Thames Water plans £15bn float

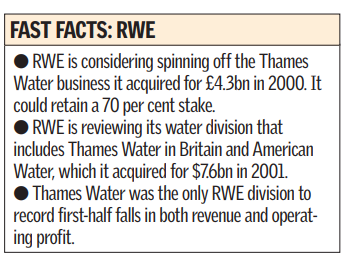

RWE, the German utility, is considering spinning off the Thames Water business. A float on the London Stock Exchange (LSE) is expected to a capitalisation of up to £15bn.

Thames Water left the LSE following the RWE acquisition in 2000. According to German press reports yesterday RWE is now weighing up a partial flotation, possibly using WestLB.

RWE chief executive Harry Roels recently launched a review of the group’s water investments, which consist mainly of Thames Water, bought for £4.3bn, and American Water, which it paid $7.6bn for in 2001.

Thames Water has undermined RWE’s profitability and was the only division to record falls in both revenue and operating profit in the first half. A partial IPO of 30 per cent of the division is the leading option, with the possibility of selling the remainder later to a trade buyer. RWE could retain a 70 per cent stake.

E chief executive Harry Roels recently launched a review of the group’s water investments, which consist mainly of Thames Water, bought for £4.3bn, and American Water, which it paid $7.6bn for in 2001.

Diversification was seen to have weakened RWE and the move would leave it free to concentrate on its more profitable gas and electricity assets. It has already indicated that it plans to sell its water businesses in Chile, Spain, the United Arab Emirates, Thailand and Australia.

Analysts have questioned the logic of having a water business, which is highly regulated.

A full board meeting, at which the final course of action will be decided, is expected soon. WestLB CEO Thomas Fischer is RWE’s supervisory board chairman and is tipped to win the mandate to sell the group’s water assets after a flotation. RWE declined to comment on a possible spin-off but said: “RWE continually reviews its business strategy for all its divisions, including the water business, to see if it is necessary to modify it to market conditions.”

A full board meeting, at which the final course of action will be decided, is expected soon. WestLB CEO Thomas Fischer is RWE’s supervisory board chairman and is tipped to win the mandate to sell the group’s water assets after a flotation. RWE declined to comment on a possible spin-off but said: “RWE continually reviews its business strategy for all its divisions, including the water business, to see if it is necessary to modify it to market conditions.”