UK takeover bids tumbled amid banking crisis fears – as private equity firms smell bargains

Takeover attempts in the UK tumbled sharply in the first three months of the year as fears of a global banking crisis roiled markets and spooked the City’s dealmakers.

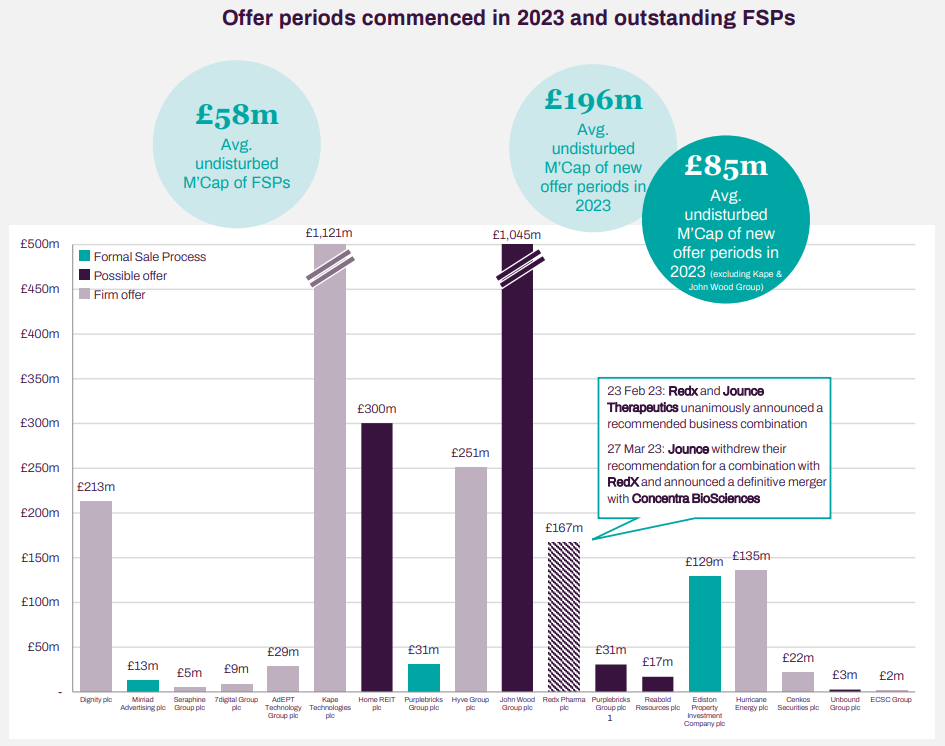

The total number of bids for UK firms fell by over a quarter on the same period last year with just 11 new firm offers made to buy UK listed companies, according to new data from broker and investment bank Peel Hunt.

The cumulative value of the proposed offers came to just £2.47bn, Peel Hunt found, with bid activity heavily skewed towards small private equity-led deals, who kickstarted dealmaking again after a slowdown last year.

“Bid activity was focused on the smaller end of the market, [with] 10 of the 11 firm offers for companies with undisturbed market capitalisations below £250m,” Peel Hunt analysts said.

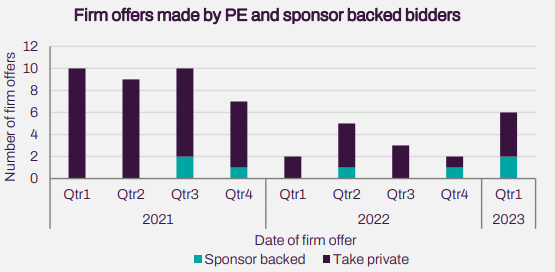

“After a quiet 2022, private equity showed signs of increasing activity with two-thirds of firm offers extending from a PE or privately owned bidder during the quarter,” the analysts added.

The figures come after a year of subdued deal flow as the City’s dealmakers sit on their hands and wait out the historic volatility that has roiled markets since Russia’s invasion of Ukraine last year.

Fears of a global banking crisis in recent weeks have added to jitters and unsettled valuations further.

The deal slowdown over the past year has hammered firms like Peel Hunt who have suffered sharp falls in profits as bumper deal fees dry up. In a trading update on its first six months trading in December, the London-listed firm said its profits had plummeted by 99.7 per cent.

The tie-up of City brokers and Peel Hunt rivals FinnCap Group and Cenkos Securities pointed towards the “merits of relative scale in the current capital markets environment”, analysts at Peel Hunt said in the research.

In a recent trading update at the end of its financial year, Peel Hunt said the recent “bail out of a number of banking institutions on both sides of the Atlantic” meant executing deals would remain tricky and it expected to turn a narrow loss.

Private equity swoops back in

Peel Hunt found that deal activity was beginning to pick back up in the smaller end of the market however, as private equity buyers look to snap up firms on the cheap.

Of the 11 firm offers made since the start of 2023, 6 have been either a direct take private or an acquisition by a sponsor-backed corporate, which surged 200 per cent on the fourth quarter of 2022.

“This activity is especially notable given that PE bidders were almost entirely absent from UK takeover activity in [the second half of 2022],” Peel Hunt said.

Some analysts have warned of a flurry of take private deals this year as cashed up private equity firms pounce on cheap British listed firms.