Softbank’s Vision Fund posts record profit as startup valuations recover

Softbank’s Vision Fund division posted a record ¥784.4bn (£5.7bn) profit for the third quarter after a recovery in startup valuations helped the unit rebound from a ¥612bn loss the previous year.

The Japanese tech investment giant, which has stopped reporting operating profit figures, reported a net quarterly income for the entire group of ¥627.5bn. This took net income for the first half to ¥1.88 trillion – a more than four-fold increase from the same period a year earlier.

Softbank is recovering from a record loss in the previous financial year after a massive global rally in tech shares boosted the value of its holdings in publicly traded firms, as well as improving the prospects for startups in its portfolio.

The group’s rising net income primarily reflected a gain related to the merger of portfolio firm Sprint with T-Mobile US, Softbank said. The Japanese conglomerate has been selling down core assets such as stakes in Chinese e-commerce giant Alibaba and domestic telecoms firm SoftBank to raise cash to weather the coronavirus crisis.

However Softbank reported a ¥131.7bn loss from speculation on tech stocks after an attempt to diversify using its massive cash pile turned sour.

Before the Open newsletter: Start your day with the City View podcast and key market data

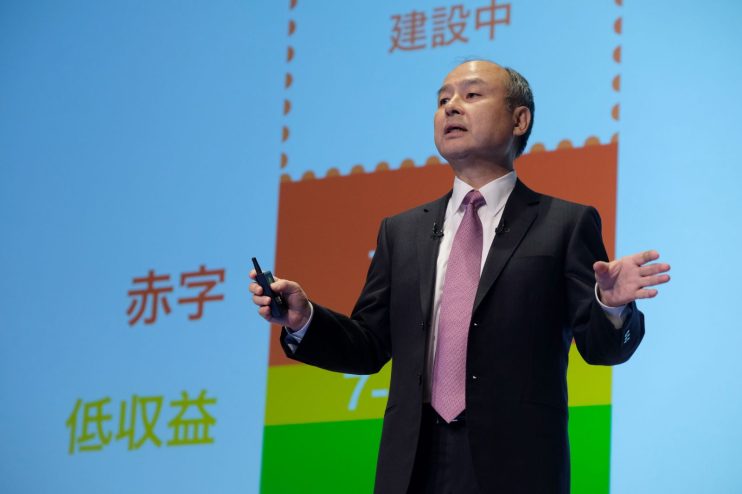

Chief executive Masayoshi Son said in August that the Japanese tech investment giant would invest cash from asset monetisation in tech stocks and derivatives in a bid to benefit from rising valuations in the sector.

The bets, which come as SoftBank hopes to reestablish its investing chops after portfolio companies such as Wework struggled, turned sour after the firm booked a ¥292bn derivative loss for the six months to September.

At the end of September, the group held positions worth $16.8bn in Amazon, Facebook, and Google parent company Alphabet. Softbank bought up ¥1.7 trillion of “highly liquid listed stocks” during the quarter, it said.

In brighter news, Softbank reported that the investment portfolio of its $100bn Vision Fund – the world’s largest technology investment vehicle – was no longer worth less than cost due to the upswing in tech valuations.

Vision Fund’s $75bn investment in 83 startups was worth $76.4 billion at the end of September, Softbank said.