Supply chain snarl ups pull UK construction growth down to six-month low

The UK construction industry grew at the slowest pace for six months, driven by supply chain snarl ups leaving builders unable to progress work, according to a closely watched survey released today.

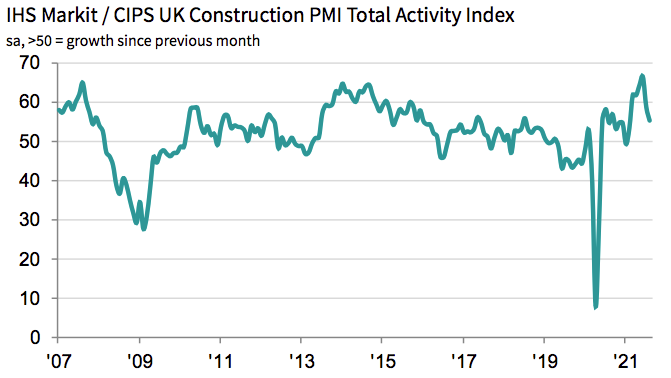

The latest IHS Markit / CIPS UK construction purchasing managers’ index slid to 55.2 in August, down from 58.7 in July.

However, the latest edition of the survey indicates construction activity has grown in each of the last seven months.

A reading above 50 suggests a majority of firms reported activity growth. The reading comes as PMIs for the UK manufacturing and services industries also showed a marked slowdown in activity last month.

A shortage of building materials, compounded by rising transport costs caused by delays in global supply chains, led construction firms to limit work.

Suppliers are buckling under the weight of a resurgence in demand as economies across the globe emerge from Covid restrictions. This intense pressure is triggering delays in deliveries as suppliers struggle to ramp up production to meet high demand.

Meanwhile, a shortage of HGV drivers in the UK is causing logistics firms to delay or cancel deliveries of raw materials.

IHS Markit said: “Anecdotal evidence suggested that ongoing material shortages were exacerbated by a lack of transport and freight availability, compounding existing issues related to the supply of materials due to port congestions and demand and supply imbalances.”

As a result of supply chain bottlenecks, the price of building materials soared at their second fastest pace on record.

Usamah Bhatti, economist at IHS Markit, said: “Supply chain disruption continued to disrupt activity across the UK construction sector, as demand for materials and logistics capacity outstripped supply.”

“The rate of input cost inflation faced by construction companies accelerated to the second-fastest on record, while the increase in subcontractor rates hit a fresh series high, fuelled by supply shortfalls in the sector,” Bhatti added.

Slowing output growth led to a marked drop in demand for workers from construction businesses.

Martin Beck, chief economic advisor to the EY Item Club, noted the slowdown in the UK construction was a symptom of constrained supply rather than any fundamental hit to demand.

“Structural factors – such as higher demand for larger, out-of-town, properties and retail-to-residential conversions in cities – will support new home building, while maintenance and repair activity will gain from the strength of households’ appetite for home improvements and the need to retrofit buildings to meet the Government’s net zero ambitions,” he said.

The survey noted construction firms are still upbeat about their future prospects, driven by confidence in new order pipelines.