Start of 2023 a disappointing vintage for fine wine investments – but new Bordeaux gives reason to cheer

Fine wines stored in oak barrels and stashed away in climate-controlled cellars may have been growing all the more delicious over the first few months of 2023.

But one quality has proved more unpredictable – price. Fine wines, which have proved a safe bet for investors looking to hedge against volatility over the past three years, stalled in price in the first quarter of 2023.

A global index of fine wines compiled by investment platform Cult Wines recorded a 42.5 per cent rise between the end of April 2020 and the end of 2022, but the index dipped 0.48 per cent in the three months to the end of March, as a sluggish January and March offset a more steady February.

Analysts say that price have stalled across all areas of the market after a bumper few years of returns.

“The present market downturn is likely a manifestation of price consolidation, leading to a generalized slowdown across all wine-producing regions,” Olivier Staub, chief investment officer for Cult Wine Investment told City A.M.. “Buyers displayed increased selectivity concerning elevated prices, seemingly pursuing wines offering the most compelling relative value.”

The market has also been unsettled by political volatility in both France and the UK. An inflationary hike in alcohol duty by Jeremy Hunt in March was met with disdain from the drinks industry and widespread strikes in France have snarled supply chains.

“Following plans from the government to raise the retirement age, France has been plunged into a chaos of strikes and protests,” analysts at wine trading platform Liv Ex said in a note. “The disruption in transport and supply chains is strongly felt, as railways and refineries are among the sectors striking.”

Uncertainty has dealt a blow to some of the most steady performing areas of the market. The Rhone 100 index, compiled by Liv-ex and regarded by analysts as one of the most stable regions in the fine wine market, recorded a fall of 4.9 per cent at the start of the year.

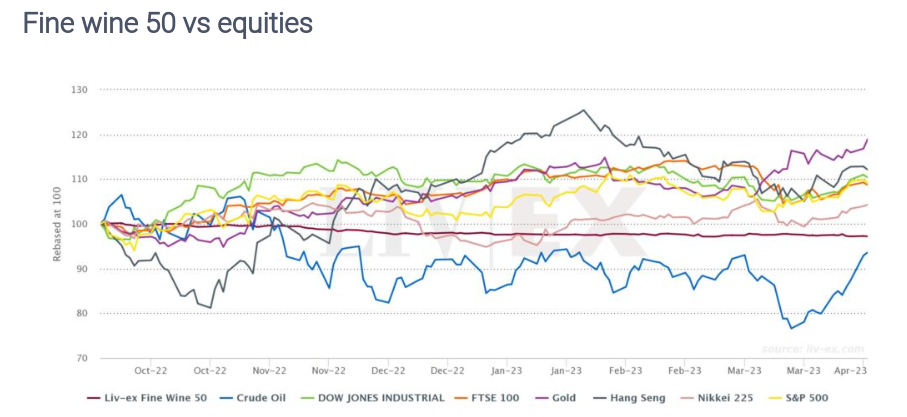

Analysts at Liv-ex point to the longer-term picture as proof of its resilience, however. Over five years fine wine has delivered average returns of 41.4 per compared to FTSE 100’s 8.2 per cent to the end of the first quarter of 2023. Fine wine has also outstripped residential property over the past year with an average growth of 3.8 per cent against property’s 1.6 per cent.

Aficionados are also now predicting a bump in prices as volatility shakes equity markets and slackening Chinese Covid-19 restrictions restore demand for fine wine.

“We expect the activity to pick up especially in [the second half of the year], when the unwinding of China’s lockdown starts to show both for China and for other affected Asia trade,” Matthew O’Connell, chief of wine-trading platform Live Trade told City A.M. “This comment should apply to both activity and also prices, which could well resume their gains.”

A new vintage out of the storied wine region Bordeaux could spur prices further, he added.

“Bordeaux has been uneventful for much of the last year, but the new vintage (2022) is being reported as a new benchmark, something which should shake the segment up a bit,” O’Connell said.