The six biggest bull runs since 1962 (and their corrections)

The current bull market in US stocks started in March 2009 at the height of the global financial crisis and is the longest in recent history, beating the rally between July 1962 and May 1970 by over four years.

At the time of writing, the bull market is still going. US stocks are up more than 400 per cent since their March 2009 low.

It is not only a US phenomenon; UK, European, emerging markets and Japanese stocks have all risen more than 150 per cent in the same period, according to data from Refinitiv.

Stock markets continue to rise despite a difficult economic and political backdrop. The rumbling trade war between the US and China and Brexit are among the major issues facing investors.

Why are stock markets rallying?

Stocks are benefiting from the favourable monetary policy that’s been in place since the financial crisis.

Central banks in developed markets have been keeping interest rates low and making it cheaper to borrow money to boost the economy.

For instance, interest rates in the US are currently 1.75 per cent, down from 5 per cent one year prior to the financial crisis in 2007. The US Federal Reserve has cut rates twice in 2019, back-tracking on its rate raising policy amid concerns of an economic slowdown.

The story is the same for other developed economies. The UK interest rate is currently 0.5 per cent, down from 5 per cent in 2008, while interest rates are negative in Japan and the eurozone.

The effect of low interest rates has driven down the yields on other investments such as government debt. The US 10-year Treasury currently yields 1.8 per cent, while the UK 10-year gilt yields 0.6 per cent.

That has forced investors to search for higher returns in riskier areas of the market such as stocks. The US S&P 500 yields 2 per cent, for example, while the UK’s FTSE All-Share index yields 4.1 per cent, according to data from Refinitiv.

Read more:

- Economy on red alert with yield curve close to inversion

- How trade wars are rocking the global economy

- Is gold the place to hide from negative yields

So how does this bull market compare to those of the past?

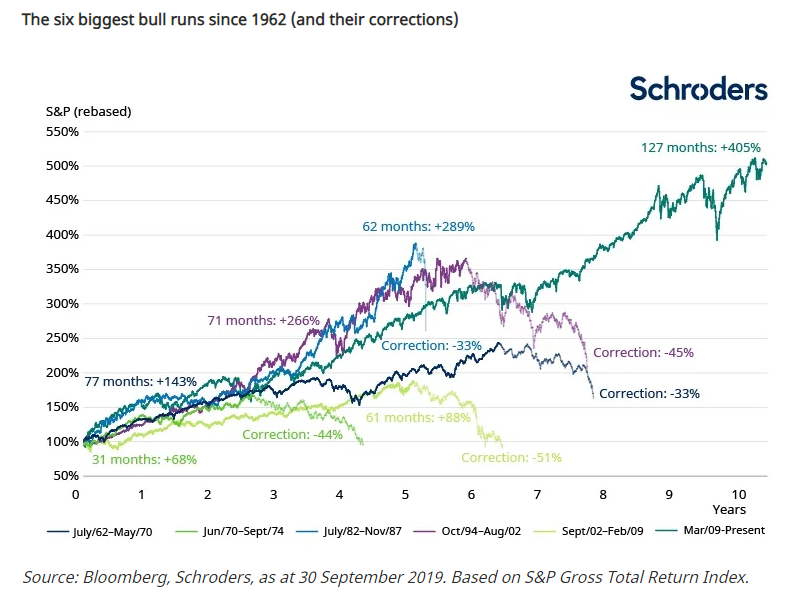

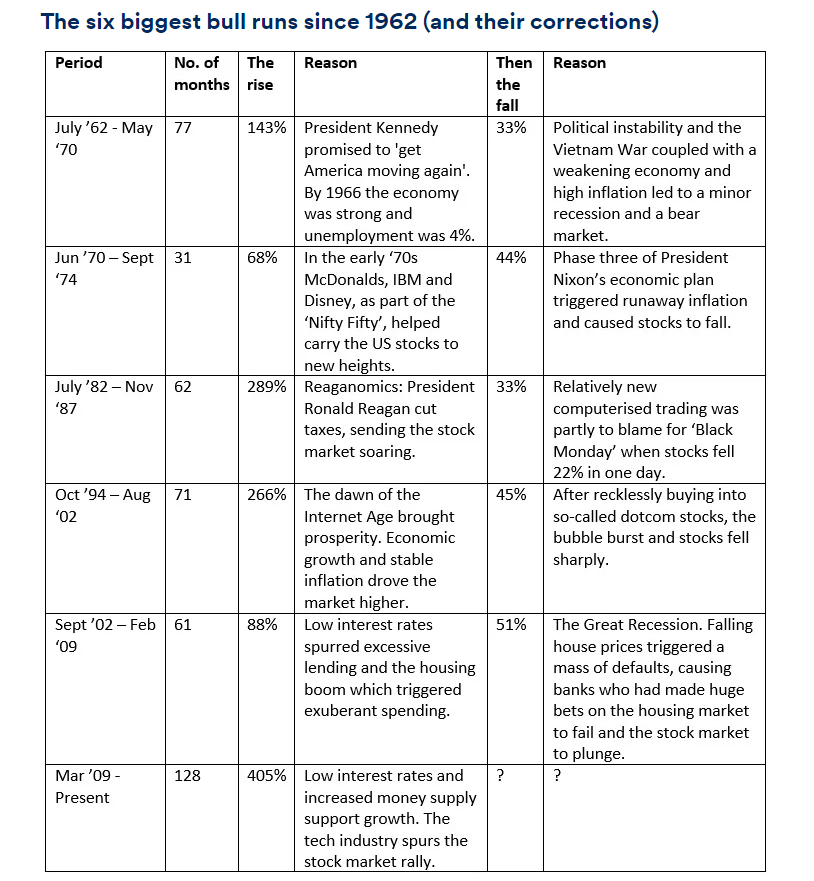

The chart below shows the six biggest bull markets in US stocks since 1962 and their subsequent bear markets.

In this example a bull market is defined as a rise of 50 per cent or more over a period lasting more than six months. A bear market is defined as a fall of 20 per cent or more that lasted at least three months.

Can the bull market continue?

Johanna Kyrklund, Chief Investment Officer and Global Head of Multi-Asset Investment, said:

“Markets have been increasingly focused on two interlinked but somewhat offsetting trends: weakening global growth and ample central bank liquidity.

“We continue to see evidence of weakness in the global manufacturing cycle and central bank liquidity has pushed markets to even more expensive levels.

“However, markets have moved to price some of that cyclical risk in that yields have rallied and defensive equity sectors have outperformed.

“If manufacturing data stabilises or if political concerns on trade or Brexit are alleviated, we could see a recovery in cyclical assets.

“As a consequence, we continue to tread a careful line between benefiting from the liquidity environment without taking too much cyclical risk.”

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.