St James’s A-Day profits

Looming changes to pension legislation have helped wealth management company St James’s Place Capital increase its pension business by 22 per cent.

New laws, due to come in on April 6 on what has become known as A-Day, have prompted more people to seek advice on their best personal pension plan including the chance to invest in residential property for the first time.

St James’s, which has around 400,000 clients, said it had seen new pension business increase £50.8m since the start of the year.

Its investment business was up £87.5m, an increase of 25 per cent.

Mark Lund, the chief executive, said: “New business in the third quarter was up 29 per cent driven by substantial growth in both single premium investment and pension business.”

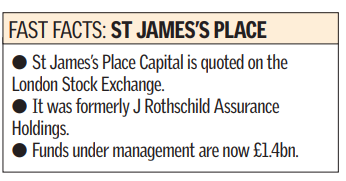

Funds under management now total £11.4bn, up 20 per cent since the start of the year and 31 per cent over the same period last year.

Lund said that A-Day was having a big impact and that the generally rising stock market was helping the investment business, which performs better when equities are rising.

It is the eighth successive quarter that the company has reported new business growth.

The pace of new sales in the July to September quarter matched its record growth in the second quarter.

Last January the company launched an open-ended commercial property fund to take advantage of a boom in demand for offices, retail, industrial and logistics property, which Lund said had proved popular.

The latest figures mean that, in total, new business since the beginning of the year has grown £156m, 19 per cent more than last year. These figures build on first-half profits which were up by 14 per cent, with the second quarter being its best ever for new business.

Analysts called the performance a strong one. Numis said: “These figures bode well, comparing very favourably with forecasts for the full year.”

The broker said its full year forecasts of 11 per cent growth up would have to be revised up.