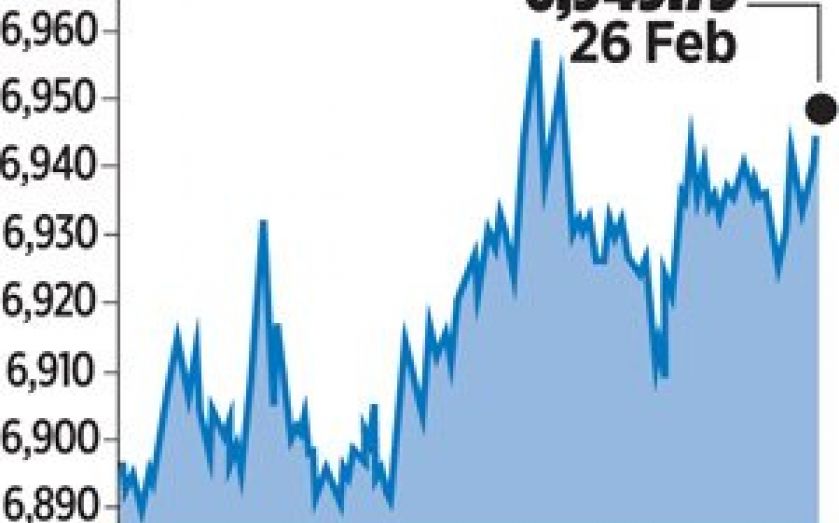

StanChart’s new man lifts FTSE to a record level – London Report

Britain’s top equity index yesterday hit a record closing high – for the second time this week – helped by a surge in the share price of the Asian-focused bank Standard Chartered.

Standard Chartered advanced by 5.4 per cent as traders welcomed its appointment of a new chief executive, former JP Morgan investment bank boss Bill Winters.

The company gave one of the biggest lifts to the FTSE 100, which ended 0.2 per cent higher at 6,949.73 points – a new closing high and near the intra-day record high of 6,958.89 points it reached on Tuesday.

Morrisons continued to do well, up almost two per cent to 196.30p, following the supermarket’s appointment of former Tesco director David Potts on Wednesday. Tesco was also 2.12 per cent higher at 246p, with Sainsbury’s climbing 1.25 per cent to 275.1p.

Ladbrokes said its profits were 13.5 per cent lower at £98m in 2014 after a strong World Cup performance was offset by an “exceptionally high” loss of £8.1m on Boxing Day football when leading Premier League teams secured victories. But traders were happy that it intends to maintain its dividend next year, sending the shares up 5.95 per cent to 121p.

Dominos Pizza was a big riser in the FTSE 250 after it reported a large jump in annual profits and said it was upbeat about its prospects for the coming year. Shares were 5.42 per cent higher at 730p.

Cigarette maker British American Tobacco rose 1.72 per cent to 3,795p after reporting a less-than-expected 8.4 per cent fall in 2014 revenue to £13.97bn, compared with the consensus forecast of £13.89bn.

But not all companies rode the rise in the index.

Reed Elsevier fell 4.8 per cent, making it the worst-performing FTSE stock in percentage terms. The company reported 2014 results in line with forecasts, predicted further growth for 2015 and announced plans for a £500m share buyback.

Insurer RSA fell 4.7 per cent. Even though it swung back into a profit for 2014, its results were below forecasts. So was a modest 2p final dividend payment.

Royal Bank of Scotland also slid 4.1 per cent. The bank posted a 2014 loss of £3.5bn and announced plans to shrink its investment banking operations to allow the state-controlled lender to refocus on local lending in Britain.