St Modwen to put £620m Nine Elms Square up for sale, paving the way for next year’s biggest land deal

St Modwen has announced plans to put its £616m Nine Elms Square residential scheme up for sale in what it predicts will mark one of the biggest land deals in the market this year or next.

The regeneration specialist and its French joint venture partner Vinci are carrying out a complete overhaul of New Covent Garden Market, the UK’s largest fruit and vegetable market, which will take 10 years to complete.

The 57 acre site will also include offices, shops and three residential "neighbourhoods" comprising 3,000 new homes – of which Nine Elms Square is the largest and most valuable.

St Modwen’s chief executive Bill Oliver, who also announced plans to step down this year, told City A.M.: “We are exploring options in the market place. An outright sale is one option or a level of continued involvement depending on how involved the prospective owners would like us to be.”

Oliver hailed the site as “one of the best pieces of real estate available in the UK and in Europe" and said he was confident of attracting several prospective buyers.

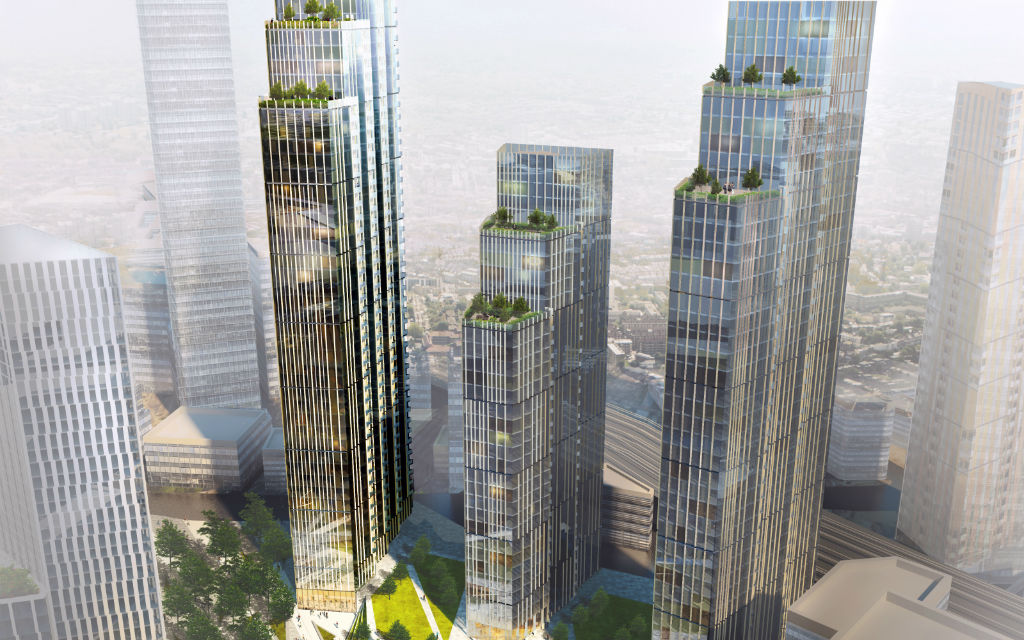

“It is situated on the south bank, it overlooks the Thames, the Houses of Parliament and has permission for 50-storey towers in clusters – so there should be strong demand. And it will be one of the largest land transactions in the UK next year,” he said.

The company gained planning permission to build 1,800 homes on the 10-acre site last year and expects to gain vacant possession in 2017 once it has finished building new accommodation for its current residents.

Nine Elms Square will comprise of a cluster of towers including a 54-storey tower with 346 flats, two buildings up to 46 and 36 storeys, a 10 storey building and ten buildings between five and 32 storeys.

Asked whether the company was concerned that the property market had reached it peak, Oliver said: “There are a few doom-mongers out there saying prices are collapsing. But what is actually happening is that stamp duty measures have cooled the market, prices are not increasing but they are not decreasing either. That is totally different to saying there is a glut and a fall in structural demand. It’s much more sustainable to have a stable market as we have now.”

Property agency JLL is advising St Modwen on its options for the scheme.

Read More: Here's what New Covent Garden Market will look like

News of a sale came as St Modwen announced a 91 per cent jump in pre-tax profits to £258.4m for the year to 30 November, thanks a £127.4m contribution from its New Covent Garden Market development, which achieves unconditional status last year. The group's net asset value per share increased by 27 per cent to 413.5p from 325.1p last year.

Separately, Oliver announced plans to step down as chief executive in November at the end of St Modwen’s financial year after 17 years at the company and 13 years in the top job. The board has kicked of the search for his successor.

Oliver said: "I have had quite good innings. I'm sixty this year and it is a sensible decision to move on. The company is in great shape, we have got a good team in place and the company is performing well so if you are going to choose a moment to step down, this is it."

St Modwen’s chairman Bill Shannon said Oliver has made a “significant contribution” to the property industry as well as the company, guiding it through significant changes and challenges.

“Under his leadership the company has delivered excellent returns for shareholders and has furthered its reputation as the UK's leading regeneration specialist,” Shannon, said.