“Stumbling from lamppost to lamppost”: Making sense of the UK’s GDP figures

New GDP figures out this morning showed a better than expected economic performance in November – but it’s more complicated than that.

The figures showed a 0.3 per cent uptick in economic activity in the eleventh month of the year, above analysts’ consensus of 0.2 per cent.

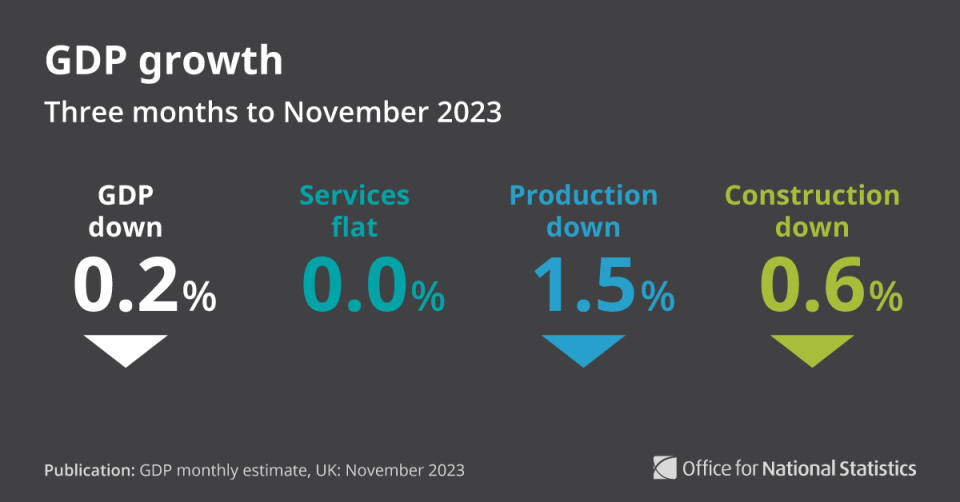

However a host of downgrades to previous data and a 0.2 per cent contractions across the closely-watched three month period – including November’s beat – has left many economists scratching their heads.

One analyst, Panmure Gordon’s Simon French, described UK monthly GDP as a “random walk… stumbling from lamppost to lamppost.”

The new consensus is that the UK is still just about bumbling on – but that growth could well keep inflation higher than expected, and potentially stave off rate cuts.

“Proving resilient”

The UK economy is proving resilient despite projections for a slowdown. As the year begins, it seems that the global economy is chugging along better than expected,” said George Lagarias, chief economist at Mazars this morning.

“However, all other things being equal, better growth also translates into higher inflation. We are already seeing a pickup in Europe and the US. Better growth and possibly persistent inflation could delay rate cuts by central banks and disappoint buoyant markets,” he warned.

US inflation figures published yesterday also suggested stickier than expected price hikes.

The read-out for annual inflation to the end of December came in at 3.4 per cent, above analyst expectations of 3.1 per cent.

“Recession on the cards”

Downgrades to third quarter data mean that should the UK be in negative economic territory in the fourth quarter, that would represent two consecutive three-month periods of negative growth: a technical recession.

Kathleen Brooks, research director at XTB, warned that “bad weather in December will have added more downward pressure to the construction sector at the end of the year, which could make it difficult for the UK to avoid a technical recession.

Pre-Christmas spending could, however, help the GDP numbers.

“December service growth will have to do the heavy lifting. So far, signals about the strength of the consumer have been mixed, with signs that consumers were willing to pay for recreational activities and seasonal ‘fun’, but less willing to buy general goods and clothing,” she added.

Her comments follow bumper results from hospitality outfits including Wetherspoon and Nightcap, which suggested more resilient – and fun-loving – UK consumer spending than some had expected.

Markets react

The domestically-focussed FTSE 250 shot up on the beat this morning, settling up 0.88 per cent an hour into trading.

French said the numbers indicated the UK economy was in broad terms doing better than some competitors, and certainly better than many commentators expected.

“The GDP rebound in November is consistent with a basket of soft data indicators that has seen UK move from 8th place out of the nine biggest European economies at the start of 2023, to 3rd by year-end,” he posted on twitter/X.

“Not spectacular in absolute terms, but progress vs most appropriate benchmarks,” he added.