TCFD’s Grand Finale

The latest (and last) annual update from the TCFD revealed that companies are increasingly publishing their climate-related risks and opportunities.

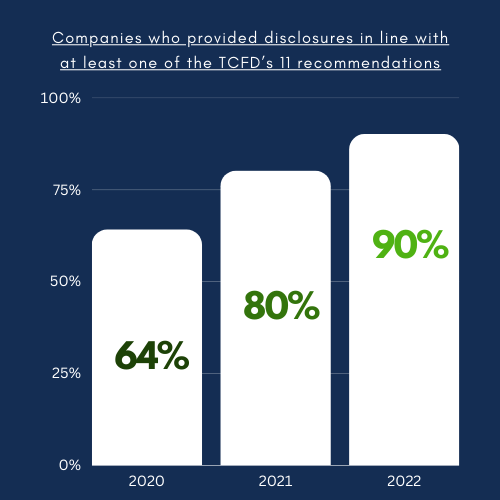

The study used AI technology and examined the public reports of more than 1,350 large companies across a range of regions and sectors over a three-year period:

- 90% of companies in 2022 provided disclosures in line with at least one of the TCFD’s 11 recommendations, compared with 80% in 2021 and only 64% in 2020

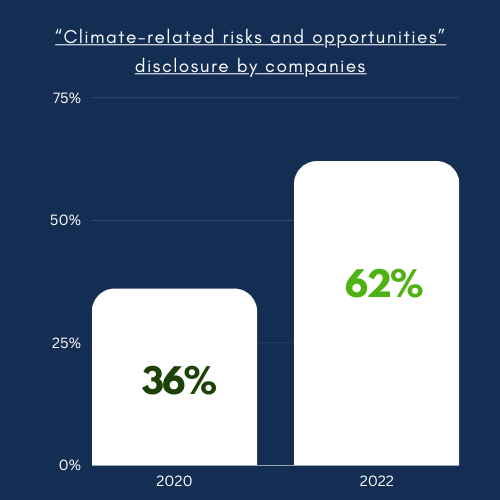

- The category that saw the most significant growth in reporting was “Climate-related risks and opportunities,” disclosed by 62% of companies in 2022, a stark increase from only 36% in 2020.

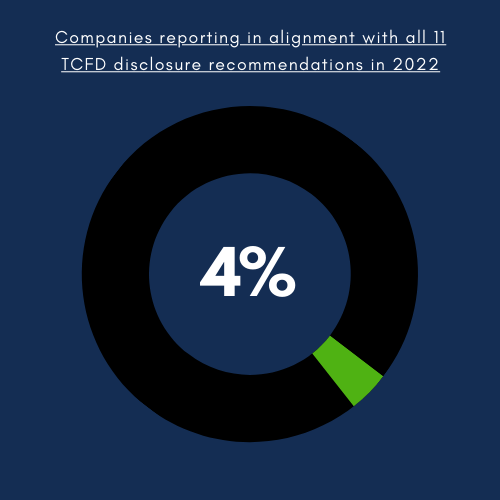

- Significant room for improvement remains; most companies are not yet reporting across all TCFD recommendations – only 4% of companies reported in alignment with all 11 TCFD disclosure recommendations in 2022.

While the TCFD found the results of the survey “encouraging,” it added “more companies need to consider the effects of climate-related issues on their financial statements.”

Perhaps a reason for the minimal number of companies complying with all 11 recommendations though, is that not all the recommendations are deemed truly material to these companies, with limited resources to expend on climate change compliance and risk assessment.

Does this corroborate with Integrum ESG’s findings?

An increase in reporting of climate risks and opportunities corroborates with the findings at Integrum ESG. Out of the almost 6,000 companies we have coverage of in our database, almost 600 companies have the metric “managing business risk from climate change” as material.

To score well under Integrum ESG’s scoring methodology, a company must disclose how they are identifying and managing physical risks and/or opportunities of climate change on their business operations, as well as demonstrate alignment to the TCFD framework.

Approximately 55% of those companies have adopted at least part of the TCFD framework, with 24% of these companies having seen an improvement in their score for this metric between their current and previous reporting years.

Perhaps more telling is that just less than 3% of companies have had a decrease in their YoY overall rating for this metric.

Can we expect to see this trend continue after the TCFD standards are adopted by ISSB?

The TCFD is being disbanded, and its recommendations are becoming a set of IFRS Sustainability Disclosure Standards, which are to be managed by ISSB.

Since these revised ISSB Standards now cover disclosure components that were previously part of TCFD’s domain, companies no longer need to ensure their compliance with TCFD recommendations separately.

However, from January 2024 there will now be additional, slightly more stringent requirements in IFRS S2, such as the requirements for companies to disclose industry-based metrics, to disclose information about their planned use of carbon credits to achieve their net emissions targets, and to disclose additional information about their financed emissions.

A key motivator for the creation of the ISSB was the need to address the ‘alphabet soup’ of sustainability reporting initiatives by integrating key investor-focused disclosure initiatives.

Having a more complete suite of sustainability standards could mean companies are more likely to increase compliance when all the standards are in one entity, meaning the observed TCFD trend could continue to grow in the future.

For a deeper insight into the final TCFD annual update, Click here.