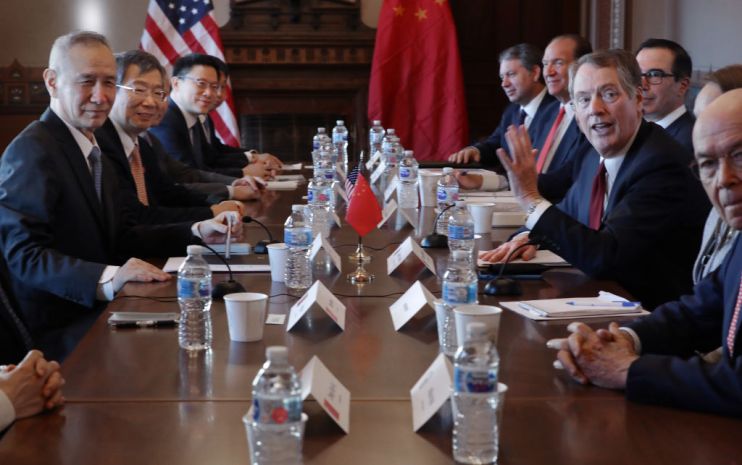

Stock markets edge up after US and China call trade talks ‘constructive’

Both Washington and Beijing have described a round of trade talks as “constructive”, pushing global stock markets tentatively higher.

Read more: Stock markets slide as Donald Trump lashes out at China before key meeting

The White House said China had confirmed a commitment to buy agricultural products following the talks, which took place in Shanghai yesterday and today.

US President Donald Trump had yesterday accused China of reneging on promises of purchases, saying “they just don’t come through”.

But China’s commerce ministry today called the talks a “candid, highly effective, constructive and deep exchange”. The White House said talks will resume in Washington in early September.

Global stock markets rose after the statements. The Dow Jones index was 0.1 per cent higher by 3.20pm UK time, with the Nasdaq up 0.2 per cent.

Germany’s Dax index was 0.5 per cent higher and France’s CAC 40 had risen 0.3 per cent.

Britain’s FTSE 100 was 0.7 per cent lower, however, dragged down by a rising pound and companies’ poor financial results.

Investors are praying for a solution to the year-old trade war with China. Stock markets have been volatile since Trump slapped 25 per cent of tariffs on $200bn worth of Chinese goods after Washington accused Beijing of reneging on promises.

Yet things did not look hopeful after Trump fired a broadside at China yesterday, saying “they always change the deal in the end to their benefit”.

Geoffrey Yu, head of the UK investment office at UBS Wealth Management, said: “With expectations from this week’s trade talks at rock bottom, the fact that there has been no negative outcome will be viewed as marginally positive for markets.”

Read more: IMF head: US-China trade war biggest threat to global growth

“China’s declaration of intent on increasing its agricultural purchases from the US is a clear nod to President Trump’s tweet but does not change the fact that tariffs remain a sideshow to the key rivalry around technology.”