The “homebody economy” – investing in your digital back yard

It is clear that UK shares are unloved. No likes, no shares, no new friend requests. The level of gloom surrounding this market is remarkable even amongst UK based investors, who, you might think, should feel more comfortable investing here.

This is not just pandemic queasiness. Although the UK economy is service-led to some extent, it is not uniquely disadvantaged by the fallout effects of Covid-19.

And indeed, the government’s support schemes such as Eat Out to Help Out have focused on supporting the more vulnerable services element of the economy.

UK equities unloved

Should we blame Brexit? Last year, we saw a similar spell of despondency when international investors shunned British shares ahead of the withdrawal deadline. Once they realised the world wouldn’t end, UK mid-caps bounced back very strongly.

We’re back there again. Global fund managers are at their gloomiest, in terms of an underweight to UK equities, in two years, according to the most recent update of a monthly survey by Bank of America.

There’s no guarantee history will repeat itself. But it seems reasonable to assume that current fears will subside as the usual brinkmanship around EU negotiations results in an agreement of sorts, and that UK share prices will rally.

UK earnings set to recover?

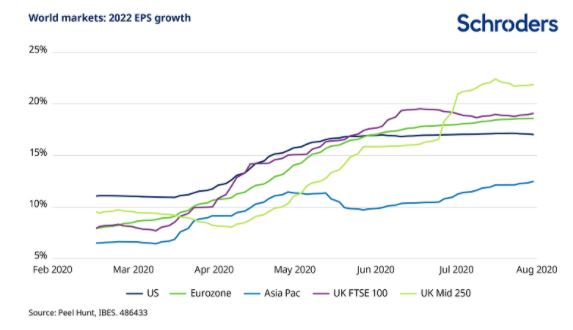

One chart, from Peel Hunt, captures the story from a different angle. It shows analysts’ consensus for increases in earnings per share for certain markets. The FTSE 250 is forecast to recover with more gusto than other major markets, shown below.

The forecasts included should not be relied upon, are not guaranteed and are provided as at the date of issue. Forecasts and assumptions may be affected by external factors and are subject to change

Valuations are also worth considering. UK small and medium-sized stocks trade at a discount of around 25% to similar stocks globally, based on a blend of valuation yardsticks including price-to-earnings and price-to-book.

Regardless of whether confidence returns, we’re focused on a certain characteristic of the market – the “homebody economy”.

Find out more from Schroders:

– Read: Big Tech’s market might in five charts

– Learn: What anti-obesity measures and the National Food Strategy mean for businesses

– Watch: Should investors fear a Biden election win?

– Bookmark: Schroders insights

Why the “homebody economy” is flourishing

The term will be familiar to those in the US; less so elsewhere. It is the increased shopping, studying, working and entertainment we’ve all been doing at home during lockdown.

“Homebody” is no longer considered a derogatory word; it reflects a trend that’s widespread, growing, and a force to be reckoned with. Most importantly, you can get plenty of exposure to it in the UK, through underappreciated technology or technology-enabled growth companies, and their enablers.

In my world, as an investor focused largely on medium-sized FTSE 250 companies, or mid-cap, I see industries and sectors that are firmly in this space.

The companies benefiting

You will have noticed these trends yourself – the boom in pet ownership, for instance, thanks to the likely new normal of two or three days a week working from home. This shift in pet ownership has been a boon to Pets at Home, an out-of-town superstore for pet owners.

The increase in gaming has also been widely reported. With non-existent commutes and more time available at home, many people are spending more of their wages on entertainment. It’s not just desktop gaming either; table-top gaming has flourished too.

The likes of Warhammer, a table strategy game previously associated with pre-teen boys, has seen demand soar. Its owner, The Games Workshop, has reaped the benefits.

Refurbishment is another trend that may resonate with anyone who has sat at home long enough to notice the rooms in dire need of a makeover. As a result, retail park-based companies such as DFS, a furniture chain, and Dunelm, a specialist in affordable and well merchandised homewares and furnishings, have seen demand rise.

UK tech

All this increased working from home is only made possible by good connectivity and reliable “kit” however. Homeworkers are at the whim of technology, so companies providing infrastructure and support have naturally thrived amid the homebody digital economic boom.

Examples include under-appreciated UK tech companies such as Computacenter (which seems to keep upgrading its earnings forecasts) and Softcat.

Other trends are less obvious. The increase in stock market trading has been helpful to online trading companies. This is the result of a section of the population, having more time (and privacy!) to dabble, more money after saving on travel costs, and the inspiration of a breathless rally for high-profile stocks, such as Apple, Amazon and Tesla.

Digitally advanced UK online financial spread betting companies IG Group and CMC Markets, for example, have significantly expanded their audiences.

And what of office stocks? Well, these can benefit from an increasingly digital world too. IWG, the largest flexible office space platform, is well placed to respond to what is likely to be a rapidly evolving backdrop, with employees mixing and matching working from home alongside collaboration sessions in the office.

Much rests on which of these trends hold. The government has told us to go back to the office. But changes which were already happening have been accelerated by the pandemic.

The shrewd investor must judge the extent to which they will persist. Only then does assessing the long term winners and losers become possible.

Any references to companies is for illustrative purposes only and not a recommendation to buy and/or sell. The article is not intended to provide, and should not be relied on for investment advice. Information and opinions contained herein are subject to change. Reliance should not be placed on any views or information in the article when taking individual investment and/or strategic decisions. The value of investments may go down as well as up and you may not get back the amount you originally invested .

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.