Solar power pipeline exceeds onshore wind

Solar power development plans have heavily outstripped proposed onshore wind projects over the past two years, revealed Cornwall Insight.

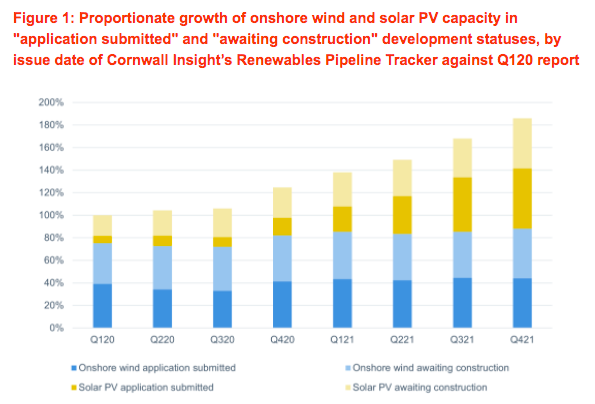

According to the energy specialist’s latest Renewables Pipeline Tracker, the pipeline for solar photovoltaic (solar PV) projects has effectively quadrupled in the past two years

Between April 2020 and March 2022, projects classified as either “application submitted” or “awaiting construction” increased 298 per cent.

By contrast, onshore wind development has risen only 17 per cent over the same period.

This overall increase in proposed developments translates into an average quarter-on-quarter increase of 26 per cent for solar capacity, but only a three per cent growth in onshore wind power.

Cornwall Insight suggests the significant ramp up in the pipeline for solar PV reflects increased government investment alongside more commercially viable and subsidy-free projects entering the market.

It also argues the difference in the development growth rates between solar PV and onshore wind reflects vastly contrasting planning environments for the two technologies.

Lucy Dolton, senior analyst at Cornwall Insight said: “Restrictive planning rules have been slowing down onshore wind development and we hope the soon to be published energy security strategy and government’s review of the energy National Policy Statements will include a review of the regulations.”

Solar PV technology refers to projects that use solar cells to generate energy – such as solar panels – while the photovoltaic process describes the conversion of light into electricity using semiconducting materials.

Onshore wind’s role unclear in upcoming energy strategy

The government is set to unveil the UK’s energy security strategy later this week – with a focus on ramping up renewables, nuclear power and North Sea oil and gas exploration.

However, there have reportedly been splits in the cabinet over onshore wind with Business Secretary Kwasi Kwarteng wanting to double generation from 14GW to 30GW by the end of the decade.

He wants to reduce the ability of local authorities to turn down onshore wind sites and lift restrictions that require them to be part of village plans.

The plan has the backing of industry body EnergyUK and energy investment group Octopus Renewables, which has described the current situation as an “effective moratorium.”

The proposal is highly divisive in cabinet, and partly explains delays to the rollout of the strategy.

Kwarteng’s plans have the support of Levelling Up Secretary Michael Gove, but have faced opposition from other cabinet members such as Work and Pensions Secretary Thérèse Coffey and Transport Secretary Grant Shapps.

Shapps told Sky News last week that onshore wind farms “sit on the hills and can create something of an eyesore for communities”.

Meanwhile, the Prime Minister Boris Johnson has played down the prospect of ramping up onshore wind power in the government’s upcoming energy strategy.

The Prime Minister instead singled out ramping up offshore wind power and nuclear power when facing questions about his energy plans from the House of Commons’ Liaison Committee last month.

He said: “Renewables are fantastic and offshore wind – and I stress offshore wind – I think has massive potential. But so does nuclear. In the UK we have failed for a generation to put in enough long-term supply and it’s been one of those colossal mistakes.“

Cornwall Insight argues the rising global gas demand and soaring wholesale costs reflect the need for the UK to diversify its energy sources.

Dolton said: “If we want to protect our energy supply and prices from geopolitical or economic changes in the future, extending our renewable projects including solar PV and onshore wind will be part of the solution.”

Households are now feeling the heat from spiralling gas prices, with price cap hiked to nearly £2,000 per year this month – with Cornwall Insights forecast a further £600 rise in October.

It suggests diversification is key to easing pressure on households over the medium to long term, with onshore wind and solar having quicker timelines than offshore projects.

Dolton concluded: “While other renewables such as offshore wind could take six years to construct, solar farms and onshore wind farms have much shorter construction times and can be completed within six months of construction commencing. Encouraging development of these projects, which already have planning and grid connections in place, will help speed up the diversification of the UK’s energy supply.”