Super efficient DAOs can change the world, and they’re only just starting

Decentralized Autonomous Organisations

In 2013, in one of our meetings in London, Vitalik Buterin was entertaining the question… “What if, with the power of modern information technology, we can encode the mission statement into code; that is, create an inviolable contract that generates revenue, pays people to perform some function, and finds hardware for itself to run on, all without any need for top-down human direction?”

This was my introduction to the concept which was beyond intriguing to me. Decentralised Uber, decentralised Amazon, decentralised ebay, decentralised Twitter. Today, just eight years later, the number of digital organisations capable of generating real economic activity are growing exponentially and are jurisdictionless, ie, out of the hands of governments.

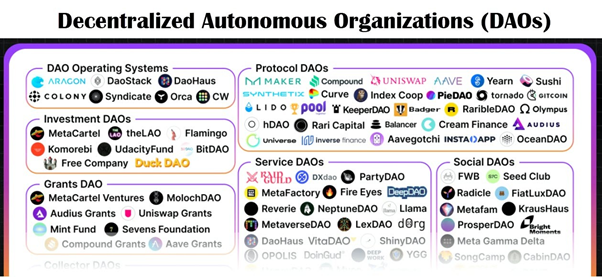

There are currently hundreds of such DAOs all operating with their own platforms, upending old school legacy systems as the efficiencies of far fewer people required at far greater efficiencies wins capital investment.

To further fuel exponential growth, DAOs are about to employ what Reid Hoffman in his book calls blitzscaling.

Hoffman writes: “Blitzscaling is a strategy and set of techniques for driving and managing extremely rapid growth that prioritize speed over efficiency in an environment of uncertainty. Put another way, it’s an accelerant that allows your company to grow at a furious pace that knocks the competition out of the water.”

Microsoft has been notorious

Bill Gates, anyone? Microsoft has been notorious since its early days for releasing software before it was properly debugged. This kept them ahead of the competition. The largest companies today that blitzscaled include Amazon, Facebook, Uber, and AirBnB.

So rather than taking the careful, conservative approach, blitzscaling emphasizes growth above all else. The cost of moving too slowly is greater than the risks of rapid capital allocation. Achieving a substantial network effect is key to prevent competitors from spending their way past you to a point where you become less competitive.

Crypto is hypercompetitive due to its open-source nature. Any platform can be copied and pasted, thus getting to scale quickly is essential. Uniswap was forked into Sushiswap which is a relevant competitor. Many DAOs have large warchests of capital that should be used for growth to attract more users yet remain dormant.

If DAOs spent just 10 per cent of their treasury via a grant committee (as everything is done by consensus), they still would have 10 years in the worst case to spend their entire treasury which is a couple of centuries in crypto time. This assumes no growth nor additional adds to the treasury. Far more likely, the quality DAOs will generate millions of dollars in revenue per year thus decreasing the burn rate for treasury funds.

Capital should be spent on building the most user-friendly tools to encourage mass adoption. AOL and Netscape did this in the early days of the internet to win the retail market. Attract the best smart contract auditors to minimize any potential setbacks as reputation is everything. Further, eyeballs are key. There are plenty of billion dollar DAOs that can sponsor a major league sports team or high value commercials such as one that airs during the Super Bowl.

Embracing the highest levels of transparency that blockchain enables, DAOs have provided real-time balance sheets and P&Ls to view the financial state of a protocol. This can encourage further investment as investors have access to far greater and higher quality data which can then be analysed and properly discussed by armies of analysts. Separate grant committees could exist for product, marketing, and research to allocate treasury capital appropriately.

DAOs are just getting started with seemingly limitless potential. Far greater efficiencies at far lower cost and far fewer human beings needed to maintain the platform make DAOs transformational.

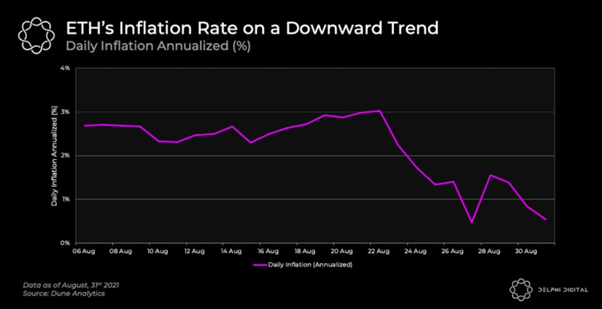

ETH inflation rate craters

Before EIP-1559 was implemented on August 5, Ethereum’s annualised daily inflation was hovering between 2.7-3.0%. ETH’s inflation rate has since plummeted to an annualised emission rate of under one per cent since the EIP went live. EIP-1559’s impact on ETH’s inflation is the equivalent of two BTC halvings.

In the first 25 days since EIP-1559, approximately ~150,000 ETH (~0.13% of Circ.) has been burned. NFT auctioneer OpenSea’s contracts alone contributed to 30.67% of all ETH burned as OpenSea surpassed $3 billion in transaction volume as of September 1. The NFT craze is single-handedly driving ETH burns higher.

Handle leverage with kid gloves

The flash crash was caused by futures open interest and spot margin borrowing, both which were peaking. Both markets combined created enough liquidations to flush the price. Several billion dollars were liquidated across futures exchanges and leveraged spot positions. This happens over and over as those with large amounts of capital can control the markets in the short term, typically flushing out overly leveraged shorts or longs. They can then swoop in and buy at a lower price when longs get flushed out, and vice-versa.

If you’re going to use leverage, make sure your liquidation point is sufficiently well below prior major areas of support. Keep in mind that as the price drops, your liquidation point rises. Know that in stocks, 2:1 leverage, ie, buying on margin, is a sharp double edged sword.

Since stocks are not nearly as volatile as cryptocurrencies, 2:1 leverage wields are far sharper sword. The traders that typically get liquidated in crypto when buying futures or on margin are those using 20:1 or greater leverage.

That said, even 5:1 can be dangerous depending on your liquidation point. I personally have a rule that I never risk more than 10% of my account in leveraged trades, so I can then use up to 10:1 leverage. If I get liquidated, 90% of my account remains untouched from the leverage.

As my principle grows should my leveraged coins go on a nice uptrend to where the 10% becomes say 33%-50% of the account, taking at least 50% of the profits off the table is wise. Then one can use those profits for future (or future futures) trades. 😉

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

https://hansecoin.medium.com/subscribe

Virtue of Selfish Investing Crypto Reports

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoinhttps://www.linkedin.com/in/chriskacher/