Stock Exchanges in Nigeria and Ghana aim to deepen West African capital markets

CFA Institute has examined Africa’s 10 largest capital markets in a major report compiled by Heidi Raubenheimer, CFA, our senior director for journal publications. Here we highlight key developments in the West African states of Nigeria and Ghana.

Download the full report here.

LSEG partnership boosts confidence in Nigerian exchange

The economy of Nigeria – the most populous country in Africa, with more than 200 million inhabitants – was transformed post-independence with the adoption of an International Monetary Fund (IMF) programme in 1986, which kick-started economic liberalisation.

The repeal of indigenisation decrees and exchange controls, as well as privatisation of public corporations, induced a wave of stock market listings in the 1990s. Policy initiatives such as pension reforms, consolidation of the banking sector and the creation of a debt management office produced large domestic institutional savings pools.

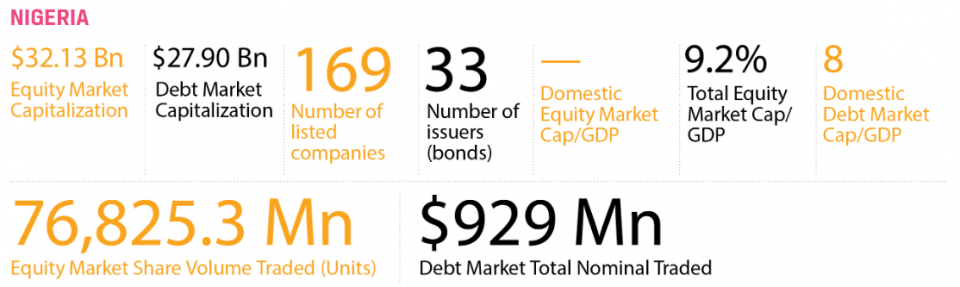

Despite these advancements, the Nigerian Stock Exchange (NSE) market remains small, with a market cap/GDP ratio of just 9%. Its 169 stocks are concentrated in three sectors: banking (33% of market cap), materials (32%) and consumer goods (27%). But these sectors together account for less than 10% of economic activity.

One reason for the poor economic representation of the NSE is the informal nature of key sectors of the economy, such as agriculture (21% of GDP), construction and real estate, and trade.

In a bid to restore confidence and solve the problem of thin domestic capital pools, the NSE has partnered with the London Stock Exchange (LSEG) to allow dual listing of Nigerian-based entities on the LSEG. The recent listing of two telecommunications giants in Nigeria and a growing enthusiasm among pension providers for equities are signs that the NSE may soon be punching its weight.

Oscar Onyema, chief executive of the Nigerian Stock Exchange, was interviewed at the 71st CFA Institute Annual Conference in Hong Kong in 2018. Click here for the video.

Ghana mines a new future as finance sector dominates trades

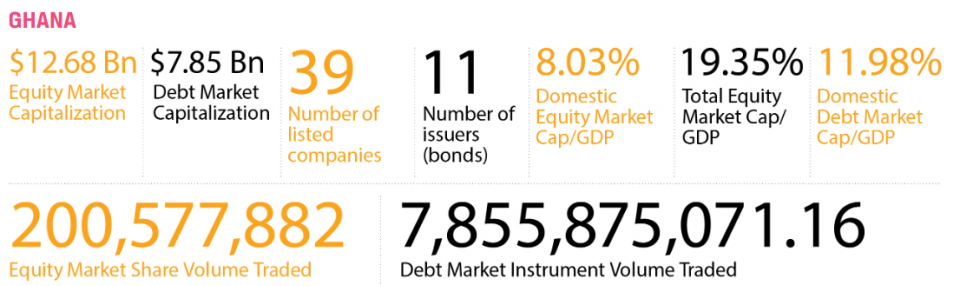

Ghana, which has less than a fifth of the population of Nigeria, is endowed with precious metals—gold, in particular—and hydrocarbons. Unsurprisingly then, the dominant sector on the Ghana Stock Exchange (GSE) is mining (69%), but financials is also sizeable at 21% and is the fastest-growing sector in terms of listings. The finance sector dominates trading activity, too.

Capital markets in Ghana, in common with some other developing markets, are plagued with problems with disclosure, a dearth of listings, low financial knowledge, the small size of issuances, and low trade volumes.

Initiatives to address these issues include the launch of the Ghana Alternative Market for smaller companies, permission for derivatives trading, and in 2018, the creation of the Ghana Commodity Exchange. Longer-standing incentives include zero capital gains tax on GSE securities and Ghana’s promotion of West African capital market integration.

The Ghana Fixed Income Market (GFIM) is larger than its equity equivalent with listed debt of USD$14.7 billion (about £11.1bn) (compared with USD$10.9 billion of listed equity on the GSE).

Fund management is growing with a developing middle class and offers mainly vanilla equity and debt strategies. Recent legal changes now allow the marketing of non-traditional asset classes, too.

To bolster investment, the GSE is leveraging technology to give investors access to better information and to improve financial literacy.

Our next posting… we conclude this series by heading to the north of the continent to examine capital market developments in Egypt & Morocco.

Click for our pieces on South Africa & Namibia; Botswana & Zimbabwe; East Africa & Mauritius.

Visit CFA Institute for more industry research and analysis.

About the report

Our tales of African capital markets’ history and future reflect the journey of CFA Institute: from a lunch group in New York City in 1937 to a diverse collection of 170,000 members and 157 societies worldwide in 2019, united with the purpose of leading the investment profession globally for the ultimate benefit of society.

Some of Africa’s exchanges were established in early colonial times. South Africa led the way on the heels of the diamond and gold rush, followed by Zimbabwe, Egypt, and Namibia (a German colony at the time) – all before 1905. Some didn’t outlive the commodities rush but others are still thriving – substantially diversified and modernised.

Some capital markets were established more recently, and their development tells of independence and nation-building: Nigeria in the 1960s; Botswana, Mauritius and Ghana in 1989; Namibia post-independence from South Africa in the 1990s. Others, particularly the East African exchanges, are new and leapfrogging toward greater participation.

All tell of how regulation, trading technology and fintech are enabling fairer, faster and lower-cost participation in finance and investment for more market participants.

The CFA Institute Research Foundation brief was developed in conjunction with the African Securities Exchanges Association (ASEA).

Authors:

Nigeria

Dave Uduanu, CFA, Chief Executive, Sigma Pensions Limited – Nigeria

Ghana

Ivy Hesse, CFA, CIPM, Founder and Principal Consultant, Synercate

Image credit: Getty Images/ olasunkanmi ariyo