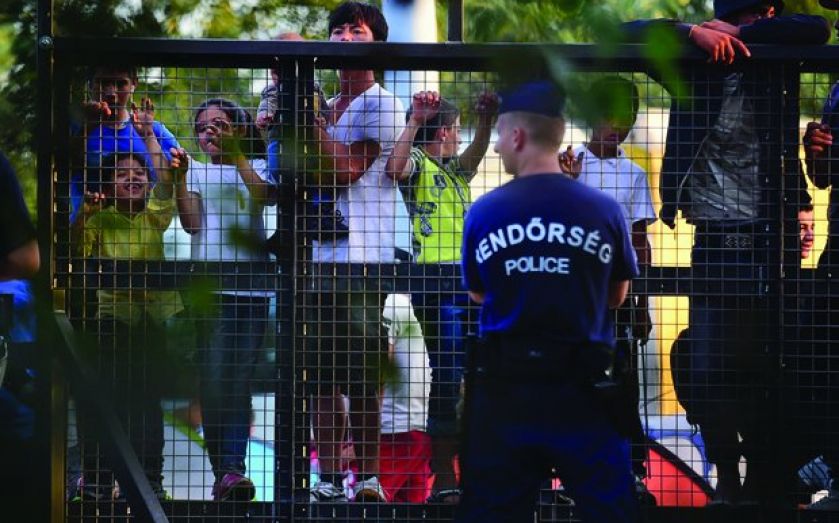

S&P: Politics of refugee crisis poses big risk

THE RECORD surge of refugees into Europe is unlikely to hurt the economies of EU countries.

However, European leaders’ inability to find “co-operative solutions” to the crisis could have long-term consequences for their sovereign debt ratings, a leading credit agency has said.

In a new note, Standard & Poor’s says that an “elusive compromise could indicate that the EU still has governance problems, which [they] consider a key factor when rating sovereigns”.

“The politics of the refugee question may be what matters most. The narrow national interests of nation states may still constitute an obstacle that hampers the ability to arrive at a swift and appropriate collective response,” said S&P credit analyst Moritz Kraemer. “This could be relevant for EU sovereign ratings in a future financial crisis.”

He added: “The response to the refugee question could also lead to more support for populist and even outright xenophobic parties, taking away from the budgetary reform agenda.”

EU interior ministers failed on Monday night to agree unanimously on a plan to relocate 120,000 asylum-seekers with mandatory quotas.

Yesterday, German Chancellor Angela Merkel called for an emergency EU summit of heads of state and government to be held next week to discuss the migrant crisis.

A second emergency meeting of EU interior ministers has already been called for 22 September, and it is understood that European Council president Donald Tusk will decide by tomorrow whether or not an emergency leaders’ summit is also needed.

S&P also indicated that contrary to some governments’ concerns over accepting migrants, over the longer term, there could be a “mild positive impact on growth in EU countries that grant asylum to the new arrivals, who could alleviate the looming economic and fiscal challenges that adverse demographic trends will bring”.

“The fiscal implications are significant in the short term: EU members will have to administer shelter, subsistence, and education, including language courses,” the credit agency said.

It added: “Before too long, those who are granted asylum will enter the labour market.”