Suppliers fear revenue cap could deter investment and risk supply security

The Government’s decision to cap revenues from renewables generators risks deterring investment into the UK, warned some of the country’s biggest electricity generators.

SSE feared the intervention could jeopardise the country’s green ambitions just as the country is pushing for supply security and to meet its climate goals.

The energy giant told City A.M. it was crucial the cap was not set at a higher level than the the continental equivalent, with the European Union (EU) recently establishing its own limits for generators.

A spokesperson said: “Any revenue cap must be set at a level that doesn’t discourage essential investment in the UK’s renewable energy sector and therefore should be comparable to other countries, particularly given the €180 cap being implemented by the EU. After all, the key lesson of the current energy crisis is the need to bolster our homegrown energy defences.”

| Energy source | Overall Capacity | Generation Target | Target Date |

| Offshore Wind | 11GW | 50 GW | 2030 |

| Solar | 14GW | 70GW | 2035 |

| Nuclear | 7GW | 24GW | 2050 |

| Hydrogen | >1GW | 10GW | 2030 |

The energy firm also argued that flexible technologies that depend on price signals such as hydro are excluded from the cap, to ensure supply security was not hampered over the coming months.

SSE concluded: “We will now work with the Government on the details of the policy to ensure it meets its objective of addressing extraordinary profits without throwing away the UK’s global leadership position on renewable energy investment.”

Meanwhile, rival renewable specialist Scottish Power has also raised concerns with the cap, especially over the lack of details concerning its implementation next year.

Chief executive Keith Anderson was frustrated renewables were targeted rather than further levies on oil and gas operators.

He said: “It’s disappointing that such a significant market intervention by the Government has come with so little detail, all this does is create uncertainty. This crisis has been caused by the cost of gas and it’s strange the proposed solution is to cap the price of low carbon generation and to leave the gas sector untouched.”

Energy Prices Bill looks to tame rising costs

The Government unveiled the cap on revenues for renewable and nuclear electricity generators in the Energy Prices Bill yesterday.

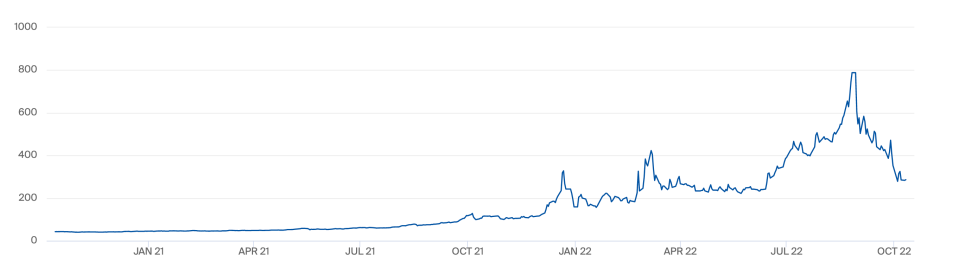

It has introduced a temporary ‘cost-plus revenue limit’, which is intended to stop low carbon generators benefitting from abnormally high wholesale costs driven by spikes in gas prices.

Renewable generators have been able to sell energy at wholesale rates dictated by gas, forcing up costs for consumers even though renewable energy is generally cheaper to produce.

This is especially urgent for the Government in an energy crisis which has driven household and business energy bills to record highs.

The fine details of the proposal are subject to the findings from an industry consultation, with the Government hoping to strike a balance between easing pressure facing households and allowing generators to “cover their costs, plus receive an appropriate revenue.”

As the mechanism will apply to excess revenues rather than profits, it is considered by the Government to be separate from the Energy Profits Levy – which targets the bumper earnings of North Sea oil and gas operators.

The revenue cap has been foreshadowed for months, with former Chancellor Rishi Sunak previously calling for renewable generators to be included in the windfall tax while the Government has been in extensive talks over renewable obligation contracts and potentially uncoupling gas and renewable prices.

Alongside the producers, industry body RenewableUK fears the measure could provide the “wrong signal” to investors, with cap essentially acting as a 100 per cent tax on revenues – which they compare unfavourably to the 25 per cent levy on oil and gas companies.

RenewableUK’s chief executive Dan McGrail warned that the UK needed to attract £175bn of investment in secure, domestic wind power to meet the country’s energy needs over the coming decades.

He also challenged the claim renewables were raking in profits, highlighting that wind turbine operators typically sell their power a year or more in advance at prices that are a fraction of the record high market prices being set by gas.

He said: “Industry will continue work with Government on policies to help cut consumer bills and safeguard investment. As such, to limit the negative impacts, it is essential that a cap is set at a level that doesn’t make the UK less attractive to investors than the EU, is technology neutral and has a clear sunset clause in place.”