Struggles continue at Asda as new owner looks to turn around supermarket giant

The continuing struggles at supermarket giant Asda have been revealed with both Tesco and Sainsbury’s hoovering up its market share in the UK, according to new figures.

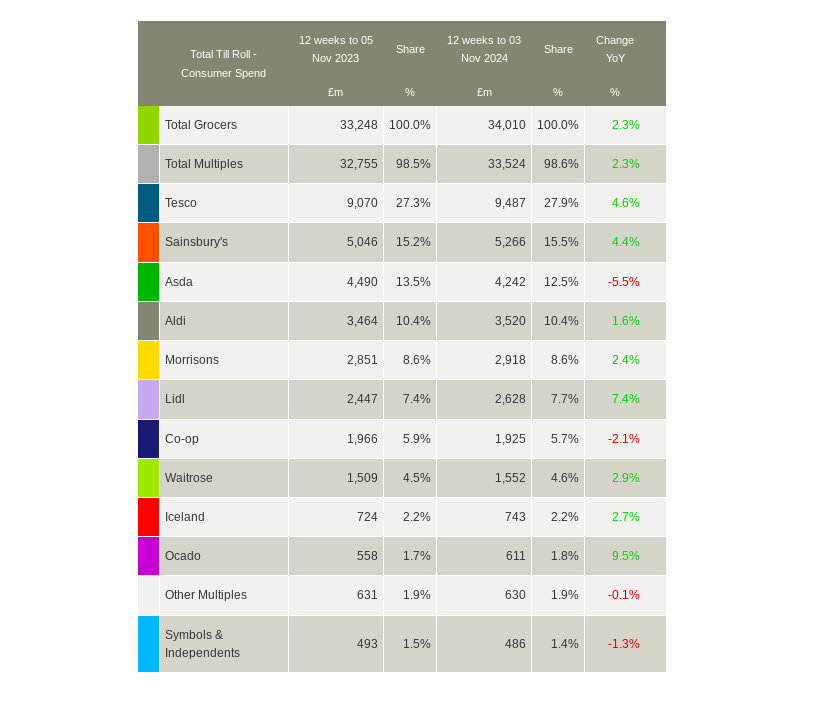

Sales at the Leeds-based grocer totalled £4.242bn in the 12 weeks to 3 November, 2024, down from the £4.490bn it reported for the same period last year, the latest data from Kantar shows.

Asda’s share of the market fell one per cent over the three months compared to the last year, with Tesco taking an extra 0.6 per cent of the market and Sainsbury’s an extra 0.3 per cent in that time.

The grocer, which became majority owned by TDR Capital recently, has enacted a wide-ranging turnaround plan this year which includes store upgrades and investment in staff, with its plan to push convenience stores on the back burner for now.

The turnaround is being spearheaded by Lord Rose, who earlier this year called Asda’s recent performance “embarrassing”.

Tesco’s rise in market share comes as the supermarket giant warned it faced a £1bn employer’s National Insurance bill over the next four years following the Budget at the end of last month.

A spokesperson for Asda said: “We know that there are some areas where we need to improve to deliver a more consistent experience for customers each time they shop with us.

“This is why we have invested to put more resource in stores and rebased our priorities around product availability, customer experience, and a revitalised trade plan. This has already started to make a difference with customers noticing improved availability both in store and online.

“We are also investing an additional £13m in store hours during Q4 to ensure more colleagues are on hand to support customers during the busy ‘Golden Quarter’ period.”

October was 2024’s biggest month so far for grocers despite Asda dip

The new Kantar data also shows that UK grocers had their busiest month since March 2020, with October spending boosted by Halloween and pre-Christmas shopping.

Grocery inflation was 2.3 per cent in the month, up slightly on September’s figure of 1.8 per cent but still close to the UK’s target of two per cent.

The rate has now been below three per cent every month since the early summer, with discounting in particular having helped keep prices down, Kantar said.

Sales increased by 2.3 per cent overall, to reach £11.6bn, making October the biggest sales month of the year so far.

“What’s interesting this month is the number of households who are already stocking up the cupboards for the big day in December,” Fraser McKevitt, head of retail and consumer insight at Kantar, said.

“Some people think Christmas ads hit our screens too soon but it’s clearly important for retailers to set out their stalls early.”

“With Black Friday on the horizon, the grocers will be hoping to capture a slice of the action there too,” McKevitt added.

Last year’s Black Friday was the “busiest shopping day on record”, according to Nationwide Building Society, as shoppers looked to make the most of festive deals.

Online grocer Ocado races ahead

Ocado topped the growth table, boosting its sales by 9.5 per cent over the 12 weeks to 3 November, 2024.

Lidl was the fastest-growing high street retailer for the 15th period in a row, with sales up 7.4 per cent. It secured 326,000 additional shoppers this period, more than any other retailer.

Morrison’s sales grew by 2.4 per cent, outpacing the market average for the first time since June 2021. Its share of take-home sales remained at 8.6 per cent.

Aldi held its share of the market steady year on year at 10.4 per cent.

Co-op and Waitrose’s shares sat at 5.7 per cent and 4.6 per cent, respectively. Iceland took 2.2 per cent of the market, unchanged from a year ago.