Spring statement: OBR slashes economic growth forecasts on Russia-Ukraine war inflation spike

The UK’s fiscal watchdog has slashed its forecasts for economic growth this year driven by the Russia-Ukraine war sending inflation spiking.

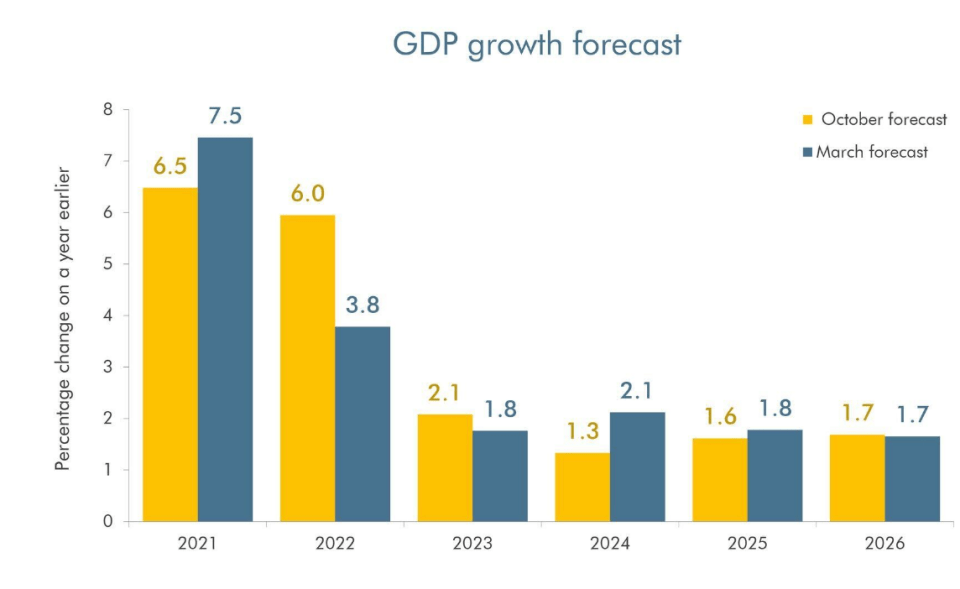

The Office for Budget Responsibility (OBR) is expecting the UK economy to grow 3.8 per cent this year, down from six per cent in its previous forecast.

Russian President Vladimir Putin’s decision to send troops into Ukraine has intensified already severe inflationary pressures building in the UK economy as a result of sending oil and gas prices higher.

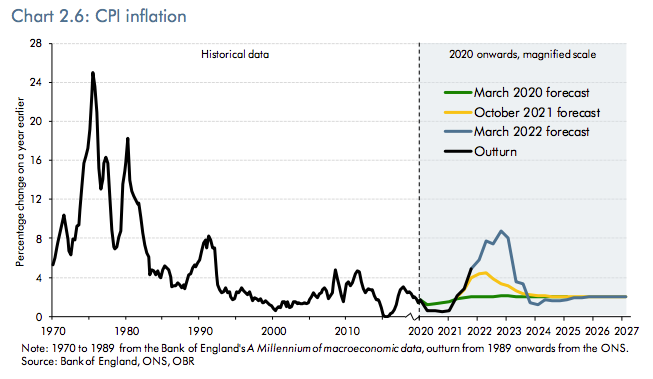

Inflation will average 7.4 per cent over the course of 2022. Before, the OBR thought the cost of living would average just four per cent this year.

Fresh figures published by the Office for National Statistics today revealed the cost of living is already running at its hottest rate since 1992, scaling to 6.2 per cent, underlining the severe living standards shock households are absorbing.

Higher energy costs tend to feed through quickly to the rate of price rises in an economy due to oil and gas being widely consumed by businesses and households.

The price of a barrel of oil briefly hit its highest level since 2008, reaching $139, while UK gas jumped 31 per cent today. Investors are concerned energy flows will be choked by Russia’s assault of Ukraine.

Soaring inflation will swell the UK’s debt interest bill to its highest level ever, reaching £83bn annually next year, driven by an old measure of inflation pushing beyond what is already a three decade high.

In its previous forecast, the OBR expected the interest bill to be a shade over £40bn.

“The OBR have not accounted for the full impacts of the war in Ukraine and we should be prepared for the economy and public finances to worsen – potentially significantly,” Sunak warned.

“We have already taken difficult decisions with the public finances; And that’s why we will continue to weigh carefully calls for additional public spending,” he added.

Key stats

Improved tax receipts driven by better than initially expected GDP growth in 2021 and elevated inflation will cut government borrowing.

Government income will come in a shade below £900bn this year, up from £862bn pencilled in in October.

Borrowing will be just over £55bn lower this year, totalling £127.8bn.

However, a record debt interest bill will push borrowing above what the OBR was expecting in October. The government will need to take on £16.1bn more debt than thought in 2022/23.

The UK jobs market is expected to strengthen significantly, driven by demand rebounding sharply as the degree of influence of the Covid-19 crisis on consumers’ behaviour fades.

The OBR thinks the unemployment rate will be four per cent this year, down 0.8 percentage points from before.

Earnings will grow 5.3 per cent this year, but will be cancelled out by inflation.