Taylor Wimpey profits hit by £1.5bn writedown

Housebuilder Taylor Wimpey’s first half profits fell sharply after writing down a massive £1.5bn loss on the value of its property assets.

The new homes specialist, which earlier in the year warned it would breach its banking covenant over the full year, said yesterday that it was still in talks with its bankers about revising the terms of its £1.7bn net debt burden, which it hopes to conclude by the end of the year.

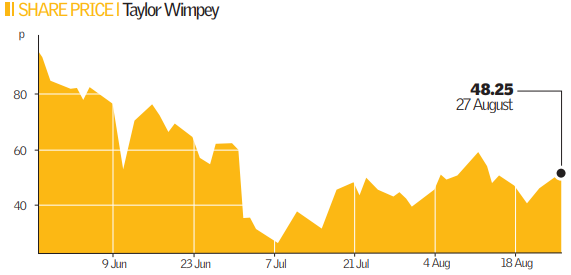

Shares in Taylor Wimpey fell as much as 13 per cent in early trading after it posted a pre-tax profit for the six months to the end of June of £4.3m, compared to £119.8m for the same period last year, with chairman Norman Askey adding the firm was experiencing “very challenging market conditions across the UK, US and Spain”.

However, in a bid to appease shareholders’ concerns the company said its North American arm was “fighting fit” to deal with the tough conditions and it was applying its experience of the downturn in the US housing market to the UK.

“Business priorities are cash management and cost reduction, to protect shareholder value, and place the business in a strong position as conditions change,” it said. The company has already taken cost cutting measures by shutting 13 of its 39 operating businesses, axing about 900 jobs by the end of September. Yesterday, it said that restructuring its UK business would cost £40m. Taylor Wimpey shares, which have slumped more than 75 per cent in the last year, fell 3.75p to 48.25p.

Analyst Views: What’s your reaction to Taylor Wimpey’s results?

Kevin Cammack (Kaupthing): “On the crucial issue of refinancing, whilst conceding that it will be in technical breach come quarter one ‘09, it is saying it is in discussions with banks and expects to conclude a renegotiation by the year end. This now seems likely to be a Barratts’ type waiver of old covenants in favour of a cash flow one.”

Oliver Gilmartin (RICS): “More bad news from yet another housebuilder demonstrates the acute challenges being faced within the sector which will have wider ramifications for the economy and jobs. Marginal projects will be put on hold as financial pressure on house builders intensifies and transaction volumes remain low.”

Tom Gidley-Kitchen (Charles Stanley): “Taylor Wimpey is performing fairly well, in the sense that it is in the process of restructuring itself to a position where it should be marginally profitable after interest, even if prices fall further. The company looks as if it will be able to see itself through to more normal markets, and will emerge in improved form.”