Surprise £118m dividend cheers Smiths investors

ENGINEERING firm Smiths’ shares were one of the FTSE 100’s top risers yesterday after it unveiled a special dividend for shareholders alongside full-year results in line with expectations.

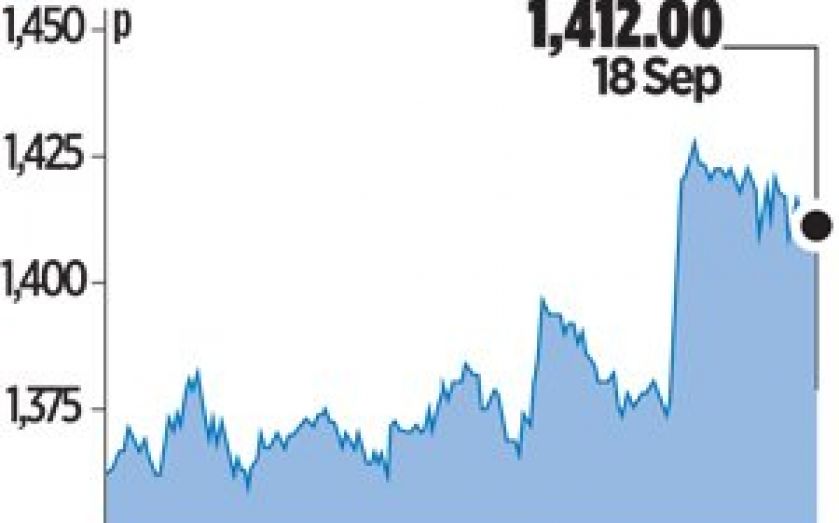

The unanticipated dividend of 30p, worth £118m in total, drove the shares 2.6 per cent higher to close at 1,412p.

Smiths also announced a restructuring programme that is expected to cut costs by £50m per year.

The firm, which makes mechanical seals, medical equipment and explosive device detectors, posted a two per cent rise in revenue to £3.1bn and a one per cent rise in operating profit to £560m this year. Earnings per share remained flat at 92.7p and the interim dividend rose four per cent to 39.5p.

Growth in the seals and power transmission component divisions offset a decline in medical revenues, which were hit by a new medical tax.

The US imposed a 2.3 per cent tax on manufacturers of medical devices as part of the Affordable Care Act, popularly known as Obamacare, from the beginning of this year.

“This was a further year of progress for Smiths Group, with organic revenue and profit growth and strong cash generation despite challenging developed market economies and government spending constraints,” said chief executive Philip Bowman.

Looking ahead, Smiths said it continues to be cautious about sectors such as defence and healthcare due to government funding constraints.

“However, we remain well placed to benefit from growth in energy demand, the need for new fuel-efficient aircraft, increased US residential construction and the ever present need for improved security in an uncertain world,” it said.

The firm unveiled the appointment of 3M’s Sir George Buckley as its new chairman back in June.