Tether’s USDT Market Cap Surpasses $15 Billion as Ether Miner Revenues hit Five-year High

This week CryptoCompare data shows the price of Bitcoin (BTC) moved from around $10,450 to $11,100 high before its price corrected to $10,700, as the cryptocurrency’s breakout seemingly failed.

Ether (ETH), the second-largest cryptocurrency by market capitalization, started the week around $360 and moved up to a $392 high before prices across the crypto space started dropping. CryptoComnpare data shows ETH is currently trading at $358.

This week the market capitalization of Tether’s USDT stablecoin surpassed the $15 billion, further helping it cement its position as the number three cryptocurrency by market cap, above XRP, and below BTC and ETH.

The stablecoin’s market cap has been rising rapidly, so much so in the last 30 days, it added $3 billion. Demand for USDT has been surging and the stablecoin allows those farming liquidity on lending platforms to avoid volatility while earning interest. Its growth has been such that CoinMetrics data revealed last month its 7-day average daily transfer value surpassed that of the flagship cryptocurrency bitcoin and PayPal, as the stablecoin’s transfer value was of $3.5 billion, above BTC and PayPal’s values close to $3 billion each.

The same liquidity mining trend that has been increasing demand for USDT and helped the cryptocurrency pegged 1:1 to the U.S. dollar surpass a $15 billion market cap has also helped Ethereum miner revenues hit a five-year high above 2,275 ETH per day.

These figures can be partly attributed to the decentralized finance space’s largest decentralized exchange, Uniswap, distributing its own governance token, called UNI, to every user who interacted with the platform before September.

For every address used on Uniswap, the protocol distributed a total of 400 UNI tokens, which are currently trading above $5. The $2,000 airdrop has seen users rush to collect their tokens and sell them on exchanges, which increased transaction fees on the ETH network.

Over the week a decentralized finance lending protocol, bZx, lost over $8 million to an attacker that exploit its interest-bearing tokens by essentially duplicating them. While users’ trust on the protocol plunged initially, shortly after the team behind it revealed they managed to recover the stolen funds.

According to bZx, using on-chain data the team managed to track down the person behind the attack and identify them. When confronted, the person agreed to return the stolen funds.

Bakkt’s Bitcoin Futures Daily Trading Volume Hits New All-Time High

Interest in bitcoin has also seemingly been on the rise, as this week the Intercontinental Exchange’s (ICE’s) cryptocurrency derivatives trading platform Bakkt hit a new record daily trading volume of 15,955 contracts, worth over $200 million.

The figure is up 36% compared to its previous lifetime high of 11,706 contracts, as daily volumes increased more than 1,000% on a year-to-date basis. Bakkt’s contracts are physically-settled, meaning that on expiry holders get the BTC underlying it.

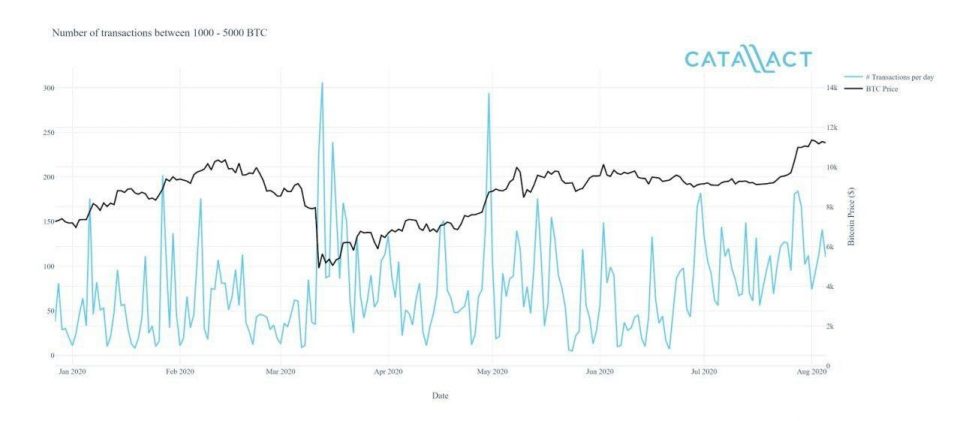

On-chain transaction data, analyzed by crypto exchange OKEx and blockchain data firm Catallact, found that while during BTC price drops this year wallets with small amounts of bitcoin tended to either sell or adopt a wait-and-see approach, wallets with 1,000 BTC (over $10 million) surged in March when crypto prices plummeted, and transactions between 1,000 and 5,000 BTC entered an upward trend at the end of June, as the price of BTC consolidated.

This suggests institutional investors have been accumulating cryptocurrency and buying the dip. Indeed, this week the CEO of billion-dollar business intelligence firm MicroStrategy revealed the firm acquired 16,796 BTC at an aggregate purchase price of $175 million.

The acquisition was on top of another $250 million bet on BTC made earlier this month. To date, per the CEO, MicroStrategy bought a total of 38,250 BTC at an aggregate purchase price of $425 million.

Despite the ongoing hype behind cryptocurrencies and the decentralized finance space, not everyone is convinced. Bloomberg reported this week, citing people familiar with the matter, that India is reportedly planning to ban cryptocurrency trading in the country.

Crypto AM: Market View in association with Ziglu