Thames Water backer USS faces grilling from pensions watchdog

The UK’s largest pension scheme faces a grilling from the regulator over its investment in troubled utility giant Thames Water.

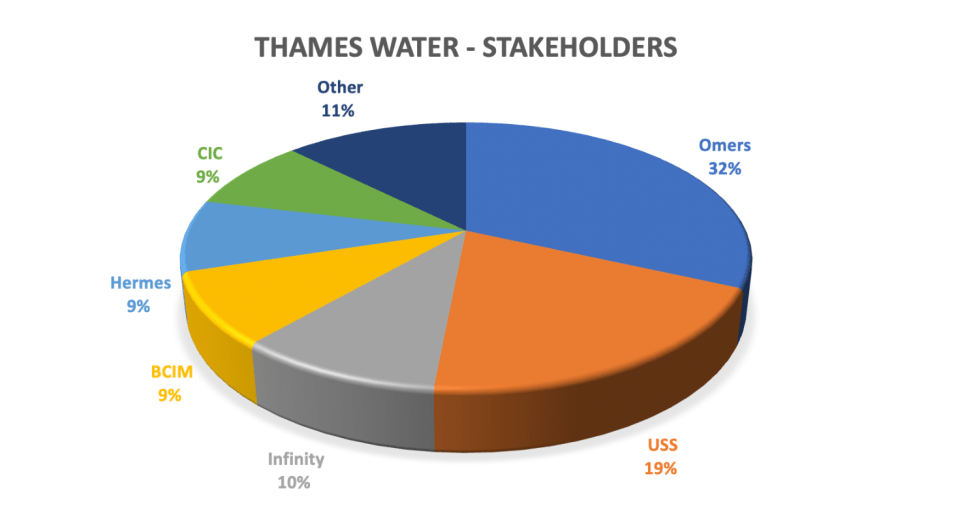

A meeting between The Pensions Regulator (TPR) and the £90bn Universities Superannuation Scheme (USS), which owns a 20 per cent stake in Thames Water, will happen as early as this week, according to the Financial Times.

While the meeting has been long anticipated, questions around the company’s stake in the water monopoly will be on the agenda, sources told the newspaper.

TPR’s intervention follows widespread media reports the government is working on contingency plans for a de facto nationalisation of Thames Water, which has a £14bn debt pile and is scrambling to secure a further £1bn capital injection from its investors.

This includes UK and international pension funds, including USS, which is home to more than half a million members – alongside state-backed Chinese Investment Corporation and Infinity Investment, which is tied to the UAE’s sovereign wealth fund.

USS first became an investor in Thames Water in 2017 – and indicated its conditional support last week for Thames Water, confirming it had given its backing to the company’s turnaround plan to address leaking pipes and sewage spills.

“We remain of the view that, with an appropriate regulatory environment, the long-term objective of repairing important UK infrastructure and paying pensions to our members are in strong alignment,” it said.

However, TPR has a statutory duty to ensure that schemes are well run, including around their investment decisions, so that pensions can be paid in full.

Currently, USS is in the process of undertaking a formal check of its financial position, known as a valuation.

This comes with Jeremy Hunt expected to unveil plans at a speech in Mansion House next week to encourage pension schemes to fund sectors that will boost economic growth and provide higher returns.

The UK’s public and private sector pensions manage around £3trn in assets – and Hunt is pushing for them to invest more widely in early-stage unlisted companies, infrastructure and private equity.

These are seen as considered more risky than publicly traded assets, because of the lack of transparency over fees and charges and general complexity.

A TRP spokesperson said: “We are in regular contact with the trustee but do not comment on these discussions.”

USS declined to comment.