Sustainable or Suspect

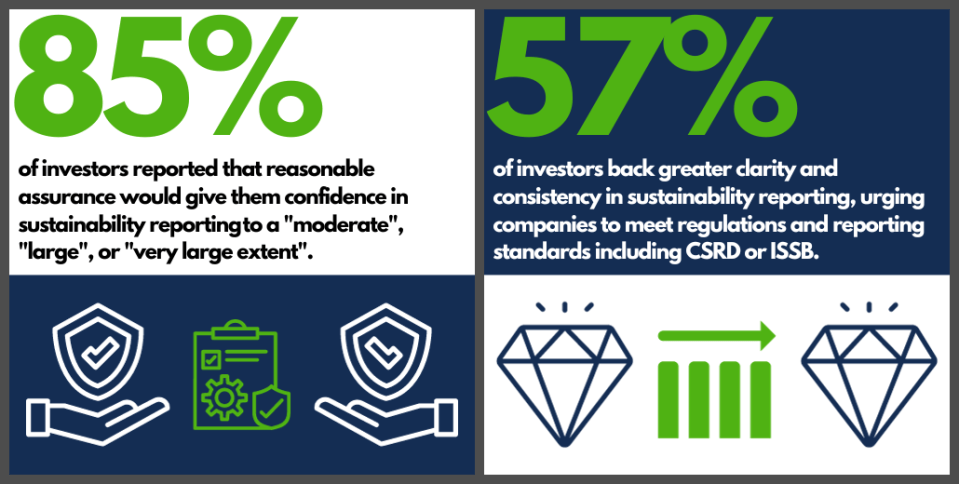

Investors worldwide are increasingly questioning the reliability of companies’ sustainability performance metrics, with a growing wariness of potential greenwashing tactics.

A recent Global Investors Survey by PwC discovered a consensus among 94% of investors, that corporate reporting on sustainability performance contains unsupported claims (an increase from last year). Yet investors continue to deem sustainability as a pivotal factor

The survey consisted of 345 investors and analysts across 30 countries. 65% of the respondents are at organisations with a total AUM of > $1bn.

The general crux of the report is that the issue of greenwashing remains as pervasive as ever amongst investors. The main way that investors believe this issue can be tackled, however, is by using regulatory sustainability reporting regimes to address their greenwashing concerns:

The SASB standards are an extremely useful tool for the implementation of ISSB standards.

The 77-industry-based SASB Standards provide useful, comparable information to investors and are cost-efficient for companies, as evidenced by their use in over 2,800 companies in more than 70 jurisdictions around the world. SASB (as well as ISSB’s IFRS S1 & S2 Standards) are emerging as the standardised global reporting framework.

This is why companies like Integrum ESG mirror the SASB reporting standards with their reporting tool. There is growing evidence to show that companies who align their disclosure to this framework will gain a competitive advantage over their peers; the standardised format of SASB makes it easier to identify material information and allows comparison to another company that has disclosed in a similar fashion, aiding investor analysis.

For companies’ sustainability performance metrics to gain trust instead of scepticism, it is therefore essential to adhere to an internationally recognized reporting standard such as SASB.

Written by Integrum ESG Analyst Kit Marks.