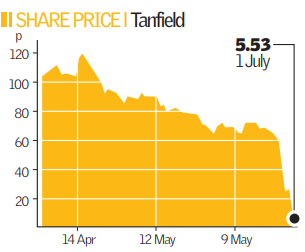

Tanfield dives after profits warning

Electric vehicle maker Tanfield crashed more than 80 per cent after warning its profits would be drastically hit by the economic slowdown.

Stunned City investors questioned the management’s credibility after the Tyne and Wear-based company gave no hint of what was to come in a statement issued on Friday in response to its share price tumbling near 40 per cent.

In a trading update yesterday Tanfield said there had been a “marked slowing” in its markets during June. Demand for platforms used on construction sites and oil rigs, which accounts for up to 80 per cent of projected revenues, have been bit by the slowing economy.

“In light of this and the deteriorating wider macro economic outlook the board has adopted a more prudent and conservative approach,” it said.

It has now put the brakes on its rapid growth plan in favour of “more moderate” growth.

House broker St Helens Capital slashed its target price from 200p to 100p which analyst David Johnson admitted to City A.M. was “probably fairly aspirational”.

“In hind-sight perhaps they should have said something on Friday but at that stage it was not 100 per cent clear,” he said.

“I was quite shocked by the update and it calls into question the credibility of management that the downturn happened so quickly,” said Paul Mumford, senior fund manager at Cavendish Asset Manager, whose Aim fund holds Tanfield shares.

He believes the company are now a takeover target. Tanfield shares plunged 82.51 per-cent to a record low of 5.53p.