So-so energy: Supplier’s push for funds is a worrying sign for the market

So Energy’s scramble for funds this winter reflects the stark reality that even with historic levels of financing and Government support for households, businesses and suppliers – the crisis is far from over.

It raises troubling questions over the future shape of the energy market – where challenger suppliers find themselves squeezed out by the realities of soaring wholesale costs and brutally shrinking margins.

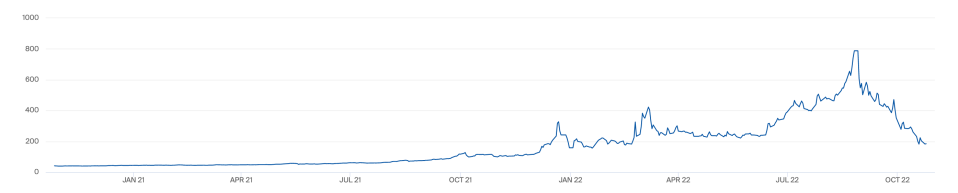

Earlier this year, gas prices skyrocketed – powered by rebounding post-pandemic demand and a Russian squeeze on supplies following the country’s invasion of Ukraine.

This has contributed to nearly 30 suppliers collapsing over the past 15 months – exposed by poor hedging strategies and crippled by the constraints of the energy price cap.

While gas prices have since dipped to near historic norms in recent weeks, the futures markets remain very expensive – reflecting concerns in the market over a challenging winter ahead.

So Energy’s pitch hampered by market chaos

So Energy is a renewables-only retail supplier, and is home to 300,000 customers across the country.

Co-founder Simon Oscroft was bullish yesterday about its prospects, telling Sky News the firm has “weathered the storm well and are the last true challenger left in the market.”

He said: “We have seen some big changes in energy policy over the last few weeks – the chopping and changing to the Energy Price Guarantee, uncertainty over the price cap, and the Energy Market Financing Scheme seemingly only available to some energy players.

“We want to make sure we have the right funding to manage this uncertainty and grow into the future, which is why we’ve started the process of exploring options for additional investment for the next two years.”

However, it is now finding itself in depressingly familiar jeopardy, appointing Interpath Advisory to try and secure £50m in funding to tide itself over the winter.

Interpath Advisory are also the administrators of Bulb Energy’s parent company – Simple Energy – the collapsed supplier that fell into special administration nearly a year ago, costing bill-payers £4bn in the process.

Bulb also desperately sought extra funding last year, appointing Lazard to bang the collection tin in a bid to lure investors, a decisively fruitless task with firms put off by their spiralling debts.

It is not the only supplier that unsuccessfully courted the market for funds with Together Energy and Avro Energy both appointing Alvarez and Marsal to look for financing prior to their collapse.

So Energy has an excellent track record with customers, with Ofgem reporting just minor issues in its handling of vulnerable customers amid much more severe issues from rival suppliers across the industry.

It also was one of two firms to have no issues when it came to refunding overcharged customers on direct debits.

The group has also been a leading voice in calling for insulation and household support amid the crisis.

However, So Energy’s numbers aren’t especially encouraging as it seeks suitors to support its business.

Its latest filings to Companies House reveal the firm made a near £16m loss in the year up to March 2021, prior to the worst spells of the crisis.

Meanwhile, its gross profit margins have dipped from nine to five per cent.

Most notably, turnover grew 22 per cent, while administrative costs soared 64 per cent.

Its merger with Irish group ESB Energy was completed last year, but it still only owns a 75 per cent stake in So Energy – making its future direction unclear.

When approached for comment, a So Energy spokesperson said: “Since taking a majority shareholding in So Energy last summer, ESB has significantly funded So Energy. They remained a majority shareholder and are aware we are seeking additional funding.”

So Energy it is not the only firm to suffer financial difficulties this year.

The Financial Times reported last week that Ofgem was preparing for the potential nationalisation of Ovo Energy (Ovo) this summer, with the renewables-only supplier considered at risk of failure.

Ovo also revealed last month its own fears for the company’s viability prior to the Government’s unveiling support packages for households and businesses.

The country’s third biggest supplier, which is home to 4.5m customers, warned there was “a material uncertainty that may cast significant doubt on the group’s and company’s ability to continue as a going concern”.

Government prepares sector for winter struggle

The Government has recognised that with futures markets remaining historically high and concerns of supply shortages this winter, suppliers have needed further support.

Earlier this month, the Bank of England and The Treasury unveiled the ‘Energy Markets Financing Scheme (EMFS)’ – allowing firms for larger credit lines from banks to secure their commercial future and meet large margin calls driven by volatile wholesale costs.

This is on top of the subsidies from the Government to pay for the difference between wholesale costs and the maximum rates suppliers can charge under the Energy Price Guarantee – set at 34p per kWh for electricity and 10.30p per kWh for gas, equating to £2,500 per year for average energy usage.

Robert Buckley, head of relationship development at Cornwall Insight argued that So Energy’s need for further financing despite the support exposed the difficulties of the current market.

He said: “It is symptomatic of a very difficult market. We wouldn’t have the Bank of England and Treasury scheme in place for the energy industry if it wasn’t needed. There are clearly big issues for suppliers financing their wholesale energy commitments – particularly due to market changes.”

Commenting on So Energy’s potential difficulties, he praised the supplier’s role in the market, with the firm committing to cheap, renewable power well ahead of many established competitors.

He said: “It would be a great shame if we ended up with a market where smaller participants couldn’t afford to exist. We all want the innovation that entrants have brought to this sector.”

Kathryn Porter, energy consultant at Watt Logic was gloomy about the prospects of challenger suppliers amid the ensuing crisis.

She said: “Structurally the market economics have improved since the price caps will be re-set quarterly, but Ofgem’s prudential regulation proposals will make it much harder for small suppliers to fund their businesses and that could push some of them under or force them out through no longer being complaint with their licence conditions and Ofgem’s regulatory tests.”