Soc Gen shares rise despite profit drop

French bank Société Générale yesterday reported a 63 per cent fall in second-quarter profits, but its shares rallied, as figures were better than analysts had expected.

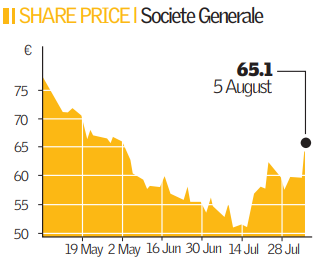

The Paris-based bank, which is still coming to terms with the rogue trading scandal that caused a €4.9bn loss, saw net profits fall to €664m (£525m) from €1.74bn last year. But analysts had previously forecast a smaller profit figure, and shares climbed 9.4 per cent to €65.1 in Paris trading.

Commenting on the results, the bank’s chief executive Frederic Oudéa said that the figures were still positive, given the current situation. He said: “During a first half of 2008 marked by a crisis on an exceptional scale, Société Générale’s performance reflects the robustness of its portfolio of activities.”

Celent’s analyst Cubillas Ding told CityA.M. that although results were “not bright” compared to boom times, they still fell into the “better-than-anticipated” category.

He said: “Here the story is similar to HSBC, which revolves around themes of finding refuge through domestic and emerging markets retail banking operations.”

Commenting on the rogue trading scandal, he added: “Coming to a year since the birth of the crisis, financial institutions have come to grips with the ins and outs of what they are holding in their books, and providing more transparency, which is what Société Générale has done. Clearing the smoke helps dispel the atmosphere of fear associated with the mortgage crisis.”

On Monday, Thomas Mougard, the assistant of Jerome Kerviel, the junior trader blamed for the rogue trading scandal unveiled earlier this year, was placed under formal investigation for complicity. Kerviel was arrested in January and then freed on bail, but remains under investigation.