The pros, cons and incentives behind the SPAC-craze sweeping markets

There have been 378 initial public offerings (IPOs) in the US in the first three months of 2021. That’s more than in any full calendar year between 2003 and 2019.

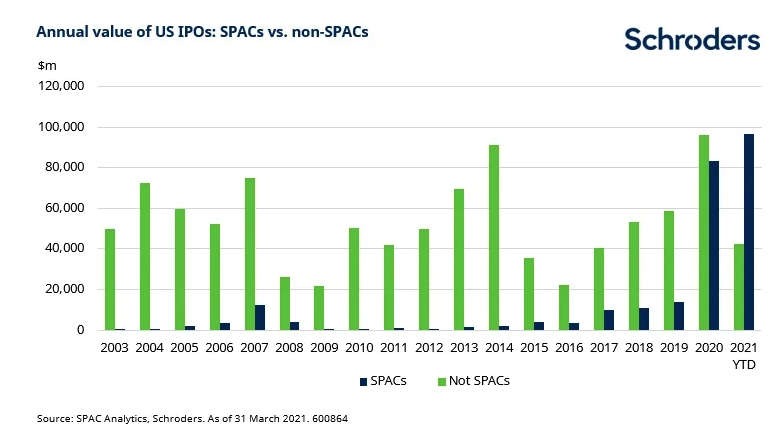

The $139 billion raised so far this year is more than two and a half times the yearly average over this period. They already have what was raised last year ($179 billion across 450 IPOs) clearly in their sights.

After a two decade period where the number of US public companies fell by almost half, this is a welcome resurgence.

But peeling back the onion reveals there is more to it than meets the eye.

SPAC-man is eating the IPO market

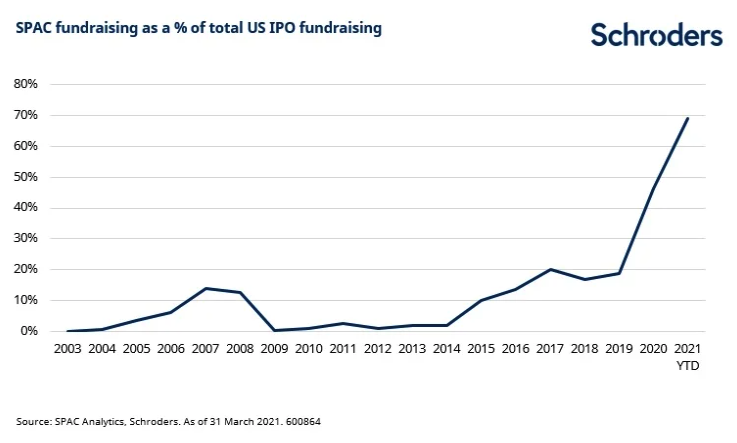

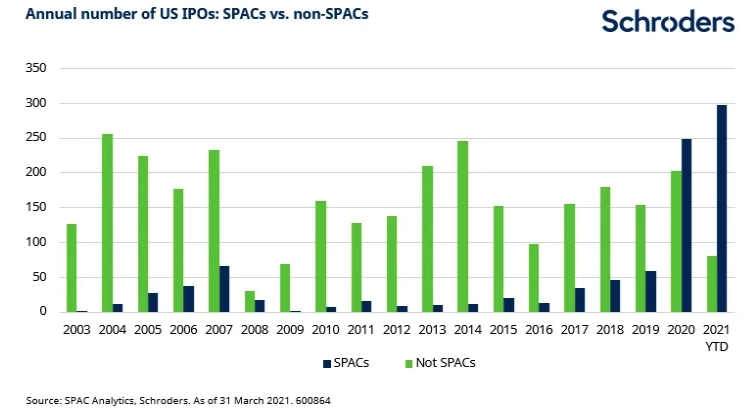

These headline figures dramatically overstate the number of companies that have joined the stock market recently. 79% of this year’s IPOs by number and 69% by value have been by what are known as SPACs – Special Purpose Acquisition Companies.

SPACs are different to regular companies. They have no commercial operations when they IPO. Instead they raise a sum of money with the intention of buying an operating business within a specified period of time, normally two years. If they don’t, and are unable to get shareholders to grant an extension, they are wound up and cash is returned to shareholders.

