Swelling NHS and social care costs will force Sunak to more than double new levy, warns IFS

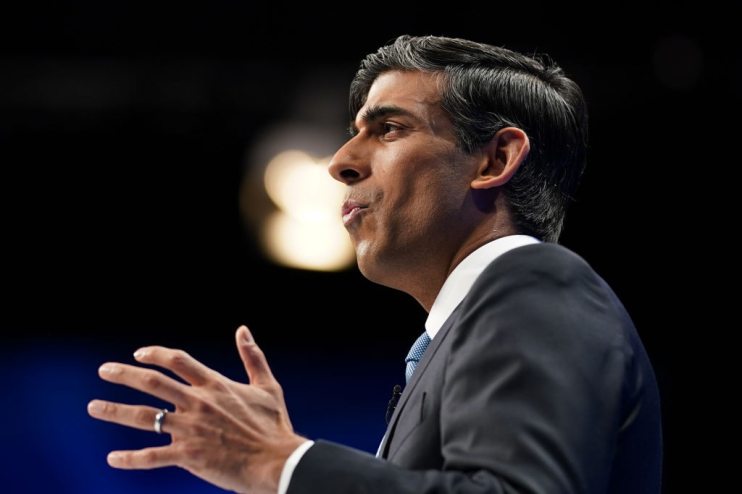

Chancellor Rishi Sunak will have to more than double a levy on employers and employees to meet the cost of an-ever demanding health and social care system.

Ongoing cost pressures generated by the UK’s ageing society are likely to force Sunak to hike the newly created health and social care levy to 3.15 per cent from 1.25 per cent by the end of the decade, according to Institute for Fiscal Studies (IFS).

The influential economic think tank predicts changing demographics in the UK will require greater spending on health and social care. These headwinds “point to a need for future tax rises, not tax cuts,” the IFS said in its Green Budget.

The IFS said the chancellor would have hiked taxes even if the pandemic did not happen, but that the government has “smuggled” them through under the guise of the Covid-19 crisis.

Paul Johnson, director at the IFS, said: “‘Rishi Sunak, a Conservative Chancellor, is presiding over an increase in the tax burden to record levels in the UK.”

Government spending is estimated to land at around 42 per cent of GDP, the highest level since the mid-80s, while the March and September’s round of tax rises will push the UK’s tax burden to its highest peacetime level.

The cost of responding to the pandemic, which has swelled the government’s stock of debt relative to the size of the economy to nearly 100 per cent, supported by inflation progressing at a fiery clip will bite through an around £15bn higher debt servicing bill this year and in coming years.

Forecasts from bank Citi put inflation peaking at nearly five per cent in April next year, more than double the Bank of England’s target. A high proportion of the UK’s stock of debt is linked to the retail price index, meaning some of the government’s interest bill rises in line with inflation.

Citi also said the UK economy will grow at around a four per cent slower pace compared to before the pandemic.

A strong rebound from the depths of the pandemic has boosted tax receipts and helped repair the damage inflicted on the public finances, meaning the Chancellor will have to borrow around £20bn less a year than was forecast in the March 2021 budget.

However, increased spending demands from the NHS, compounded by a smaller economy, will leave Sunak “short of money to spend on many other public services.”

Sunak will deliver his next budget and spending review on October 27.