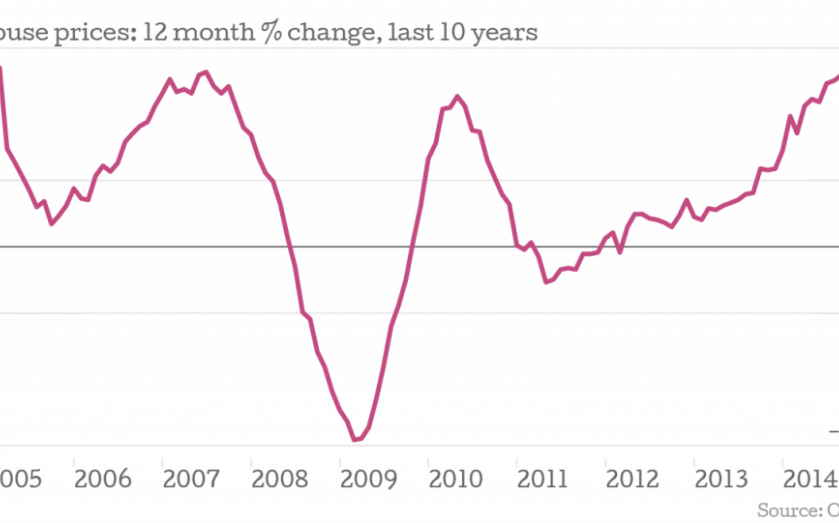

In charts: UK house price growth slows but first-time buyers still feel the pinch

First-time buyers are paying 12 per cent more this year than at the same point last year, according to data from the Office for National Statistics (ONS).

The ONS revealed house prices were flirting with stagnation in October, when they increased just 0.1 per cent on a month-on-month basis.

After yesterday’s data from Rightmove showed that asking prices are dropping rapidly, the Office for National Statistics has added its data to the pile, showing growth slowed to 10.4 per cent for the year to October, down from 12.1 per cent in the year to September.

This meant that the 12-month change for first-time buyers (FTBs) dropped too, from 13.3 per cent (1.3 percentage points lower). It is still higher than inflation for those moving up the rungs: former owners paid 9.7 per cent more compared to 11.5 per cent in September, a drop of 1.8 percentage points.

The confirmation that first timers are having to dig deep to get on the housing ladder comes after the announcement of a starter homes programme by David Cameron yesterday, which will offer 20 per cent discounts to first-time buyers when they buy newly constructed properties.

The government's plan to offer discounts on new homes will be further helped by the fact new dwellings are seeing their prices drop more rapidly than existing dwellings. New dwellings had increased by 8.5 per cent in the year to October, below the UK average of 10.4 per cent and lower too than the 12.2 per cent increase for existing homes.

The strong rise in the UK was driven by London, which continued to see the biggest gains on an annual basis, dragging the national average up.

Excluding London, house price inflation for the UK was not 10.4 per cent but 6.7 per cent. Demand in the capital has seen house prices soar this year, even if, by some measures, they dropped by £30,000 between November and December. The average price in London was £504,000 in October, according to the ONS.

Howard Archer, analyst at IHS Global Insight, said:

It is evident that house prices increases are currently being reined in by an appreciable moderation in housing market activity from the peak levels seen at the start of 2014. Latest Bank of England data show that mortgage approvals for house purchases retreated for a fourth month running and appreciably, to be at a 16-month low of 59,426 in October. Mortgage approvals in October were down by 22.4 per cent from January’s 76-month high of 76,574.

Meanwhile, latest survey evidence from the Royal Institute of Chartered Surveyors showed a fifth successive fall in buyer enquiries in November and a fourth successive drop in agreed sales (the first declines since September 2012).