Other names for SPACs include “blank check companies” and “cash boxes”, for obvious reasons.

Some of the main features of a SPAC are explained below but it should be fairly obvious that an IPO of a SPAC does not automatically lead to an increase in the number of public companies. It leads to the possibility of this happening, but only if a deal is done. A SPAC is nothing more than a cash shell when it IPOs.

The popularity of SPACs has soared, for reasons explained later. Between 2003 and 2019, an average of 17 SPACs a year Iisted on the US stock market, with the high point being 66 in 2007. Last year, there were a record-breaking 248 SPAC IPOs, more than the previous 12 years combined (Figure 2).

Unbelievably, that record has already been broken. 297 have listed in only the first three months of 2021. The amount of money raised this year so far has also overtaken last year’s record total. The $97 billion of SPAC IPOs in 2021 is more than the was raised across 2003-19 combined!

The wave of SPACs is turning into a tsunami.

The mechanics of a SPAC

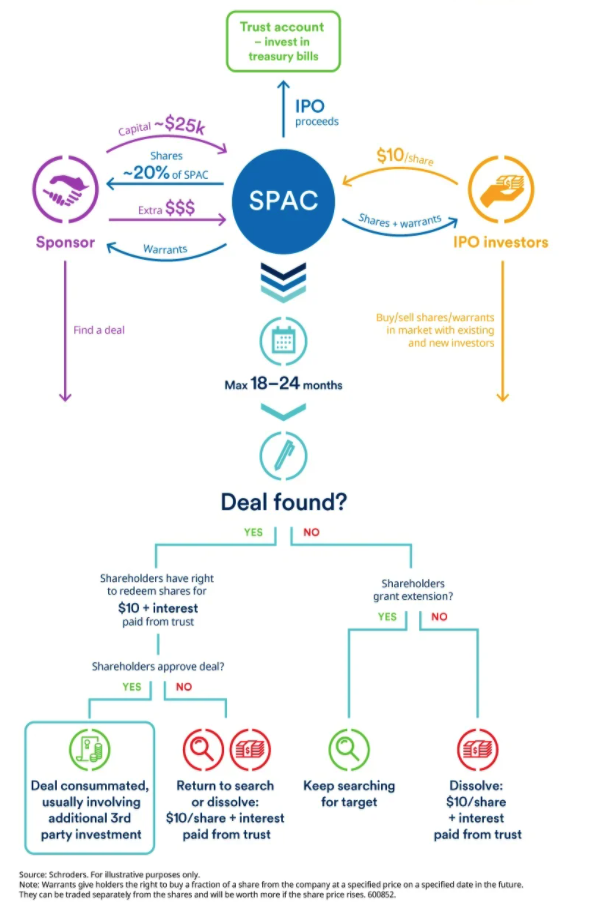

A SPAC is set up by a management team, knowns as its sponsor(s). They raise money from investors in an IPO, usually at a price of $10 per share.

For each share that is bought in the IPO, investors also receive an extra kicker, known as a “warrant”. These give holders the right to buy a fraction of a share from the company at a specified price on a specified date in the future. They normally can’t be exercised until some time after a merger has been consummated. However, they can be traded separately from the shares and will be worth more if the share price rises.

There is no visibility on what company might be acquired (this is a regulatory requirement). A SPAC’s prospectus often includes some wording about the type of company or industry it intends to focus on, but there’s nothing to stop it going in a totally different direction.

Investors in a SPAC are putting their money and confidence behind the sponsor’s ability to source and execute a deal. Although, that said, they have the opportunity to get their money back at the time of the acquisition of the private entity if they don’t want to remain invested (explained below).

Sponsors typically get around a 20% stake in the SPAC in return for a relatively small cash investment e.g. $25,000 (although these terms are becoming less generous for sponsors as the market develops). This is how they make their money. If the SPAC is successful, their shares will be worth a significant amount.

One of the interesting features of a SPAC is that money raised in the IPO is ringfenced in a trust account and invested in Treasury bills. The trust account can only be used for a limited number of activities, including being put towards an acquisition. This provides a degree of protection for investors that sponsors won’t spend it.

Discover more from Schroders:

– Learn: What 175 years of data tell us about house price affordability in the UK

– Read: The equity sectors best at combating higher inflation

– Learn: FOMO market is over – what next?

