State of the City: Is red tape holding back the Square Mile?

It has been a bruising year for the City of London.

Soaring inflation and a bruising rate hiking cycle have roiled financial markets and triggered a scramble for steady ground, while a shuttered IPO market and a flood of firms to New York have compounded the pain for dealmakers, bankers and officials alike.

Negative headlines abound and the London Stock Exchange has been plunged into a period of soul searching.

But how bad really is it in the City of London? And is London an outlier in the downturn?

City A.M.’s new State of the City page is the go-to hub to follow the trials and tribulations of the Square Mile and track the health of the City this year.

‘It’s not been this hard to raise cash in over a decade’ – and red tape’s not helping, say firms

London’s red tape burden is in the cross hairs again today after a survey of the capital’s smaller firms warned that reporting requirements in the City were choking off their ability to grow.

In a survey of listed companies by the Quoted Companies Alliance, which represents smaller listed companies in London, firms sounded the alarm over a lack of investor interest and over-the-top compliance holding back their performance and growth.

Some 25 per cent said they currently see no benefit from their London listing.

Speaking with City A.M. this morning, QCA chief James Ashton said the group’s members were warning “it has not been this hard to raise funds via the public markets for more than a decade”.

Ministers have been on an offensive to strip back red tape from the market amid fears admin and compliance concerns have acted as a deterrent and are pushing companies towards New York.

A much-delayed overhaul of the audit and reporting regime was kicked into the long grass by government in the King’s Speech amid fears over tangling up more firms in more red tape.

Business Secretary Kemi Badenoch has also shelved the government’s own push to consult on strengthening reporting in the City.

James Parkes, a corporate Partner with law firm CMS, said the removal of “regulatory red tape has been a key plank of the Government’s post-Brexit agenda” and there was likely to be more to come.

“The reform programme is ambitious but complex and is taking time to make its way through the legislative process,” he told City A.M. today.

“The clock is ticking and the QCA findings are further evidence that the Government has no time to lose.”

Does a New York listing automatically fetch firms a higher valuation?

Much has been made of the premium placed on New York-listed firms this year. However, do the numbers stack up?

City A.M. asks today whether floating in the Big Apple is really the panacea that many would believe.

Just a look at the performance of firms that crossed the pond and a different story may start to emerge.

UK venture funding roars ahead of European rivals

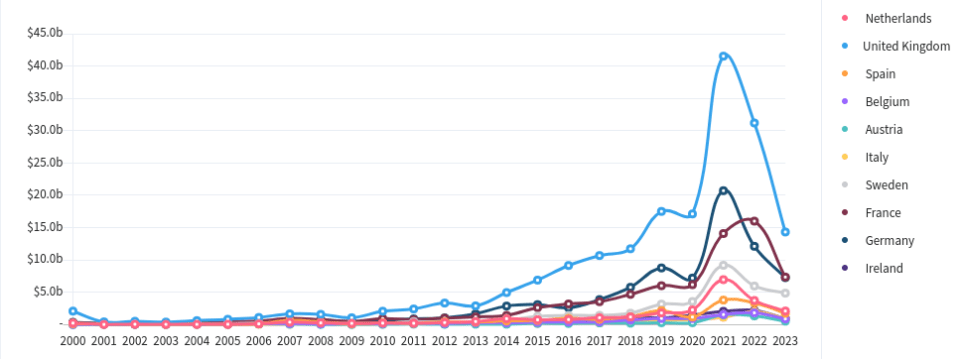

Light may be appearing at the end of the tunnel for the UK start-ups as venture capital investment began to tick up in the third quarter, taking the UK further ahead of European rivals.

The UK remains by far the leading destination for VC investment in Europe, with $15bn raised in 2023 so far and $4.9bn added in the third quarter of the year, according to the latest figures from HSBC Innovation Banking and Dealroom.

French start-ups raised $2.5bn in the third quarter while German firms bagged $1.7bn, in second and third place in Europe respectively. The UK numbers mark a 14 per cent boost on the previous quarter and place the UK firmly in third globally behind the US and china.

