| Updated:

Tesco share price hits 11-year low as supermarket chain issues yet another profit warning

The figures

The year just keeps getting worse for Tesco, with the beleaguered supermarket chain issuing yet another profit warning this morning.

It said trading profit for the financial year ending 2015 would not exceed £1.4bn – a significantly lower figure than market expectations of between £1.8bn and £2.2bn.

Shares plummeted by 16.2 per cent on the FTSE 100 to 157 pence in early morning trading, marking an 11-year low for the supermarket. Shares have risen slightly since then, reaching 168 pence at 12:53pm – but this is still a decline of more than 10 per cent decline compared to yesterday.

Why it's interesting

Only three months ago, Tesco revealed it had already overstated its profits by £263m, resulting in shares falling so low that billions of pounds were wiped off the value of Britain's biggest supermarket chain.

At the time, it became apparent that Tesco had been booking returns on promotion deals with suppliers too early, while pushing back costs at the same time.

The accounting irregularities resulted in a criminal investigation being launched by the UK's Serious Fraud Office.

Tesco's share price has consistently declined since the beginning of the year because of stiff competition from budget stores such as Lidl and Aldi affecting sales. The recent revelations have only fuelled the downfall.

What Tesco said

The warning comes 100 days after Dave Lewis became chief executive of the company. In a statement, he blamed the revised outlook on short-term sacrifices being made for long-term profitability.

“While the steps we are taking to achieve this are impacting short-term profitability they are essential to restoring the health of our business,” he said.

He added that in recent weeks, the company had implemented new policies and procedures to govern the commercial income activities of the company, and that the “entire team” was being retrained.

“Our priorities remain restoring competitiveness in the UK, protecting and strengthening the balance sheet and rebuilding trust and transparency,” he said.

Further details on how the company intends to improve its competitiveness and balance sheet are due to be released on 8 January.

——

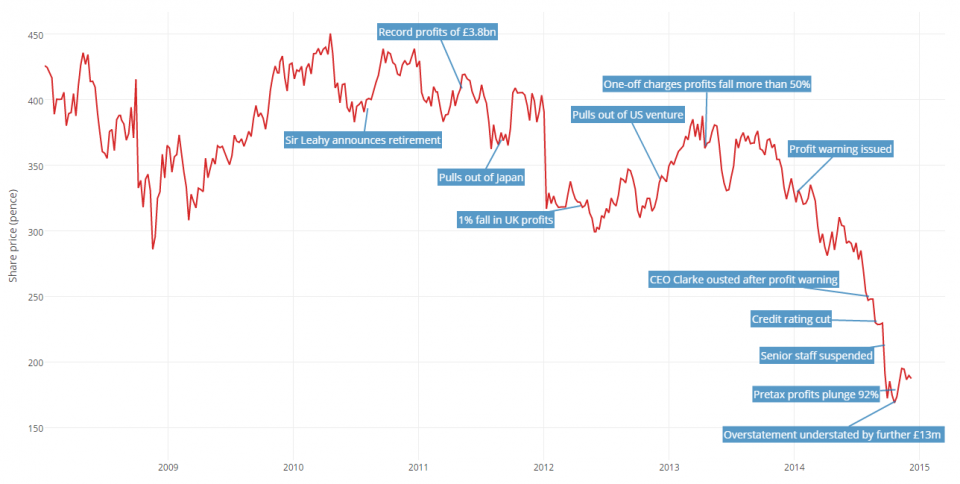

The below chart traces the rise and fall of a business giant (click to view an image which can be zoomed in on mobile).