Start it in your late 30s, and keep your founding team in place: How to create a $1bn tech startup “unicorn” – and why London has created eight in the past year

Want to own a $1bn (£644m) tech firm (yep, us too)? Get some experience, and start the business when you're in your late 30s, new research has suggested.

The research, by investment banking firm GP Bullhound to mark London Tech Week, provides a step-by-step guide to getting that $1bn tech "unicorn" off the ground. Here's what it reckons you need to do to get that unicorn flying.

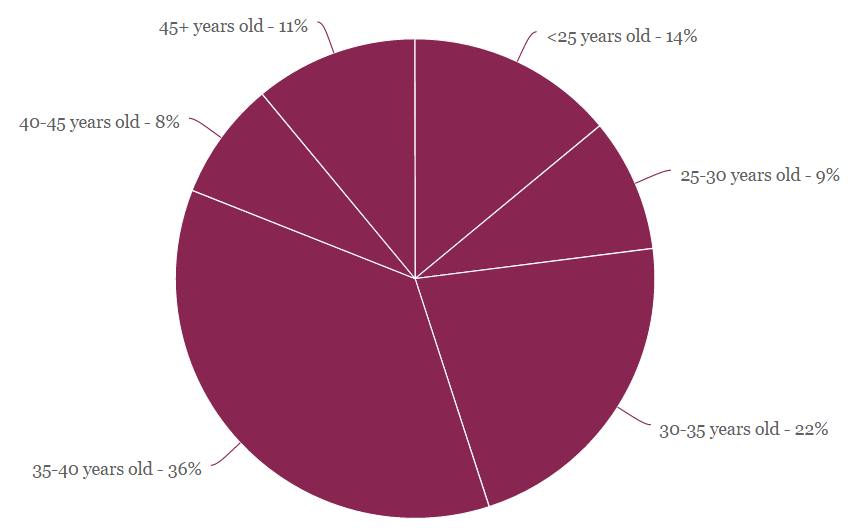

1. Start your business when you're 38

Some 36 per cent of the entrepreneurs who have started $1bn European tech "unicorns" were between 35 and 40 when they founded it, with an average age of 38. They also tended to have had some experience before – suggesting it's not just dumb luck that creates a tech success story.

2. Look after your founding team

Keeping the founding team in place is the best way to make sure your company grows. More than half of Europe's $1bn tech firms still had all their founders in place, while another 35 per cent had at least one around. At 13 per cent, all the founding team had left – suggesting that without that passion to drive it, success is unlikely.

3. Launch in London

Having spawned eight new $1bn (£644m) tech companies in the past year, London is by far the best place to launch your European unicorn – in fact, the research calls the city "the undisputed home of unicorns in Europe".

The UK's 17 $1bn tech startups (listed above) – which include Zoopla, Asos, Just East and Shazam – are valued collectively at $40.4bn, a third higher than the next-biggest European centre for unicorns, Sweden (startups include Skype and Candy Crush developer King). And the UK is also a dominant force for Fintech firms, with more than half Europe's Fintech startups based here.

4. Give it time

Be prepared to sit tight while your business increases in value: it takes the average startup nine years and $140m investment raised over five to eight funding rounds to hit the $1bn mark – although only 10 per cent of Europe's tech businesses have raised more than $300m.

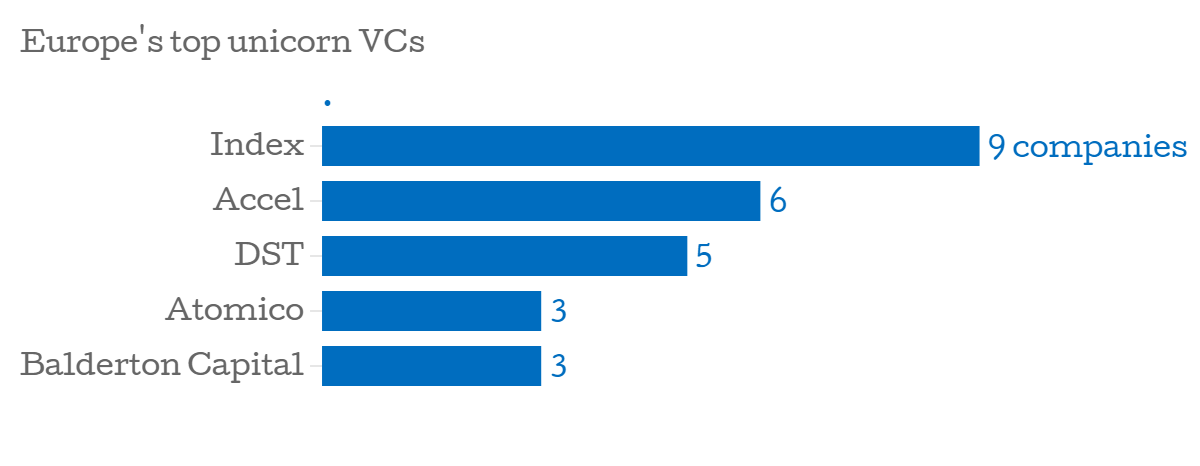

5. Seek funding from Index Ventures

If Index Ventures is sniffing around, it's a very good sign: the venture capital firm has hit the mark more than any other investor, with stakes in nine European unicorns. Accel Partners was close behind, with investment in six $1bn firms, while Sequoia was the only US-based investor to make the list, having put cash into two $1bn firms.

If Index Ventures is sniffing around, it's a very good sign: the venture capital firm has hit the mark more than any other investor, with stakes in nine European unicorns. Accel Partners was close behind, with investment in six $1bn firms, while Sequoia was the only US-based investor to make the list, having put cash into two $1bn firms.