Top funding rounds in between June and September show a trend towards hard tech, the two firms found, with £4.9bn allocated to early-stage investment so far this year.

City IPO watch

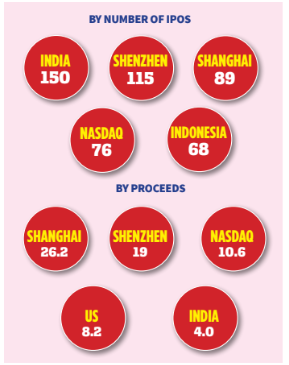

The drop off in listings has piled pain on the City of London this year amid a wider slump in the global IPO market.

The Global IPO market notched 615 IPOs in the first half of the year, raising $60.9bn, down 36 per cent in value on an already quiet 2022, according to figures from EY.

However, London has felt the squeeze more than most. While the number of floats began to tick back up in the second quarter of this year, the amount of cash raised is still in the doldrums.

Between June and September cash raised via fresh listings on London’s historic bourse fell 36 per cent to £360m as just five firms floated on the market, down from a quiet £565.5m in the same period last year, new figures from EY showed.

https://datawrapper.dwcdn.net/Glp8d/1/

How the City stacks up on IPOs

London has slumped outside of the top 12 in terms of both cash raised and quantity of IPOs in the first three quarter of the year.

While lawmakers and officials have pressed ahead with reform in London over the past two years, firms are still looking to tap into deeper pools of capital in Asia and America rather than the City.

Even Istanbul and Bucharest have seen more cash raised, while Chinese and US markets have surged ahead.

How big is London’s stock market?

Three exchanges operate in the capital, two run by the historic London Stock Exchange, and a smaller bourse run by challenger firm Aquis.

The cumulative value of the London Stock Exchange is £2.6 trillion. The biggest 100 firms listed on the main market come to a combined value of around £1.9trillion.

Sounds a lot? But those 100 biggest firms were eclipsed in value by just one New York listed company alone in July: Apple.

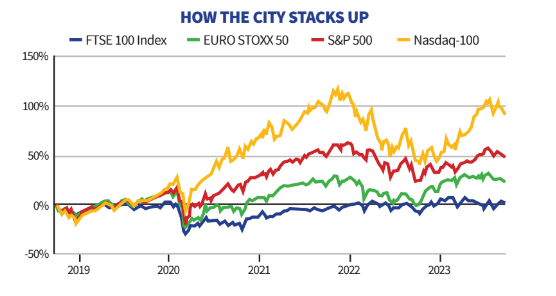

How the City stacks up on growth

London has also been plagued by the sluggish valuations of its top firms. Much has been made of the premium price tags fetched by New York’s listed giants – and a five year growth trajectory of the flagship indexes on both sides of the Atlantic shows how wide that gap has become.

New York’s listed behemoths have rocketed while European and London listed firms have been left in the dust.

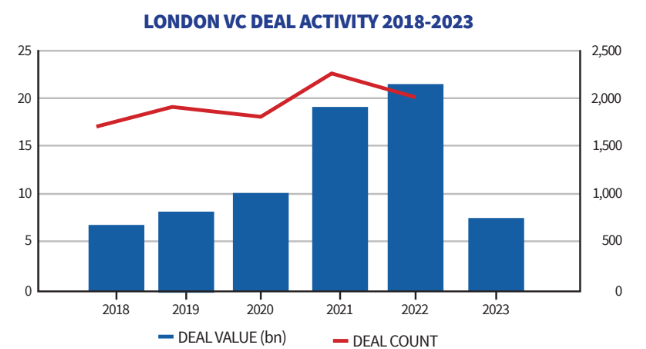

Venture View: Pull of the private markets?

Private markets have been seen as an increasingly tempting alternative by many firms this year. However, venture capital investment has been hit by a similarly shar downturn globally, as the flow of cheap cash was choked off by rapid rate hikes.

London has held up firmly on the global rankings but funding has slowed dramatically, as venture investors cast a more discerning eye on their targets.

Check in on City A.M. state of the City for a daily refresh on the health ofthe Square Mile