Strict EV targets risk increasing reliance on China, ex-Britishvolt boss warns

The UK and Europe risk becoming increasingly reliant on China to meet their needs for electric vehicles (EVs) unless they pursue more lenient targets for the transition from petrol and diesel cars, one of the founders of Britishvolt has warned.

Lars Carlstrom, who has now launched European offering Italvolt, told City A.M. that there was a “huge risk in Europe” that the current plans to transition to fully electric vehicles over the next decade would “play everything into the hands of China.”

He warned of a “perfect storm” where China “could easily take over the automotive industry in Europe” due to the unsustainable nature of the EU and UK’s targets and the need to fill the shortfall with alternative Chinese vehicles.

“This is a dream scenario for them. The more foolish we are about the transition, they are gaining on us,” he said.

The Britishvolt co-founder estimated the West was still 10-15 years behind China in terms of mineral supply chains, factories and products.

Carlstrom also believed manufacturers would struggle to reinvent themselves for the green transition in the current time frame.

“It’s good to be ambitious, but also we need to look into the facts and how much damage can this do to our industry,” he explained.

His comments come after Rishi Sunak softened plans to shift from fossil fuel powered vehicles to electric cars from 2030 to 2035 – in line with rival European markets.

But he argued that even this was too much pressure for the car industry.

“I predicted last year that the 2030 timeline for the UK was not sustainable, and now they also realise that themselves,” he said. “I will say not even 2035 is a sustainable time, I would say 2040-2045 is a more sustainable timeline for not damaging the automotive industry.”

Earlier this month, the European Commission initiated an anti-subsidy investigation into Chinese vehicles, which could lead to increased tariffs on imports to the bloc.

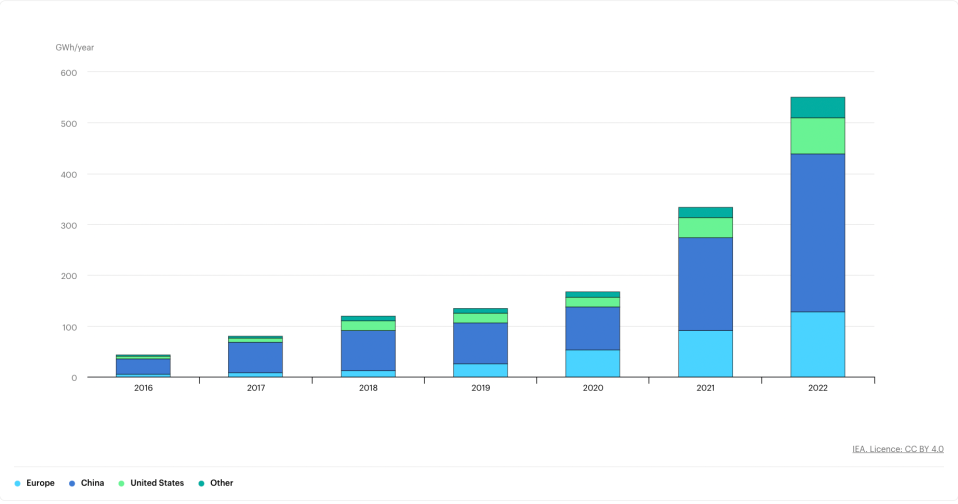

China currently supplies 80 per cent of battery cells worldwide, according to estimates from Bloomberg NEF.

This stranglehold also includes 70 per cent of the world’s production capacity of cathodes – the part of the cell that receives electrons – and more than 80 per cent of anodes (the part that releases electrons on discharge), and well over half of electrolyte and separator output.

As for minerals, International Energy Agency data indicates more than half the world’s lithium, two-thirds of its cobalt, more than 70 per cent of its graphite and about one-third of its nickel.

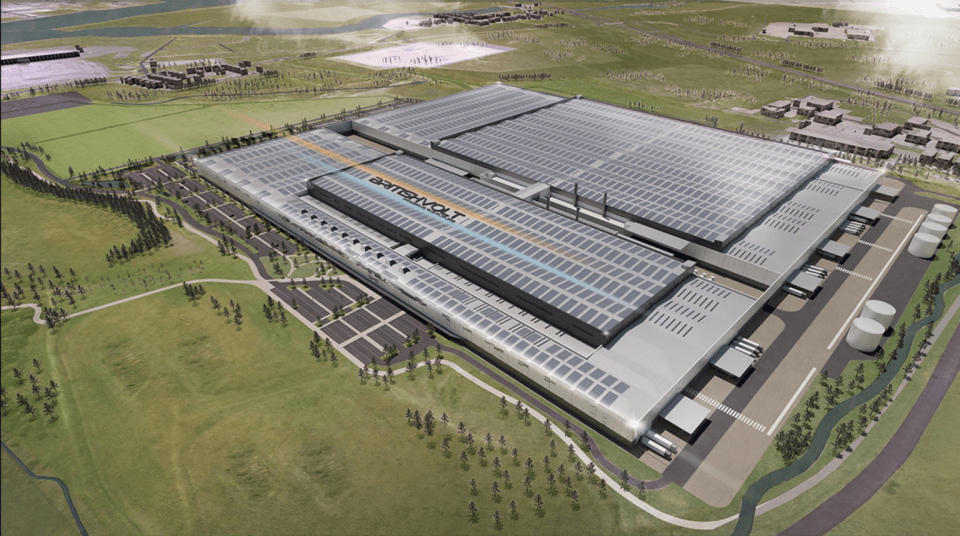

Carlstrom was one of the co-founders of Britishvolt – which planned to develop a £3.8bn gigafactory in Northumberland, a proposed EV battery production hub which would revive domestic industry.

However, he left the project in late 2020 in dramatic circumstances – resigning as chairman – before its eventual collapse earlier this year following a shortfall in cash, with ministers refusing to bring forward £100m to support its project.

Administrators EY sold its assets to Australian company Recharge Industries in February, which has since failed to provide the final payment required to complete the deal.

Carlstrom argued the debacle has created “mistrust from investors” looking at EV opportunities, and that Britishvolt “affected us all in a very bad way.”

“It’s clear that the support for this product is not as good as it should be, not just from the UK but also Europe,” he said.

He believed if governments could not support such initiatives, then it could not expect the private sector to provide the backing needed.

The businessman is now focused on Italvolt where he is founder and chief executive, with plans to build the country’s first gigafactory for EV batteries, storage and lithium ion cells, in Sicily, Italy.

He is targeting a facility with a production capacity of up to 45GWh per year, at a cost of 3bn – with the company looking to secure £100m-£200m to develop an investment platform to lure more stakeholders.

A Department for Business and Trade spokesperson said: “We are taking action on a number of fronts to reinforce the resilience of our supply chains, including signing critical minerals agreements with countries such as Australia and Canada, deepening cooperation with the US through the Atlantic Declaration, increasing links to international markets and accelerating the UK’s domestic capability.

“The government is determined to ensure that the UK remains one of the best locations in the world for automotive manufacturing, building on successes such as the recent £4 billion investment in a gigafactory by Tata Group, BMW’s £600m investment in Oxford’s Mini factory and Nissan’s £1bn EV hub in Sunderland.”