Soaring interest rates could spark five per cent London house price fall

Soaring interest rates and a tough cost of living crisis could send London house prices on a downward spiral, new research published today warns.

Home prices in the capital are on course to shed five per cent next year, driven by sellers dropping prices to attract buyers hit by an affordability crunch, according to property search site Zoopla.

That drop would wipe out 13 months of cumulative price rises in the capital, the steepest fall in the UK, taking London house prices back to August 2021 levels.

Other experts are projecting a much worse house price fall on a national scale.

Lloyds Bank last week said UK house prices could tumble every quarter next year, reaching a peak drop of 8.2 per cent caused by the Bank of England lifting interest rates to four per cent.

A tough cost of living squeeze fuelled by inflation hitting 10.1 per cent, a 40-year high, is damaging Brits’ finances, raising the risk of a slowdown in demand in the property market.

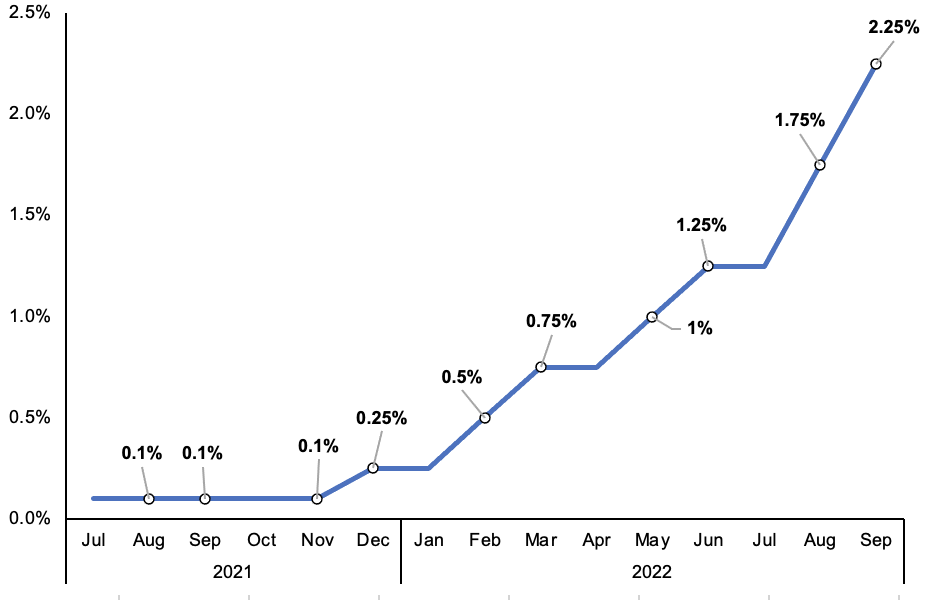

Mortgage providers have passed on a series of seven consecutive rate hikes by the Bank, pricing some prospective homeowners out of the market by reducing affordability.

Interest rates have climbed rapidly this year

That rate hike cycle was turbocharged by former prime minister’s Liz Truss’s disastrous mini-budget on 23 September roiling financial markets.

Lenders pulled products en masse after UK debt costs climbed steeply, partly caused by Truss ramping up government borrowing.

Providers returned to the market with mortgages offering rates of more than 6.5 per cent, prompting buyers to ditch home purchase plans.

Zoopla said new housing demand collapsed a third after the mini-budget.

Data out today from Threadneedle Street is expected to show mortgage approvals dropped to 65,000 in September, down from over 74,000 in August.

“New buyer demand has dropped quickly in the face of higher borrowing costs, it’s like the Christmas slowdown has come a month early,” said Richard Donnell, executive director at Zoopla

Mortgage rates have since edged lower after chancellor Jeremy Hunt calmed markets by ditching nearly all of last month’s mini-budget.

The Bank on Thursday is expected to hike interest rates 75 basis points – the steepest rise since 1989 – to three per cent to curb inflation, likely bumping mortgage costs higher again.

Despite Zoopla’s warning, London house prices remain the highest in the country, climbing 4.4 per cent over the last year to £525,900. But, that was among the slowest rises in the UK.