Sponsors also usually purchase additional warrants at the time of the IPO – the extra from this cash (often several millions of dollars) is used to cover the IPO expenses and ongoing expenses, without having to touch other investors’ $10 per share.

The sponsors then have a period of time, usually two years, to complete an acquisition. During this time, investors can buy and sell shares in the SPAC in the open market like any other public company.

If/when a target is found, shareholders vote on the deal. At this point, they also have the right to redeem their shares and be repaid from the trust account – at $10 per share plus interest. This also provides a degree of protection for investors: if you don’t like the deal you can get your money back.

At this time the SPAC usually has to raise additional money to complete the deal because: 1) the target company is often larger than the SPAC (2-4 times as large as the SPAC IPO proceeds in most cases); and 2) some of the money in the trust account has to be spent redeeming shares.

The sponsor may provide some of this but most of the time new investors are brought in, in what is known as a Private Into Public Equity (PIPE) investment. SPAC shareholders typically end up holding a minority stake in the merged entity.

Assuming the deal is approved and finance raised, the merger takes place and the SPAC starts trading as a new company, under a new ticker.

Why have SPACs become so popular?

In order to answer this it is important to understand the priorities of the various participants. These are summarised below:

Private companies

- Potential to sell themselves for a higher price than in a traditional IPO

- IPOs are normally priced to encourage a jump in the share price on the first day of trading (known as an IPO “pop”). This leads founders to feel that they have “left money on the table”. In contrast, a merger with a SPAC can be negotiated at a fair value.

- Private companies are able to use forward looking statements when marketing themselves to a SPAC, something which is particularly appealing for fast growing companies. A traditional IPO prospectus only shows historical financials to avoid any legal liability if forecasts are not met. Mergers, however, have a legal “safe harbour” from any such liability.

- Private companies which are more complicated or which investors might have more difficulty valuing might be put off an IPO over fears that they wouldn’t fetch as much as they think they’re worth. In a SPAC merger, they can sell themselves to those SPACs which are fronted by sponsors with relevant expertise, who will be able to understand and value their business better.

- More certainty on pricing than in an IPO:

- The acquisition price will be negotiated with the sponsor and set out in the merger agreement. This compares with an IPO where underwriters set a range but that range moves around depending on market conditions.

- Faster than traditional IPO route:

- A SPAC merger can take place in five or six months compared with 12-24 months for an IPO.

- Reduced regulatory burden:

- The regulatory demands on a private company in a SPAC merger are less onerous (and hence less costly) than in an IPO.

IPO investors

- Because investors in a SPAC IPO have the option to redeem their shares for what they paid for them plus interest, they essentially have a money back guarantee. In addition, they have a warrant, which may turn out to be worth a lot if the SPAC is a success. The warrant is akin to a risk-free bet on the success of the SPAC.

- Most SPAC IPO investors, who are predominantly institutional investors (and overwhelmingly hedge funds), choose the risk-free option. Across the 47 SPACs that merged between January 2019 and June 2020, redemptions amounted to 73% of IPO proceeds in the median case.

- This attractive payoff profile means that SPACs are very appealing to those who participate in their IPOs.

- In addition, there is a view that investors who are involved in a SPAC from the outset could have an opportunity to own a bigger stake in the ultimate merged company than they’d be able to achieve in the traditional IPO route. Usually, the number of shares that investors are granted in a traditional IPO is less than they apply for, due to excess demand.

Sponsors

- Because they take a 20% stake in the SPAC for a minimal investment, sponsors love SPACs. They can make hundreds of millions of dollars for only a $25,000 upfront stake.

- Importantly, sponsors are incentivised to get a deal done. Any deal. Even one that is bad for investors could make them a lot of money, and would be preferable to liquidating the SPAC. Understanding this incentive is important.

So what’s not to like?

Companies like them, sponsors like them and their investors like them. So what’s not to like? Several things, actually.

Investing after the IPO is not as great a deal

First, while IPO investors get shares and warrants, anyone who buys shares in the aftermarket only gets shares. That is a far less appealing prospect.

