Solving the crypto-fiat conundrum: how banks can offer a premium and trusted crypto-fiat service

PayPal recently announced that it will enable US users to buy and sell crypto currencies in early 2021. This has immediately fueled the interest of traditional banks in the cryptocurrency market, convincing many that it is simply impossible to ignore the record-high investor interest in digital assets.

Financial institutions see the hunger for legal crypto alternatives to traditional fiat currency banking, with banks and customers wanting the convenience of being able to store and use both, but newly entering the digital crypto assets market is not easy. Crypto products and services are now easy for banks, who were once only used to working with traditional fiat currencies. Talking to banks, I see their interest in digital assets only grows, but many do not know where to start when solving the crypto-fiat conundrum once and for all, properly joining the crypto revolution and satisfying pent-up and new customer demand. Here’s what we learned that can help you..

Where should your crypto solution reside: within the bank’s perimeter, or outside?

Even in the most advanced countries, even with high levels of digitization in their banks, there is barely a single credit institution that would want to build a crypto product on its own infrastructure.

Why? If a bank decided to create an in-house crypto solution that is based on completely different technologies than its traditional electronic fiat payments systems, it would have to reconfigure all of its processes for customer service, compliance, data storage, user service, treasury, and more. Given the peculiarities and differences in the implementation of crypto and fiat transactions, this can be difficult with no prior experience.

If the bank desires unify all existing and new processes, a new internal crypto product may require the modernization of a significant part of the IT infrastructure, which brings its own cost challenges, potential disruption and delays

Thus, to minimize resources and risks, there’s more profit and convenience for banks to create crypto products on the basis of an external organization – independent, but controlled.

How crypto products fit into the bank’s current activities?

Banks are mostly lending institutions. They operate in accordance with licenses and requirements related to certain areas of activity, including opening accounts, accepting deposits, issuing and servicing bank cards, acquisitions, currency exchange, brokerage services, and so on. This defines the entry for new product opportunities at the bank, such as the development of new services and the merging or integration of existing solutions that should not be created by third parties.

Based on the existing conditions and restrictions, the bank can determine what functions should be performed by the company it has partnered with to deal with the development of a crypto solution, and what the bank will retain in house and do itself.

What does the local regulator say about the digital assets?

Every country regulates crypto activities differently, and consequently, different rules apply. In countries where crypto regulation is highly developed and differentiated, the product’s opportunities and limitations will depend on the product’s nature. For example, in Switzerland, where Aximetria is registered, every crypto service such as crypto trading, trading in derivatives for crypto, issuing stable tokens, tokenizing assets, crypto custody or a full-fledged crypto currency service, like crypto wallets, crypto cards, fiat-crypto-fiat exchange operations, or as incoming and outgoing crypto transactions, will all have a different set of requirements.

In countries like Russia, India, and others, where clear regulation and rules for the use of cryptocurrencies has not yet been implemented, the development of a crypto product can be not explicitly prohibited, but still very challenging. For example, if the legislation explicitly prohibits only the use of cryptocurrencies as a means of payment, then owning cryptocurrencies in a wallet is still acceptable. However you will always have to take into account other regulations and laws, anti money laundering (AML) issues, personal data security, payment systems and so on.

How can the compliance of crypto solutions be ensured with legislation against money laundering (AML)?

To take into account the requirements of AML legislation, the bank needs to use advanced industry standard KYC (Know Your Customer) and KYT (Know Your Transaction) procedures for cryptocurrency accounts and transactions. Traditional transactions in fiat currencies that might be viewed as suspicious can be normal volumes in cryptocurrency trading, and there are tools to use to exclude the possibility of using a crypto product for illegal purposes.

Unlike cash, which is truly anonymous, use of cryptocurrency cannot simply be deleted from the code or the blockchain. At the same time, you need to understand that undesirable signs do not automatically mean that a crime has been committed. Even if an operation looks suspicious in the eyes of the regulator, it can still be completely legal. From this point of view, it is especially important for banks to answer this question: what can be done to prevent a breach of AML legislation? This problem is solved by technical means, such as by exerting control over transactions and clients, and which should specifically be applied to cryptocurrency transactions.

For example, anonymity (which, in fact, is also inherent in cash) can be completely eliminated using KYC (Know Your Client) procedures and can be controlled by KYT-procedures (Know Your Transaction), which provide even more opportunities for tracking financial transactions than the standard “fiat” AML procedures. KYT allows you to find out the entire history of a particular cryptocurrency unit – from the moment the token was created until it entered the user’s wallet, including every operation in which that unit of cryptocurrency participated.

The analysis of transactions is performed within the blockchain using machine learning technologies, and the generated reports can serve as the basis for refuting signs of doubtful operation and false positives. It is simply impossible to imagine such effective control tools in relation to conventional fiat banknotes, and/or by defining conditions that make it impossible to do a transaction with crypto accounts whose owners have not been identified through KYC.

How will personal data be processed?

This is another important point. Compliance with local legislation means crypto products are easy for banks to implement, and easier still if they are going to only work with local customers. Meanwhile, for banks that will work with local and international customers, cryptocurrency is extraterritorial: transactions can start in one state or country and end in another. In this case, different options are available.

The collection, analysis, storage, use and transfer of personal data of EU citizens is governed by the uniform rules of the GDPR, with the legislation of other countries having to be dealt with on a case-by-case basis. The above questions are not all that a bank needs to consider when developing a crypto product.

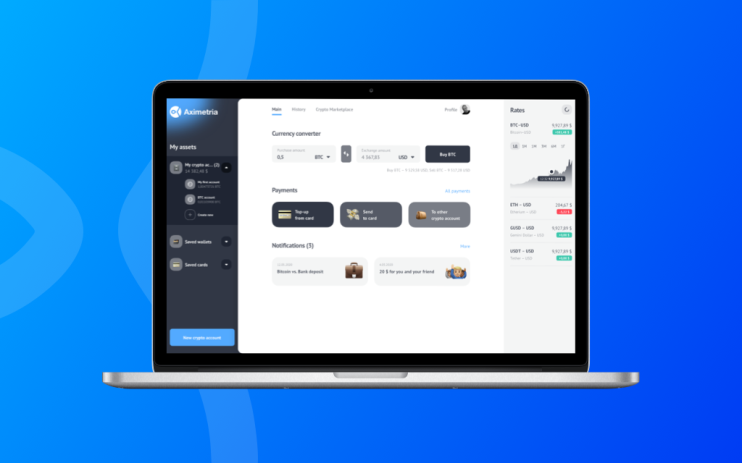

Payment and AML tools for pairing crypto and fiat legislation aren’t easy to implement, but future-minded banks and financial institutions are doing this already and are seizing the opportunity to meet the growing demand for digital assets themselves. No more do they have to see their customers – you and me – using other cryptocurrency services and wallets instead of the bank I already deal with on a regular basis through apps.

Alex Axelrod, founder and CEO of the Swiss startup Aximetria (for further information visit https://www.aximetria.com ) and is an industry expert on crypto regulation.

Alex is a serial entrepreneur with over a decade’s experience in leading, world-class technological roles within a large, No.1 national mobile operator and leading financial organizations. Prior to these roles, he was the Director of Big Data at the R&D Center of JSFC AFK Systems. Here, Alex developed mechanisms of data exchange and monetization between the group’s subsidiaries. In addition, he led an R&D group focused on the development of new next-gen technologies, such as geo-targeted advertising and subscriber solvency scoring, based on customers’ active use of communication services and services to counter fraud in remote banking channels.

LinkedIn: http://linkedin.com/in/alex-axelrod

Twitter: @axelrod_alex