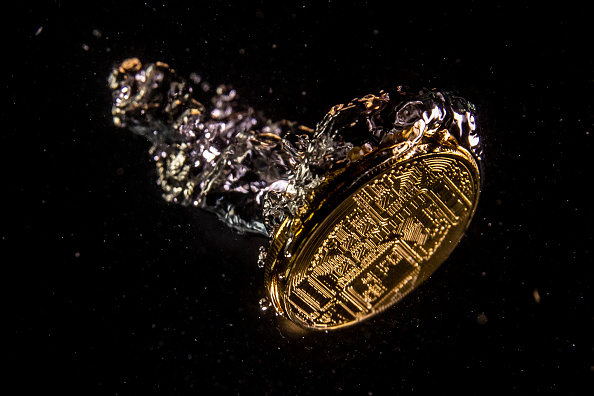

The knives are out as Bitcoin suffers its most painful month

The Week in Review

with Jason Deane

How a bear market changes things!

For those of us who have been through a bear cycle or two before, we’re familiar with the feelings that many are experiencing now – despair, loss of hope, the growing (but misguided) belief that “crypto is dead” and, of course, the blame game on Twitter.

As Bitcoin posts its worst month ever, even “the big names” find themselves in the crosshairs of criticism.

The legendary Nic Carter found himself under fire this week ostensibly because he dared to consider anything that wasn’t 100% Bitcoin, leading to all sorts of ridiculous fear-driven accusations of shilling and self-promotion. In the trough of a bear cycle it seems anyone is fair game.

Meanwhile, Anonymous announced it was coming after Do Kwon of Terra Luna infamy, a move that must surely send shivers down his spine. This is one group you really don’t want to attract the attention of, but there are many who feel that in this case their actions may well be justified.

The bad feeling continues as the SEC rejected Grayscale’s Bitcoin spot EFT resulting in an almost immediate issuing of legal proceedings from the latter to the former, but they weren’t the only ones involved in a public spat. Compass Mining was publicly humiliated by Dynamics Mining over an alleged unpaid electricity bill which Compass flatly denied.

I guess we’ll find out which side is telling the truth in due course.

On the subject of mining, I am more than fascinated to note that Bitcoin’s next difficulty adjustment is forecast to be upwards, even as miners struggle and many are now operating at a loss. It seems that confidence remains strong in this sector and it’ll be fascinating to see this play out as the self-adjusting market forces really come into force. The network itself, of course, remains entirely secure as ever.

It’s true the markets are dire and my view on this was published in Yahoo finance on Wednesday, but it’s also worth remembering that all the best stuff is built in bear markets. Seriously. This is where the smart people are quietly building the next gen of innovation in the background while the negative noise reaches a crescendo level.

As ever, the crypto world will emerge leaner, stronger and better as we move into the next phase of adoption of development so just remember, in a world where you can be anything, be nice.

Finally, I’m taking my family to the Bitcoin Adventure this weekend in Avon, near Bristol, for a Bitcoin themed family fun day at a big glamping and adventure park. It’s not a combination I’ve seen before and I just love the idea of it.

There will be stands, activities, family orientated workshops, a whole bunch of informal talks and even a visit from the Bitcoin Racing Team who will be showcasing their cars.

I’ll be speaking there myself in the afternoon about Bitcoin mining versus the environment and there will be a bunch of Bitcoin Pioneers attending helping people get started in this new digital world by giving away £10 in free Bitcoin and directing people to the next beginner’s webinar.

If you’re coming to see us (day tickets are still available here, although all glamping spots are now taken), come and say hi, but whatever you do have a fabulous weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on Wednesday 20th July at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $879 billion.

What Bitcoin did yesterday

We closed yesterday, June 30 2022, at a price of $19,784.73. The daily high yesterday was $20,141.16 and the daily low was $18,729.66.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $373 billion. To put it into context, the market cap of gold is $11.391 trillion and Tesla is $697.92 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $33,115 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 71.94%.

Fear and Greed Index

Market sentiment today is 11, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.52. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 30.32. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin is deliberately amoral, it has no requirements to entry and asks nothing of the user aside from a valid signature.”

Nic Carter, Partner at Castle Island Ventures

What they said yesterday

Buying the dip personified…

Anything but boring…

Stability in unstable times…

Crypto AM: Editor’s picks

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST