Tax investigations into large UK companies now taking three and a half years

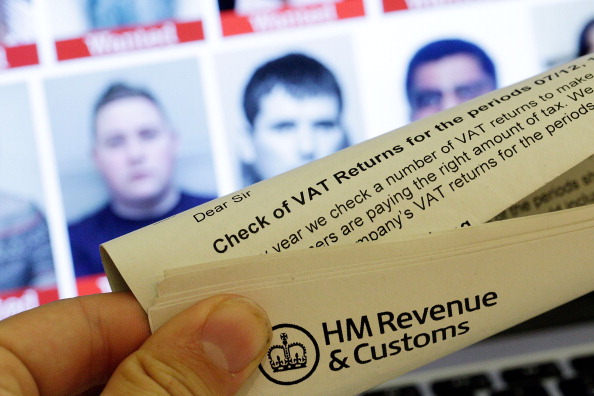

Government tax investigations into large UK businesses are now taking more than three and a half years, according to international law firm Pinsent Masons.

Read more: G20 vows to crack down on tech giant tax havens by 2020

The figure represents a 10 per cent rise from the time it took HM Revenue & Customs (HMRC) to settle cases in the 2017-19 financial year, according to Pinsent Masons analysis.

Yet HMRC said this was simply a result of more complex cases coming before it, which sometimes required legal action.

An HMRC spokesperson said: “The tax we collect funds the UK’s vital public services. We’ve secured over £62bn in additional tax revenue from large businesses since 2010 – tax that would otherwise have gone unpaid.”

However, Pinsent Masons called the longer tax disputes “very disruptive”. It said: “They can drain management time and cause lengthy periods of financial uncertainty.”

Jason Collins, partner at Pinsent Masons, labelled HMRC’s approach “inflexible”, saying it made it difficult “to settle disputes for less than the full amount of tax initially identified by HMRC as potentially underpaid”.

HMRC said it does not seek to cut deals with larger companies, and that it expects all taxpayers to cough up the full amount that they owe.

One reason tax investigations might be getting longer, Pinsent Masons said, was that they had cross-border elements.

The government introduced a “diverted profits tax” (DPT) in 2015, which encourages firms to register profits in the UK to be taxed at Britain’s 19 per cent corporation tax rate.

Otherwise firms face a tax of 25 per cent charge if they are found to be structuring their operations to pay little tax in the UK.

Read more: Tory leadership rivals turn on Boris Johnson’s tax cut plan

HMRC said in the 2017-18 financial year it brought in £388m under the DPT programme.