SPAC share prices can increase above their $10 IPO price. Buying at such lofty prices is like saying you have so much confidence in the sponsor that you are happy to pay a premium to invest in them (remember at this stage all the SPAC is is a trust account filled with $10 per share and the sponsor). This might turn out well. But it also might not. And you could suffer a loss even if you redeem your shares, as then you’d only get back $10 plus interest.

There is a risk people are taken in by famous names

Given that the success or failure of a SPAC rests on the strength of its sponsor, they are often backed by individuals with strong reputations and high public profiles. For example, industry leaders, private equity dealmakers, investment bankers and even… celebrities.

Yes, you read that right. Celebrities such as NBA star, Shaquille O’Neal, MLB star Alex Rodriguez, and popstar Ciara, have all launched SPACs. This is where the risk lies. So much so that the SEC has even put out an alert, warning investors:

“It is never a good idea to invest in a SPAC just because someone famous sponsors

or invests in it or says it is a good investment.”

Quite.

Cost

The cost of a SPAC IPO can be heinously expensive even though, on the face of it, it appears cheaper than a traditional IPO. Underwriters’ fees are 2% of the amount raised upfront with a further 3.5% contingent on a deal taking place. This 5.5% is less than the 7% often charged for a traditional IPO.

But, given that a high proportion of shareholders typically redeem their shares, this means that the SPAC ultimately gets to “keep” a fraction of the IPO proceeds.

Let’s say a SPAC raises $100 million, making underwriting fees $5.5 million if a deal takes place. But, assuming that redemptions amount to 50% of the amount raised, the company will only get its hands on $50 million (plus interest). In this example, underwriting fees work out as 11% of the effective IPO proceeds.

In reality, the median underwriting fee has been 16% of the non-redeemed IPO proceeds. Not so cheap after all.

Investors who redeem their shares for cash do not suffer this cost, as they get their money back. It is the ongoing business and its shareholders who take the pain.

Performance

There are some SPACs which go on to deliver very strong returns. The most successful is the fantasy sports and betting company, DraftKings (which merged with Diamond Eagle Acquisition SPAC in April 2020). Its share price is close to $70, a handsome return on a $10 investment. Many others have delivered returns of several hundred percent to investors.

However, most do not fare so well. A recent academic paper found that most underperform the wider market after a deal is struck. Interestingly they find that results are far better for “high quality sponsors”, which they define to be individuals who are affiliated with a private assets fund with more than $1 billion of assets, or who have been a CEO or other senior officer at a Fortune 500 company.

So are SPACs to be welcomed or feared?

For investors, the money back guarantee associated with SPAC IPOs gives them a clear attraction.

In addition, those IPO investors have a seat at the table when the SPAC is looking to raise additional money to complete an acquisition. And they have access to a high level of quality information to help make an informed decision. Some investors may also judge that participating in the IPO will enable them to achieve a bigger stake in the company than they’d manage in a traditional IPO.

SPACs are a relatively efficient route to market for young companies with limited track records. But clearly “buyer beware” and appropriate levels of due diligence are essential.

It’s less clear cut when it comes to investing in the aftermarket, especially since investors should always remember that they are essentially blank check companies. You are putting all your faith in the sponsor. Some will do well, but most are unlikely to, and it won’t be easy to tell which are which. But whatever you do, please follow the SEC’s advice of never investing solely on the back of a celebrity endorsement. You need to do more research than that.

However, despite some of the issues raised in this article, I am actually a big fan of SPACs and what they might enable. And that is a more thriving stock market.

For too long, private companies have been put off joining the stock market. As I’ve written before, this has been partly because of the cost and hassle of an IPO. If this decline can’t be averted, I have grave concerns about where it might lead us. If high quality companies reject the stock market, or delay joining until they are more mature, slower growing businesses, then it is stock market investors who are likely to suffer. More returns will be captured by private investors, including private equity, at the expense of public markets. And it is ordinary savers who will feel this pain most. Private equity is simply too expensive and inaccessible for most to access.

I believe that any kind of innovation in the IPO process which encourages companies to think more seriously about becoming a public company is to be welcomed. And SPACs deliver on that. Direct listings are worth a mention here too.

So yes, be discriminating between them. Try to avoid getting caught up in hype. Even ignore them completely if you wish, and wait until they merge with a company before you give them the time of day.

But don’t lose sight of the longer term benefits that a thriving public market can bring. SPACs can be part of the solution.

Topics:

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.