Summer closes on a sunny note for EU industry

INDUSTRY in the euro area grew at its fastest pace for two years this August, with output rising by one per cent from July alone.

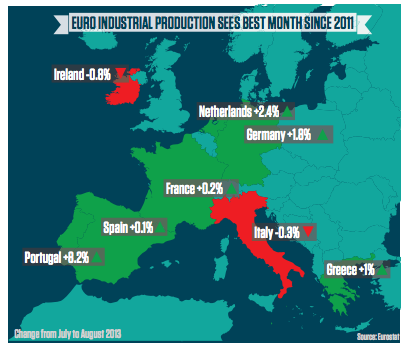

The boost to production makes up for a dip of one per cent between June and July, with a particularly impressive performance for Portugal, where production rose by 8.2 per cent in the same period.

Spain and Greece, which are among the troubled countries on the periphery of the continent, also saw more moderate growth over the month, with output expanding by one and 0.1 per cent respectively.

Of the other large economies in the Eurozone, only Germany outperformed the average in August, with production growth of 1.8 per cent. Both France, with 0.2 per cent growth, and Italy, with a 0.3 per cent contraction, were largely unchanged.

However, industrial production in the currency union is still down over the year, reduced by 2.1 per cent between August 2012 and August 2013, and industrial production is still not only below its pre-crisis peak, but also below levels seen in 2011.

Despite the uptick in August, James Howat of Capital Economics maintained that the sector is unlikely to have contributed significantly to growth during the third quarter.

“Though services might have made a slightly stronger contribution, it looks unlikely that the Eurozone’s recovery gathered much pace in the third quarter,” he said. “Overall, while industrial production is recovering, the sector still seems too weak to power a decent recovery in the bloc.”

Howard Archer, chief European economist at IHS Global Insight, suggested that manufacturers still have their work cut out: “Domestic demand in the Eurozone remains constrained by a number of factors, notably still widespread restrictive fiscal policy (despite increased flexibility now being allowed on fiscal targets), extremely difficult credit conditions in many countries, elevated unemployment, and limited consumer purchasing power.”