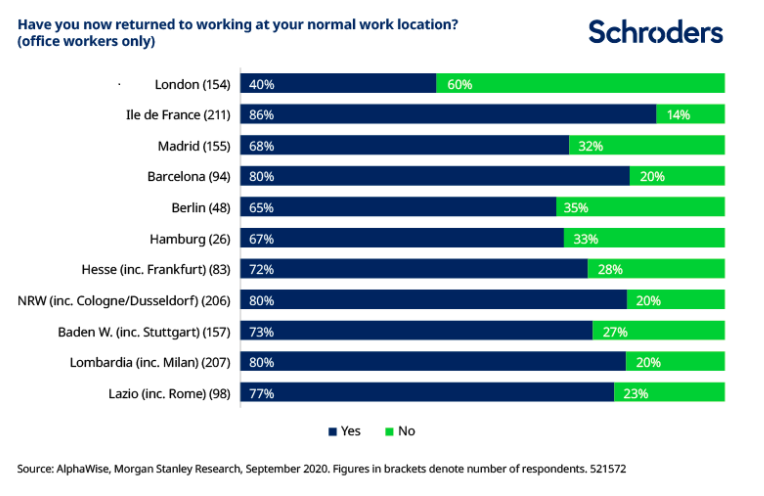

London employees, for example, are among those most keen to continue to work from home. The chart below shows the results of a survey taken in mid-September – well after the UK’s first lockdown had ended and before the current pick-up in the virus. Londoners were far more likely than other European office workers to be still working from home.

But London office workers don’t just live in the city; many live in the surrounding suburbs and travel in via multiple modes of transport. Even those who do live fairly centrally often have long travel times given London’s low population density. Employees may be reluctant to return to offices due to the virus, but many also value the time and money freed up by the lack of commute.

Of course, a prime reason for living outside the city are the high costs associated with living in major cities. In suburban locations, living costs are lower, potentially giving people space for a home office. Clearly, this makes working from home a lot easier.

However, a big house isn’t an option in more densely populated locations such as Singapore or Hong Kong, where virtually everyone lives in a flat. Not only does this often mean people live in closer proximity to the office, but lack of space makes working from home less practical. Excellent public transport also means shorter commutes.

Meanwhile, other cities are more accessible by car, enabling commuters to avoid the risk of infection on public transport. We would point to some of the US Sun Belt cities here – Austin, Atlanta or Charlotte, for example – as well as some German cities.

Culture

Our third force is culture. For cities such as London, the pandemic didn’t start the working from home trend; it accelerated a shift that was already happening. Modern office developments are no longer let on the basis of one desk for one employee; shared workspaces help employers save costs and employees embrace flexible working practices. Expensive, time-consuming commutes and a desire for better work-life balance were already seeing many office workers choose to work from home for a day or two per week.

By contrast, a culture of needing to be present in the office still prevails in many places; Japan is often singled out here.

We would also point to culture beyond the office too. The current pandemic has been described as “unprecedented” in many quarters but for many Asian cities, it isn’t. Similar virus outbreaks have occurred in the recent past, notably SARS in 2003 which centred on China, Hong Kong and Vietnam.

It’s partly because of these outbreaks, as well as seasonal colds and flu, that people in many Asian cities are already accustomed to measures like wearing a face mask. In cities such as Tokyo or Hong Kong, wearing a mask not perceived as an inconvenience or a reason not to go about your business as usual.

In addition, even as recently as 2003, the technology simply wasn’t advanced enough for people to work from home. Broadband speeds have increased to a sufficiently high speed to enable a trend that was previously impossible.

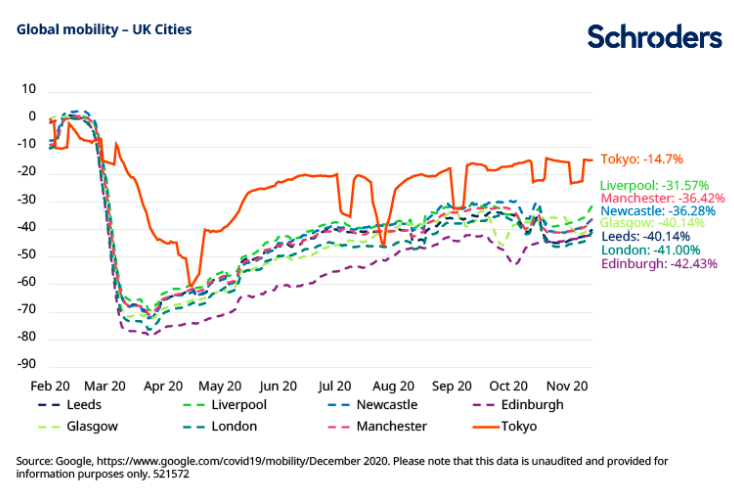

We can see these trends come together in the chart below, which compares mobility trends in Tokyo to various UK cities. UK mobility fell sharply during the initial lockdown and recovery has been very slow. By contrast, mobility in Tokyo didn’t fall so far, and has been quicker to recover towards normal levels.

Select your office exposure carefully

These three themes – Covid-19, commuting and culture – all intersect and are creating the varied picture we see in terms of the return to the office globally. For some cities, home-working was on the rise anyway and is likely to lead to reduced office demand. However, we think employers will always want to retain an office presence, even if not every employee is working there every day.

A recent report by Barclays found that office-based employers expect work-from-home days to rise on average to two per week, from 0.9 pre-pandemic. Offices may end up being smaller if fewer people are working in them each day. But we think this will emphasise their importance as a hub, where employees can meet and exchange ideas.

From an employer’s perspective, the collaboration and idea generation that happens when people are together in the office is crucial. Workers also need to make connections with new colleagues and train junior staff. These things are not impossible when working virtually but they are easier face to face. Even maintaining existing work relationships becomes harder if communication is solely via email or Zoom for a prolonged period.

Those cities that are most impacted are likely to have longer commute times and a high cost of living; London and New York are prime examples. In contrast, smaller living areas and shorter commute times will reduce the adoption of working from home; the likes of Hong Kong and Singapore neatly fit this description.

The reality for many is that a new hybrid working life will now be normal. The winds of change were already pushing real estate markets in this direction – Covid-19 has just accelerated the inevitable.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.