Spring Budget 2024: OBR upgrades UK growth forecasts on lower inflation and growing population

The Office for Budget Responsibility (OBR) has upgraded its expectations for UK growth over the next couple of years on the back of lower inflation and a growing population.

The independent fiscal watchdog now expects the UK to grow 0.8 this year, up from a previous estimate of 0.7 per cent. The following year, growth is expected to pick up to 1.9 per cent, up from its November forecast of 1.4 per cent.

“Inflation has receded more quickly than we expected in November and markets now expect a sharper decline in interest rates,” the OBR said.

“This strengthens near-term growth prospects and should enable a faster recovery in living standards from last financial year’s record decline.”

Despite a stronger performance over the next couple of years, the level of GDP in five years time will be roughly in line with the OBR’s November’s forecasts. This reflects the UK’s weak performance last year, which undershot expectations.

| Economic & Fiscal Forecasts | ||||||||||||

| Real GDP Growth (%) | 2024 | 2025 | 2026 | 2027 | 2028 | |||||||

| Spring Budget 2024 | 0.8 | 1.9 | 2.0 | 1.8 | 1.7 | |||||||

| OBR Nov. 23 | 0.7 | 1.4 | 2.0 | 2.0 | 1.7 | |||||||

| Bank of England (Feb.) | 0.2 | 0.6 | 1.1 | – | – | |||||||

| Consensus (Feb.) | 0.4 | 1.2 | 1.6 | 1.7 | 1.7 | |||||||

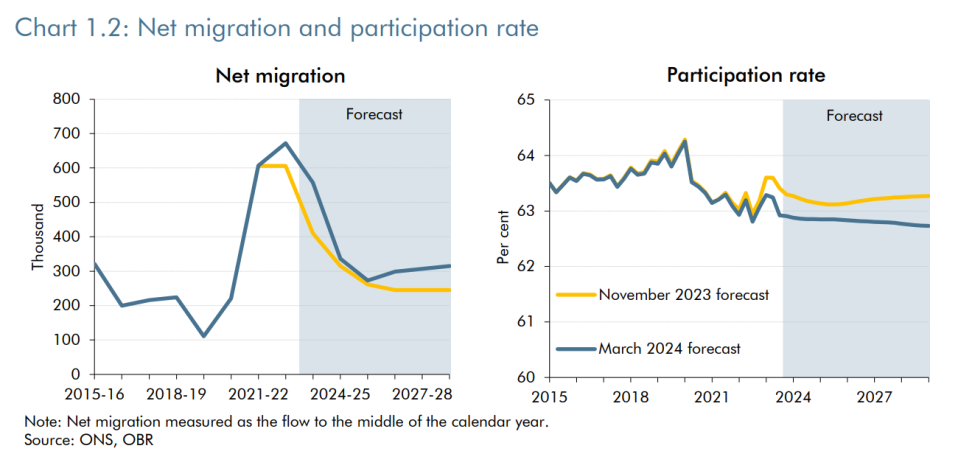

The OBR noted that an increase in the size of the UK population was “one of the biggest changes” compared to the November forecasts.

However, this would be offset by higher levels of economic inactivity. “The post-pandemic rise in economic inactivity is likely to prove more persistent than we previously thought,” it noted.

About a third of inactive people of working age were inactive due to long-term sickness, it said.

Taking higher migration and higher inactivity together, the level of GDP will remain “virtually unchanged” but GDP per person was set to be “slightly lower”.

The forecasts will make Chancellor Jeremy Hunt uncomfortable, after he stressed his determination in the Spring Budget to bring about “not just higher GDP, but higher GDP per head”.

The forecasts came as the Chancellor delivered the Spring Budget, the Conservatives’ last throw of the dice before a general election later this year.

Hunt cut National Insurance by a further 2p, following a similar move in the Autumn Statement. This left Hunt with headroom of just £8.9bn to meet his target of getting debt falling in the fifth year of the forecast, down from £13bn in November.

Public sector debt is expected to peak at 93.2 per cent of GDP in 2027-28 before falling marginally to 92.9 per cent. Despite the cut to National Insurance move, the tax burden is still on track to reach of 37.1 per cent of GDP by 2028-29, its highest level since 1948.

The OBR pointed out that almost half the headroom would be eroded if future Chancellors continued to freeze fuel duty, as has been the case since 2011, and did not reverse 2021’s ‘temporary’ 5p cut to fuel duty.

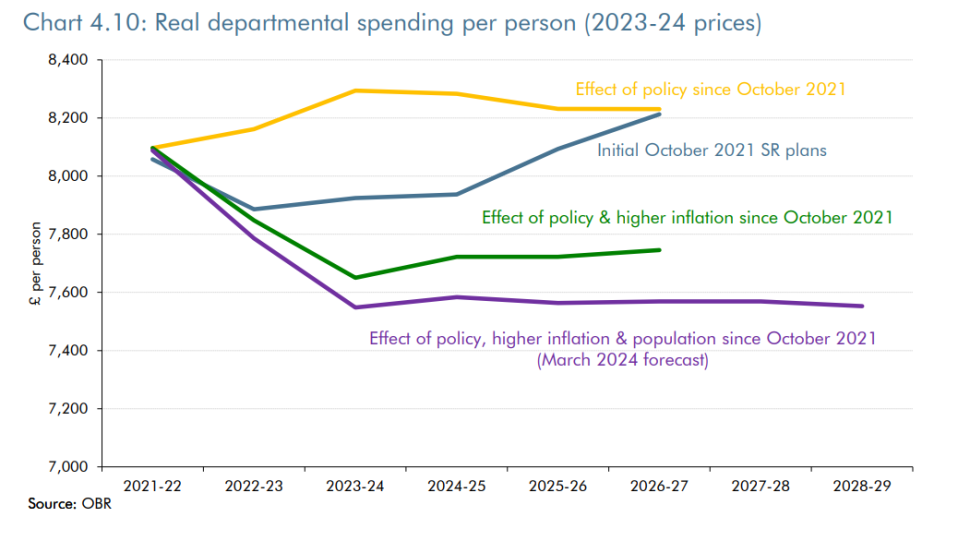

It also stressed that debt would only be falling if the government adheres to its tight public spending plans, which will see a one per cent increase in departmental budgets after the election.

“By leaving departmental expenditure plans unchanged, it (the government) also accepts no real growth in public services spending over the next five years,” the OBR said.

Growing the economy has been one of Rishi Sunak’s key pledges as the election approaches, but stagnation would be a more apt description of its performance over the previous year.

The UK grew just 0.1 per cent in 2023, falling into a shallow recession in the second half of the year.