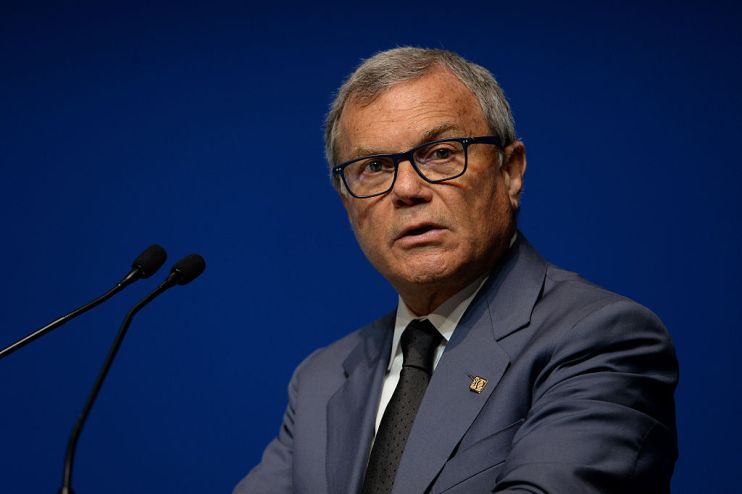

Sorrell’s S4 Capital buys Silicon Valley agency Firewood for $150m as digital drive deepens

Sir Martin Sorrell’s S4 Capital has bought digital marketing agency Firewood for $150m (£122.5m) as the ad veteran gears up for a further wave of acquisitions amid an aggressive growth strategy.

Firewood, which is Silicon Valley’s largest independent agency, will merge with S4’s digital content division Mediamonks.

Read more: S4 Capital sees earnings slip amid rapid expansion

In keeping with previous acquisitions, the deal involves a payment of $112.5m on completion, half in cash and half in shares. A further $37.5m will be paid if Firewood hits its full-year earnings target.

S4 said it will raise £100m through a share placing to help part fund the deal. The fundraising will be priced at 142p per share, representing a 1.4 per cent premium on yesterday’s closing price.

The placing will also help S4 to build up its reserves for future acquisitions, with a second deal said to be in the pipeline.

The move represents Sorrell’s drive to build up a purely digital approach for his nascent advertising venture, and the deal will grant S4 access to Firewood’s roster of Silicon Valley clients including Facebook, Google, Linkedin and Salesforce.

“This merger is a further step in creating a new era communications services leader,” said executive chairman Sorrell. “Firewood has an enviable client list comprising many of Silicon Valley’s finest.”

Firewood, which is run by husband and wife team Juan and Lanya Zambrano, operates a so-called embedded model, where its staff are integrated into the client’s business.

Read more: Martin Sorrell’s S4 Capital buys influencer agency IMA

Wesley ter Haar, Mediamonks founder and chief operating officer, said: “Firewood’s ‘embedded’ approach will allow us to build deeper and broader relationships with our clients, helping us work in a more flexible, collaborative and integrated way.”

S4 posted increased revenue and profit in the first half, boosted by a string of new client wins. Sorrell has said the firm is on track to meet its target of doubling in size by 2021.

Main image credit: Getty