| Updated:

Tesco in further turmoil after profits tumble

Investors fled for cover yesterday as Tesco warned on profits for the fourth time in five months, raising fears in the City that the ailing supermarket could become a takeover target.

Analysts at investment bank Espirito Santo compared Tesco’s demise to that of Sears in 2004, when the US retailer – once the biggest in the country – was taken over by Kmart.

Like Tesco, Sears was burdened by a huge store portfolio and was struggling against stiff competition from cheaper rivals such as Target and Wal-Mart.

“We think the Sears example provides a stark reminder that big companies can potentially fail despite their size,” Espirito Santo analyst Tony Shiret said.

“The best case scenario for Tesco is private equity or retail interest, which could prove optimistic given Tesco’s high leverage and dwindling freehold,” he added.

Tesco’s shares plunged 13 per cent yesterday as the supermarket group said trading profits for the year to February would not exceed £1.4bn.

That is almost 30 per cent below analysts’ forecasts of £1.94bn. It also compares with already lowered estimates of £2.4bn after its profit warning in August and a month before it revealed a £263m black hole in its accounts.

Broker Cantor Fitzgerald downgraded its UK trading profit for Tesco’s second half to just £15m, down 98.6 per cent.

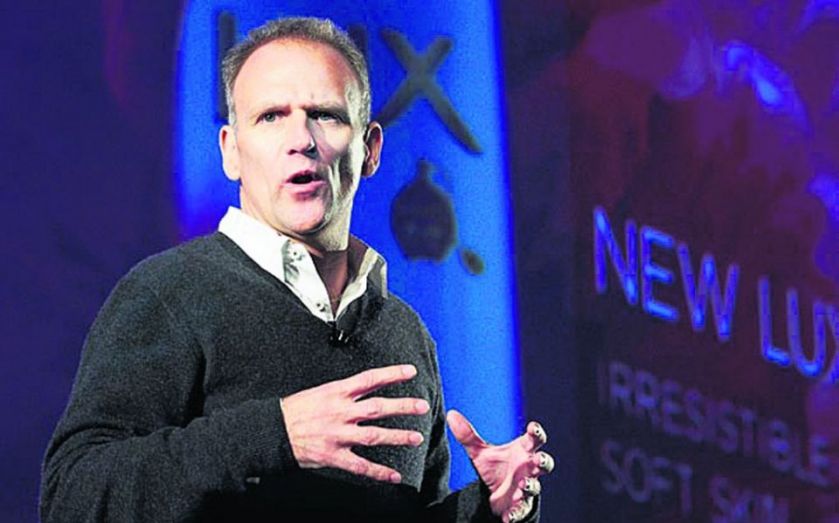

Chief executive Dave Lewis said the profit shortfall was the result of steps taken in recent weeks to nurse the business back to health, including “resetting” its relationship with suppliers, recruiting an extra 6,000 staff, increasing availability on its popular lines and slashing more prices.

He said it had also axed certain “artificial measures” Tesco used to carry out at the end of the financial year to hit profit targets, such as reducing the number of staff in its stores after the Christmas rush to save costs.

“There are certain things you can do to run the machine slightly leaner in the last quarter of the year, but that impacts quality and service,” he said. “We’ve taken the decision that that’s not what we want to do.”

These actions have cost Tesco more than £500m, Lewis said, adding that so far the feedback from customers, staff and suppliers was “encouraging”.

He added: “We are taking a surgical approach without impacting what is a very important time of year.”

Tesco said it would share more details about the measures it would to take to “improve the competitiveness of the UK customer offer” and “strengthen its balance sheet” in its update on 8 January.

The prospect of a right issue, as well as asset disposals, now appears more likely, analysts said. And having already slashed its first-half dividend by 75 per cent, analysts also fear the final dividend may be scrapped altogether.

“The announcement prolongs the agony investors have to endure before the business can grow again,” Shore Capital analyst Clive Black said.

Meanwhile, credit ratings agency Moody’s yesterday kept its Baa3 rating, but warned of “increased negative pressure on its current rating”.

…BUT THE CITY BACKS LEWIS DESPITE PROFIT DIVE

Tesco’s shares have nearly halved over the past year after accounting scandals, profit warnings, high-profile exits and sliding sales. Several shareholders, including Warren Buffett’s Berkshire Hathaway and Harris Associates, have fled the business, but others see Tesco’s woes as an opportunity in the long term.

Ian Kelly, a fund manager at Schroders, which holds a 1.67 per cent stake in Tesco, said: “While most investors are focusing heavily on the bad news, uncertainty and panic can create exceptional opportunities for long-term value investors like us”.

HSBC analyst Dave McCarthy also believes Tesco “still has the potential to be a strong UK market leader”, but warned that it needs to start delivering improvements in sales sooner rather than later.

Meanwhile, Shore Capital’s Clive Black said: “Lewis is doing the rights things. He is simplifying Tesco but it is a more complex and a more messy business than we first thought… It also means that there is more fog in terms of Tesco’s financial outlook”.

LEWIS’ 100 DAYS OF WOE

■ 1 September Dave Lewis is parachuted in as chief executive of Tesco one month early.

■ 22 September Tesco shares plunge as it admits to overstating its profits by around £250m in relation to supplier payments. Four senior executives are suspended.

■ 23 September Former Marks & Spencer finance director Alan Stewart joins as Tesco’s new finance boss two months earlier than planned to help with the accounting probe.

■ 24 September Tesco’s second biggest shareholder, BlackRock, sells a chunk of its 5.03 per cent stake.

■ 25 September Sports Direct owner Mike Ashley makes a £43m bet on Tesco after entering a put option agreement.

■ 2 October Warren Buffett says buying shares in Tesco was “a huge mistake”.

■ 6 October Tesco appoints Mikael Ohlsson, the former boss of Ikea, and Compass chief Richard Cousins, as non-executive directors.

■ 14 October The group suspends three more top executives taking the total to eight.

■ 23 October Interim results show Tesco’s profit overstatement is higher than originally estimated at £263m. Chairman, Sir Richard Broadbent, says he intends to step down.

■ 24 October Harris Associates, once Tesco’s seventh biggest shareholder, confirms it has sold its remaining stake in Tesco.

■ 27 October Tesco reveals Lewis has been handed £4m golden hello in share options.

■ 29 October The SFO says it has begun a criminal investigation into Tesco practices.

■ 1 December Lewis takes over the day-to-day running of the UK business after Tesco’s poor handling of Black Friday when police had to be called into some of Tesco’s overcrowded stores.