Team of ex-Neobank execs launch Gro Labs to bring automated trading to DeFi

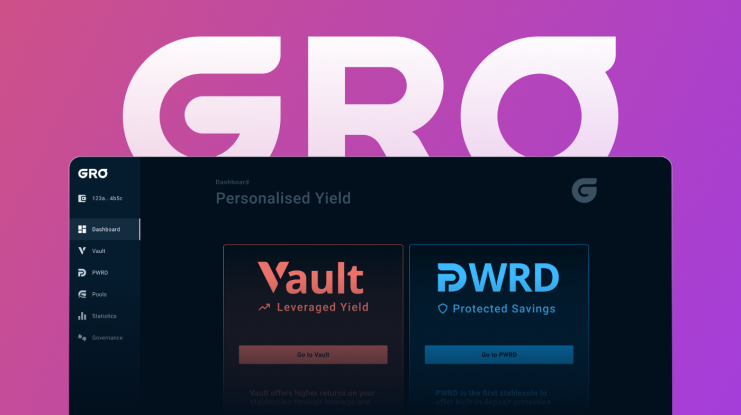

Gro, the stablecoin yield farming protocol, has announced the launch of its first automated leveraged yield farming product, as part of its new ‘Labs’ offering.

Alpha Homora v2 on Avalanche is Labs’ first strategy. Distinct from Gro’s PWRD and Vault offerings, which offer comparatively more predictable and consistent returns through stablecoin risk tranching, Labs will make cutting-edge strategies with higher-yield potential and lower gas costs accessible to more DeFi users.

Labs was designed by a team that has worked on some of the world’s most popular web apps – including Revolut, Monzo and Spotify. Through Labs, they are now bringing best-in-class user experiences to DeFi – benefiting users with the unprecedented convenience of live position dashboards and intuitive user interfaces.

“We are proud to reduce barriers to participation in one of the most exciting and rewarding opportunities in decentralised finance with the much-anticipated launch of our Labs Product,” said Hannes Graah, founder of Gro.

“Labs will enable a new generation of DeFier’s to enter the world of yield farming and seamlessly generate some of the highest APY in the sector on their stablecoins. Alpha Finance Lab’s Alpha Homora v2 offering was a natural choice for our first yield strategy.

“Alpha Finance Lab continuously innovates to bring best-in-class leveraged products to the DeFi community, their Alpha Homora v2 platform is now a hugely popular DeFi protocol, with almost a billion dollars in TVL.

“Leveraged yield farmers have typically needed to devote considerable time to continuously monitor their positions to ensure they aren’t getting liquidated, and also to rely on different tools to keep track of their exposure levels as markets move. Gro’s pioneering new Labs product can now automate this burden entirely, providing enhanced security and efficiency for users, and enabling them to access leveraged yield farming as a source of alpha.”

Labs will initially launch exclusively to Gro DAO members holding 500+ GRO tokens next week, with access opened up to DAO members with smaller holdings on a waterfall basis thereafter. This approach was successfully pioneered in the rollout of Gro protocol – except this time GRO tokens will be used as the gatekeeper instead of Degenscore.

Leveraged yield farming, with its superior capital efficiency to alternative DeFi products, has become a popular choice for highly-experienced DeFi users to maximise their yields in recent years. However, despite the huge opportunities alpha presented, the requirement for advanced technical capabilities in exposure calculation, as well as continuous portfolio monitoring requirements, have acted as major deterrents to broader engagement with leveraged yield farming strategies until now.

Labs users will be alleviated of the burden of tracking when they should open and close positions, claim rewards tokens, or calculate how much to borrow in order to remain market-neutral on non-stablecoin assets. When there is a major pump (or dump), Gro’s Labs product can also gauge when the market resumes bi-directional volatility before opening new positions, so that user funds are not subject to high impermanent loss.

About Gro

Gro is a decentralised finance (DeFi) protocol offering leveraged and protected stablecoin yields through risk tranching. It’s products include PWRD, Vault and Labs. The protocol uses an automated portfolio of stablecoin yield strategies to balance yield against risk. PWRD users are protected from loss by Vault users. In return for the increased risk, Vault takes a leveraged share of protocol returns from PWRD. As Gro focuses almost entirely on stablecoins, market price volatility is minimized, even in higher risk products.

Gro is backed by investors including Galaxy Digital, Framework Ventures, Variant Fund, Three Arrows Capital, and many more. To find out more, visit gro.xyz.